I recently heard a Wade Pfau interview discussion that focused on how/when to consider using SPIAs as another investment in your RE planning. I have to admit, my knee jerk reaction to the word "annuity" is negative. That said, I sense that Pfau is really a big proponent of their use. Putting legacy desires aside, one of the arguments is looking at our assets once we RE as how they create the most dependable income for life. I am hearing more people warming up to the idea of buying a SPIA to cover their base expense needs, but also some funding their wants/wishes budget with a SPIA. Assuming you are well funded, one argument is to fund your whole budget with a SPIA and then have everything else in stocks. While I have a hard time making peace with the fact that once i write the check my $$ are gone/locked into the SPIA for life, I can see somewhat of an argument here if the focus is on solely maximizing your cash flow needs in RE. So, should SPIAs be considered as at least part of your/in lieu of your bond allocation??

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Should SPIAs be part of your AA?

- Thread starter DawgMan

- Start date

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I dunno. You can get a good idea of the interest rates the insurer is using by calculating the IRR for period certain annuities. I got on immediateannuities.com and priced $100,000 for a 65 yo male in FL and got the below.

The 10 year is yielding 1.47% and the 5 year is yielding 0.67%.

You can somewhat mitigate the $$$ gone risk by buying a life contingent with 10 years certain... that assures that your IRR will not be any less than MINUS 9.3%. Returns don't get attractive unless you live beyond your mid 80s.

I will take my chances. If I did buy a SPIA for our gap between spending and SS and invested the rest in equities we would end up with a 66/34 AA.

How lucky do you feel?

The 10 year is yielding 1.47% and the 5 year is yielding 0.67%.

You can somewhat mitigate the $$$ gone risk by buying a life contingent with 10 years certain... that assures that your IRR will not be any less than MINUS 9.3%. Returns don't get attractive unless you live beyond your mid 80s.

I will take my chances. If I did buy a SPIA for our gap between spending and SS and invested the rest in equities we would end up with a 66/34 AA.

How lucky do you feel?

| Lump Sum | 100,000 | |

| Monthly benefit | 494 | |

| Payout rate | 5.93% | |

| Age | n | IRR |

| 65 | 0 | |

| 66 | 1 | -98.3% |

| 67 | 2 | -80.7% |

| 68 | 3 | -60.3% |

| 69 | 4 | -44.8% |

| 70 | 5 | -33.7% |

| 71 | 6 | -25.7% |

| 72 | 7 | -19.8% |

| 73 | 8 | -15.3% |

| 74 | 9 | -11.9% |

| 75 | 10 | -9.2% |

| 76 | 11 | -7.0% |

| 77 | 12 | -5.2% |

| 78 | 13 | -3.8% |

| 79 | 14 | -2.5% |

| 80 | 15 | -1.5% |

| 81 | 16 | -0.6% |

| 82 | 17 | 0.1% |

| 83 | 18 | 0.7% |

| 84 | 19 | 1.3% |

| 85 | 20 | 1.8% |

| 86 | 21 | 2.2% |

| 87 | 22 | 2.6% |

| 88 | 23 | 2.9% |

| 89 | 24 | 3.2% |

| 90 | 25 | 3.4% |

| 91 | 26 | 3.7% |

| 92 | 27 | 3.9% |

| 93 | 28 | 4.1% |

| 94 | 29 | 4.2% |

| 95 | 30 | 4.4% |

| 96 | 31 | 4.5% |

| 97 | 32 | 4.6% |

| 98 | 33 | 4.7% |

| 99 | 34 | 4.8% |

| 100 | 35 | 4.9% |

I dunno. You can get a good idea of the interest rates the insurer is using by calculating the IRR for period certain annuities. I got on immediateannuities.com and priced $100,000 for a 65 yo male in FL and got the below.

The 10 year is yielding 1.47% and the 5 year is yielding 0.67%.

You can somewhat mitigate the $$$ gone risk by buying a life contingent with 10 years certain... that assures that your IRR will not be any less than MINUS 9.3%. Returns don't get attractive unless you live beyond your mid 80s.

I will take my chances. If I did buy a SPIA for our gap between spending and SS and invested the rest in equities we would end up with a 66/34 AA.

How lucky do you feel?

Lump Sum 100,000 Monthly benefit 494 Payout rate 5.93% Age n IRR 65 0 66 1 -98.3% 67 2 -80.7% 68 3 -60.3% 69 4 -44.8% 70 5 -33.7% 71 6 -25.7% 72 7 -19.8% 73 8 -15.3% 74 9 -11.9% 75 10 -9.2% 76 11 -7.0% 77 12 -5.2% 78 13 -3.8% 79 14 -2.5% 80 15 -1.5% 81 16 -0.6% 82 17 0.1% 83 18 0.7% 84 19 1.3% 85 20 1.8% 86 21 2.2% 87 22 2.6% 88 23 2.9% 89 24 3.2% 90 25 3.4% 91 26 3.7% 92 27 3.9% 93 28 4.1% 94 29 4.2% 95 30 4.4% 96 31 4.5% 97 32 4.6% 98 33 4.7% 99 34 4.8% 100 35 4.9%

See, you are looking at it the way I am... but should we?? IF it's all about maximizing RE income, should we care if we croak in 5 yrs or 40 yrs?? You are sort of making my point. It's hard to give up the "I want to grow my assets" mind set and give up the control... or just the thought that I just wrote a check for $1M and its gone!

In one respect, I can see (on paper) an attractive plan where you have funded somewhere between your base needs all the way to your needs/wants/wishes needs in SPIAs and the balance in stocks. I just don't know anyone doing it, and as a control freak, I think I would struggle with seeing my NW drop after writing a big check!

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

While I have a hard time making peace with the fact that once i write the check my $$ are gone/locked into the SPIA for life, I can see somewhat of an argument here if the focus is on solely maximizing your cash flow needs in RE. So, should SPIAs be considered as at least part of your/in lieu of your bond allocation??

Let me cast it in an alternate light which we are all familiar with.

Let's suppose you have a pension coming from your employer. You have to make a decision whether to take a lump sum today or monthly payment for the rest of your life. Which do you choose?

It's exactly the same thing.

Let me cast it in an alternate light which we are all familiar with.

Let's suppose you have a pension coming from your employer. You have to make a decision whether to take a lump sum today or monthly payment for the rest of your life. Which do you choose?

It's exactly the same thing.

Agreed. Only difference is you are making a decision to write a big check vs getting a big check. I’m just wondering how many of us are really writing the big check from those $$ you invested all those years to see it leave your account, despite the fact it is producing monthly $$.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Endless debate. I am very glad to see SPIAs singled out since there is a tendency lump all annuities together. The variable index variety annuity has tainted the whole industry. SPIAs and MYGAs in particular have some value for specific situations and I might consider either of these. My issue with SPIAs at the current time is locking in all time low rates. I seriously considered taking a lump sum pension and waiting until rates rose to buy a SPIA but Megacorp subsidized the survivor benefit so that made the decision easy for me. Bottom line it's an individual choice based on your comfort with risk vs. guaranteed income.

TechLead

Recycles dryer sheets

- Joined

- Jul 14, 2020

- Messages

- 100

It could be a good investment if you know inflation rate/Tax rates/ACA for a remainder of your life.

VanWinkle

Thinks s/he gets paid by the post

It could be a good investment if you know inflation rate/Tax rates/ACA for a remainder of your life.

And what the stock market will be doing for the next 30 years!!

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't think stocks is a valid comparison.... totally different risk profiles.... even insurers who issue these products don't buy stocks to fund them.

TechLead

Recycles dryer sheets

- Joined

- Jul 14, 2020

- Messages

- 100

And what the stock market will be doing for the next 30 years!!

Let's make it simpler and say what will S&P 500 dividends do. I think I can handle any 30 year period just fine. I can

control lot of things about ACA/Taxes by having some in 401k, some in Roth accounts, some in taxable accounts AND they keep

up with inflation.

https://www.multpl.com/s-p-500-dividend/table/by-year

Last edited:

TechLead

Recycles dryer sheets

- Joined

- Jul 14, 2020

- Messages

- 100

I don't think stocks is a valid comparison.... totally different risk profiles.... even insurers who issue these products don't buy stocks to fund them.

Insurers can buy real garbage.

Do you remember AIG bailout?

Last edited:

VanWinkle

Thinks s/he gets paid by the post

I don't think stocks is a valid comparison.... totally different risk profiles.... even insurers who issue these products don't buy stocks to fund them.

I didn't make my point, the choice is between an annuity, or taking on some risk yourself which could include the stock market. I agree that a SPIA does not take stock market risk, but the decision on whether to buy a SPIA may make the potential buyer wonder about the stock market return over the same period in his conservative 30/70 portfolio.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It is an interesting discussion. Contrast the sometimes negative view of SPIA with the oft-repeated advice to defer social security to FRA or beyond. Your IRR there could be minus 100%.

The adage that one should not feel bad that after you bought insurance your house didn't burn down comes to mind.

Stated differently, if an annuity was key to making my retirement work, I would consider one.

The adage that one should not feel bad that after you bought insurance your house didn't burn down comes to mind.

Stated differently, if an annuity was key to making my retirement work, I would consider one.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Insurers can buy real garbage.

Do you remember AIG bailout?AIG sells ton of annuities. I think government backs annuities up to some limit (100k-300k)

You are incredibly misinformed. The AIG bailout had nothing with them selling annuities, or for that matter it had absolutely nothing to do with AIG's insurance companies. It was a bunch of yahoos who thought they were the smartest guys in the room selling credit default swaps up at the corporate level.

In fact, AIG's insurance companies ended up being their salvation as the bailout allowed AIG time to do an orderly selling of many of their non-US insurance companies and they used the proceeds from thoe sales to pay off the loans that the US goverment made to them.

I guess that it proves that you don't know what you don't know.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think those people are guilty of very naive thinking. Suppose those needs are $50K/year, so they buy a $50K annuity. In 20 years at 2.5% inflation, that annuity will have $30K of purchasing power. The long term US inflation rate is 3.11% and the 40 year trailing average is in the neighborhood of 4%, so it's hard for me to see that 2.5% is a pessimistic number.... I am hearing more people warming up to the idea of buying a SPIA to cover their base expense needs ...

The only way an annuity can be expected to cover base expenses going forward is if it is indexed.

@pb4, great chart in post #2. How about adding a column or a couple of columns (2% and 3% inflation or your choice) that shows the purchasing power of that $494 as the annuitant ages?

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It is an interesting discussion. Contrast the sometimes negative view of SPIA with the oft-repeated advice to defer social security to FRA or beyond. Your IRR there could be minus 100%.

The adage that one should not feel bad that after you bought insurance your house didn't burn down comes to mind.

Stated differently, if an annuity was key to making my retirement work, I would consider one.

To me, deferring SS is nothing more than making a decision to buy a COLA adjusted life annuity... the benefits that I forgo are the installment "premiums" that I pay, and the increase in benefits vs taking earlier is the benefit.

With both deferring SS and a SPIA, if you die right after you pay the premium your IRR can be -100%.

For contrast, below the same analysis as in Post#2 but for deferring SS from 62 to 70 for someone whose FRA is 66. The premium is the future value of the $750/month that would be received at 62 for 8 years. The monthly benefit is the excess of the $1,320 that would be received if claiming at age 70 over the $750 if claiming at age 60. Also, note that because SS benefits increase with inflation, the returns are effectively real returns rather than nominal returns.

| "Premium" | 88,305 | |

| Monthly benefit | 570 | |

| Payout rate | 7.75% | |

| Age | n | IRR |

| 70 | 0 | |

| 71 | 1 | -97.7% |

| 72 | 2 | -77.0% |

| 73 | 3 | -55.0% |

| 74 | 4 | -39.1% |

| 75 | 5 | -28.1% |

| 76 | 6 | -20.3% |

| 77 | 7 | -14.7% |

| 78 | 8 | -10.5% |

| 79 | 9 | -7.2% |

| 80 | 10 | -4.8% |

| 81 | 11 | -2.8% |

| 82 | 12 | -1.2% |

| 83 | 13 | 0.1% |

| 84 | 14 | 1.2% |

| 85 | 15 | 2.1% |

| 86 | 16 | 2.8% |

| 87 | 17 | 3.4% |

| 88 | 18 | 4.0% |

| 89 | 19 | 4.4% |

| 90 | 20 | 4.8% |

| 91 | 21 | 5.2% |

| 92 | 22 | 5.5% |

| 93 | 23 | 5.8% |

| 94 | 24 | 6.0% |

| 95 | 25 | 6.2% |

| 96 | 26 | 6.4% |

| 97 | 27 | 6.5% |

| 98 | 28 | 6.7% |

| 99 | 29 | 6.8% |

| 100 | 30 | 6.9% |

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

.... @pb4, great chart in post #2. How about adding a column or a couple of columns (2% and 3% inflation or your choice) that shows the purchasing power of that $494 as the annuitant ages?

Your wish... ah, strike that.

| Lump Sum | 100,000 | |||

| Monthly benefit | 494 | |||

| Payout rate | 5.93% | |||

| Spending power @ | ||||

| Age | n | IRR | 2% inflation | 3% inflation |

| 65 | 0 | |||

| 66 | 1 | -98.3% | 100.0 | 100.0 |

| 67 | 2 | -80.7% | 98.0 | 97.0 |

| 68 | 3 | -60.3% | 96.0 | 94.1 |

| 69 | 4 | -44.8% | 94.1 | 91.3 |

| 70 | 5 | -33.7% | 92.2 | 88.5 |

| 71 | 6 | -25.7% | 90.4 | 85.9 |

| 72 | 7 | -19.8% | 88.6 | 83.3 |

| 73 | 8 | -15.3% | 86.8 | 80.8 |

| 74 | 9 | -11.9% | 85.1 | 78.4 |

| 75 | 10 | -9.2% | 83.4 | 76.0 |

| 76 | 11 | -7.0% | 81.7 | 73.7 |

| 77 | 12 | -5.2% | 80.1 | 71.5 |

| 78 | 13 | -3.8% | 78.5 | 69.4 |

| 79 | 14 | -2.5% | 76.9 | 67.3 |

| 80 | 15 | -1.5% | 75.4 | 65.3 |

| 81 | 16 | -0.6% | 73.9 | 63.3 |

| 82 | 17 | 0.1% | 72.4 | 61.4 |

| 83 | 18 | 0.7% | 70.9 | 59.6 |

| 84 | 19 | 1.3% | 69.5 | 57.8 |

| 85 | 20 | 1.8% | 68.1 | 56.1 |

| 86 | 21 | 2.2% | 66.8 | 54.4 |

| 87 | 22 | 2.6% | 65.4 | 52.7 |

| 88 | 23 | 2.9% | 64.1 | 51.2 |

| 89 | 24 | 3.2% | 62.8 | 49.6 |

| 90 | 25 | 3.4% | 61.6 | 48.1 |

| 91 | 26 | 3.7% | 60.3 | 46.7 |

| 92 | 27 | 3.9% | 59.1 | 45.3 |

| 93 | 28 | 4.1% | 58.0 | 43.9 |

| 94 | 29 | 4.2% | 56.8 | 42.6 |

| 95 | 30 | 4.4% | 55.7 | 41.3 |

| 96 | 31 | 4.5% | 54.5 | 40.1 |

| 97 | 32 | 4.6% | 53.5 | 38.9 |

| 98 | 33 | 4.7% | 52.4 | 37.7 |

| 99 | 34 | 4.8% | 51.3 | 36.6 |

| 100 | 35 | 4.9% | 50.3 | 35.5 |

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

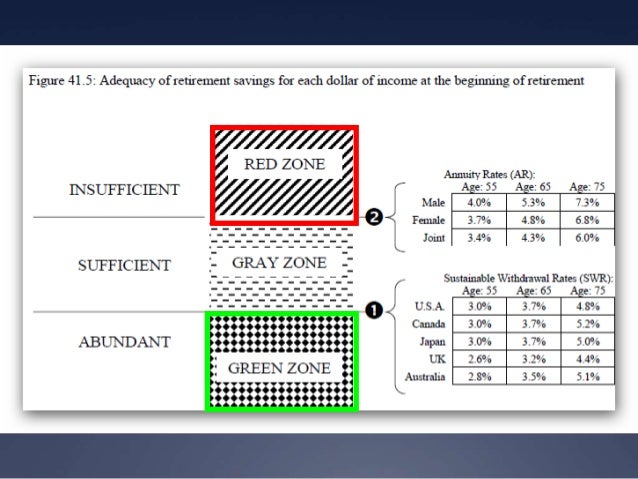

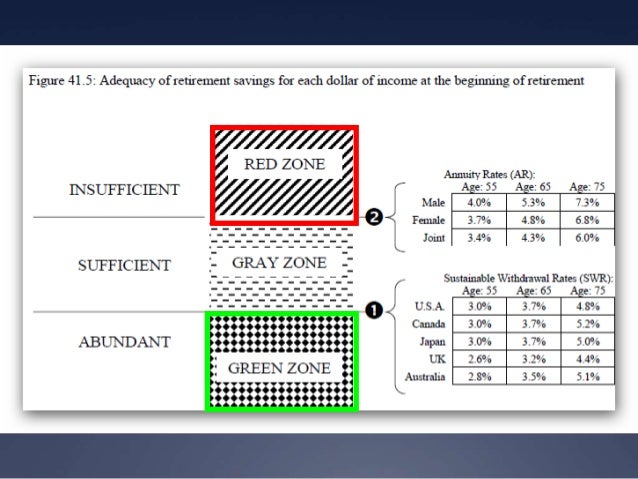

That's what Jim Otar's book Unveiling the Retirement Myth was about, specifically the Zone Strategy - who should annuitize, who doesn't need to, and the gray area in between. otar retirement calculator

Of course the threshold WR numbers are subject to some debate, there are no guarantees.

http://docshare04.docshare.tips/files/22966/229669551.pdf

Jim Otar [page 440] wrote:

1. If your withdrawal rate (WR) is lower than the sustainable withdrawal rate (SWR), then you are in the green zone. You have abundant savings. No annuitization necessary.

2. If your withdrawal rate is greater than the annuity rate (AR), then you are in the red zone. You have insufficient savings. Full annuitization may not be enough to meet your projected spending.

3. If your withdrawal rate is between SWR and AR, then you are in the gray zone. You have sufficient savings. Some annuitization may be wise.

Of course the threshold WR numbers are subject to some debate, there are no guarantees.

http://docshare04.docshare.tips/files/22966/229669551.pdf

Last edited:

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

To me, deferring SS is nothing more than making a decision to buy a COLA adjusted life annuity... the benefits that I forgo are the installment "premiums" that I pay, and the increase in benefits vs taking earlier is the benefit.

With both deferring SS and a SPIA, if you die right after you pay the premium your IRR can be -100%.

You have made that analysis I think very well and I found it useful to quantify the intuitive insurance element.

Are you also "taking your chances" by not deferring SS?

GravitySucks

Thinks s/he gets paid by the post

I purchased a delayed annuity that starts paying on my 62nd birthday 6 years ago. (1 month and 28 days till I get that 1st check!) It's a bit less than 10% of my portfolio at that time. The reason I invested in it is that SS at 62 + the annuity covers my basic expenses.

It was insurance. Things went great those first 7 years so it wasnt the best investment, but it was nice knowing that I only had to make sure the nut lasted till now and barring a bad inflation run I won't ever be living under a bridge.

It was insurance. Things went great those first 7 years so it wasnt the best investment, but it was nice knowing that I only had to make sure the nut lasted till now and barring a bad inflation run I won't ever be living under a bridge.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

... Are you also "taking your chances" by not deferring SS?

Did you mean to say "by [-]not[/-] deferring SS?"?

If so, then of course yes, if one defers and dies on the day before their 70th birthday then they took a chance and lost the bet because they forgo benefits that would have been worth $88k and bnever received a benefit payment.

TechLead

Recycles dryer sheets

- Joined

- Jul 14, 2020

- Messages

- 100

You are incredibly misinformed. The AIG bailout had nothing with them selling annuities, or for that matter it had absolutely nothing to do with AIG's insurance companies. It was a bunch of yahoos who thought they were the smartest guys in the room selling credit default swaps up at the corporate level.

I know that. So you are saying if AIG Insurance bankrupted it would have 0 effect on Annuities they sold because it is different department that caused that bankruptcy.

That surprises me.

So you think Feds were bailing them out because they worried about bunch of yahoos but overall company was doing just fine.

This was the biggest bail out they did during crisis of 2008-2009. What a waste of money if they did not need to do it.

BTW Credit Swaps are Insurance Contracts.

Last edited:

Out-to-Lunch

Thinks s/he gets paid by the post

I recently heard a Wade Pfau interview discussion that focused on how/when to consider using SPIAs as another investment in your RE planning. I have to admit, my knee jerk reaction to the word "annuity" is negative. That said, I sense that Pfau is really a big proponent of their use. Putting legacy desires aside, one of the arguments is looking at our assets once we RE as how they create the most dependable income for life. I am hearing more people warming up to the idea of buying a SPIA to cover their base expense needs, but also some funding their wants/wishes budget with a SPIA. Assuming you are well funded, one argument is to fund your whole budget with a SPIA and then have everything else in stocks. While I have a hard time making peace with the fact that once i write the check my $$ are gone/locked into the SPIA for life, I can see somewhat of an argument here if the focus is on solely maximizing your cash flow needs in RE. So, should SPIAs be considered as at least part of your/in lieu of your bond allocation??

Here is my take, from a 30,000' view.

You want to live out your life without going broke, and continuing to enjoy the fruits of your labors. You face many risks and uncertainties in doing so. One obvious uncertainty is that you don't know how long you will live. You also don't know exactly what your expenses/needs will be in the future, and you don't know the market performance going forward.

If you think about it, it is kind of crazy that we are largely expected to manage all these uncertainties and bear all those risks as individuals. Everyone pretty much has to plan for the worst-case scenario of a long life in the face of poor market returns. So everyone needs to save a lot, spend cautiously, and, consequently, die rich.

Risk-pooling, in the form of an SPIA, for example, is a way to transfer some of that longevity risk and market risk. People who die early subsidize people who live a long time. You therefore have a guaranteed income as long as you live. Therefore, everyone does not need to plan to retain a nest egg late in life that can meet all of their expenses. In exchange, of course, you give up all the upside.

Another risk you have is prematurely depleting your portfolio. You can play with this risk via your withdrawal plan. At the extremes, you could guarantee that you never deplete your portfolio by taking, say, a fixed percentage of your nest egg each year. But now you have a volatile income. Instead, you could keep your withdrawal amount rock steady (i.e., 4% rule), but now you have a risk of depleting your portfolio. (I think almost everyone does something in between these extremes.) But another way to play those factors off one another is to use a SPIA with some of your nest egg. Again, you get a guaranteed base income, moderating your income volatility, but you gave up the hope of having high market returns.

As pointed out by Midpack, conventional wisdom (Otar, Zwecher, Pfau, Kotlikoff...) is that if you are very well-funded, you are able to bear these risks yourself, and don't need to annuitize anything. If you are underfunded, your best hope of not going broke may be to annuitize nearly everything you have. In between, you get to consider using SPIAs to decide how much of these risks you wish to retain yourself (in hopes of realizing the upside) vs. how much of these risks you wish to transfer to an insurance company.

So, yes, in answer to your question, I think annuities deserve to be considered in your AA. In fact, right now I am struggling to decide on this tradeoff myself! (For me, I have the option of buying more credits in my pension plan, which I equate to a particularly favorable annuity.) And I have not yet determined where the right point on the curve is!

If someone is just going to put $$$ in a bank account earning nothing, than I think a SPIA (or MYGA) could make a lot of sense. i would probably wait until I'm in my late 60s or 70s to buy a SPIA Before interest rates went way down, I could have bought a $100k DIA that started paying out at age 70 that paid something ridiculous like $36k/yr with cash refund if I die first, but it just seems so far out. Who knows how much that will actually be worth then, and what the $100k might grow to over the next few decades. plus annuities get taxed as ordinary income vs the lower rate for qualified dividends and capital gains. If the special tax treatment for QD and LTCG disappears, I think annuities and other insurance products might make more sense.

Similar threads

- Replies

- 10

- Views

- 615

- Replies

- 41

- Views

- 4K

- Replies

- 10

- Views

- 3K