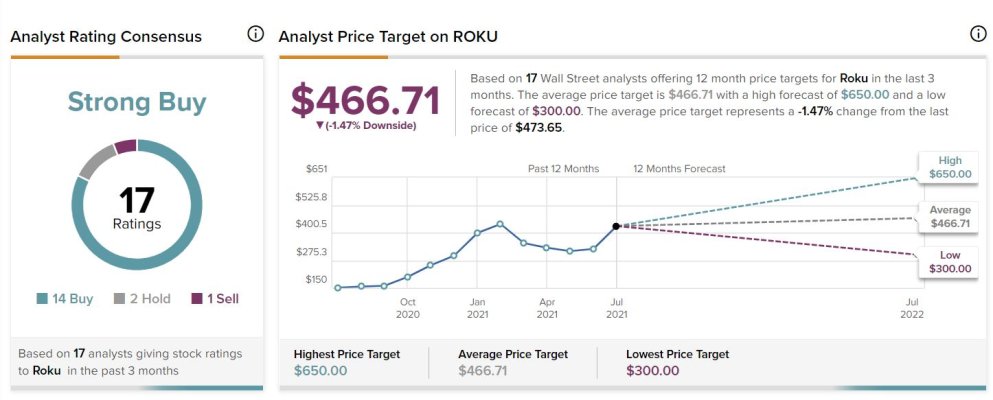

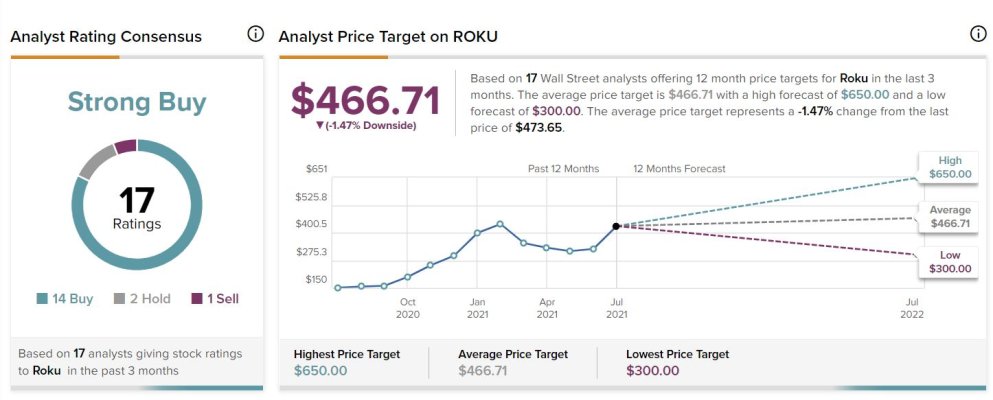

https://www.tipranks.com/stocks/roku/forecast

https://simplywall.st/stocks/us/media/nasdaq-roku/roku#summary

https://simplywall.st/stocks/us/media/nasdaq-roku/roku#summary

We perform automated risk checks on every company. We flag any failed checks as potential investment risks. A company which passes all our checks, however, is not 'risk free'.

Roku (ROKU) Risk Checks

Fail

Has there been substantial insider selling in the past 3 months?

Significant insider selling over the past 3 months

Section 9.1

Fail

Have shareholders been diluted over the past year?

Shareholders have been diluted in the past year

Section 9.3

Pass

Are they forecast to achieve profitability?

The company is currently profitable

Section 5.1

Pass

Are revenue and earnings forecast to grow?

Earnings are forecast to grow by an average of 51.7% per year for the next 3 years

Section 4.1

Pass

Are they in a good financial position?

Debt level is low and not considered a risk

Section 6.2

Pass

Is their dividend sustainable?

They do not pay a dividend

Section 7.0

Pass

Is their share price liquid and stable?

Share price has been stable over the past 3 months

Section 2.1

Pass

Do they have high quality earnings?

The company’s earnings are high quality

Section 5.1

Pass

Have profit margins improved over the past year?

Profit margins improved or ROKU became profitable

Section 5.1

Pass

Do they have sufficient financial data available?

They have sufficient analyst coverage

Section 4.0

Pass

Are there any concerning recent events?

No concerning events detected

Section 2.1

Pass

Do they have meaningful levels of revenue?

Revenue is meaningful ($2B)

Section 5.1

Pass

Do they have a meaningful market capitalization?

Market cap is meaningful ($63B)

Section 10.0

Pass

Do they have negative shareholders equity?

ROKU does not have negative shareholders equity.

Section 6.2