twaddle

Thinks s/he gets paid by the post

- Joined

- Jun 16, 2006

- Messages

- 1,703

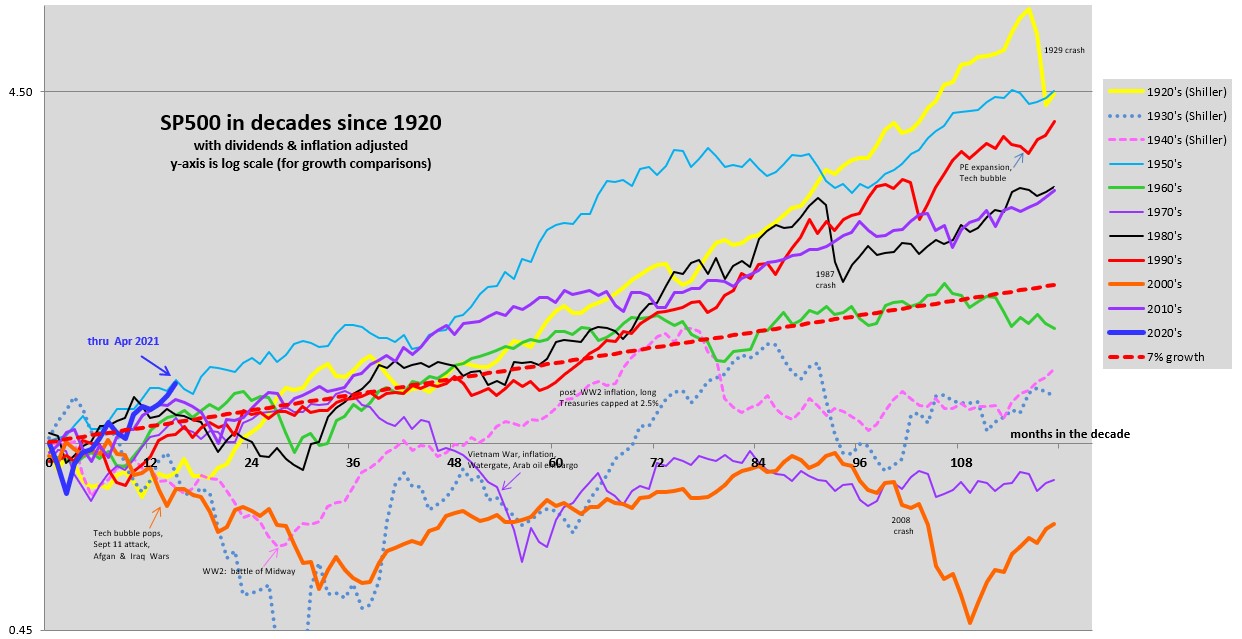

The late Bogle talked about P/E reversion, and used it to set his forecast. However, he used that to temper people's expectations, and never claimed he knew when that P/E reversion would happen or how it would happen. It may happen in a hurry, or spread out over many years. Hence, he stressed that his forecast of future returns was for long periods of a decade or more, not for next year.

Absolutely. There's no timeframe implied in his equation, but if you believe it, then today's outsized returns predict future below-average returns. That's all mean-reversion suggests.