Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Opinions I hear are all over the map.

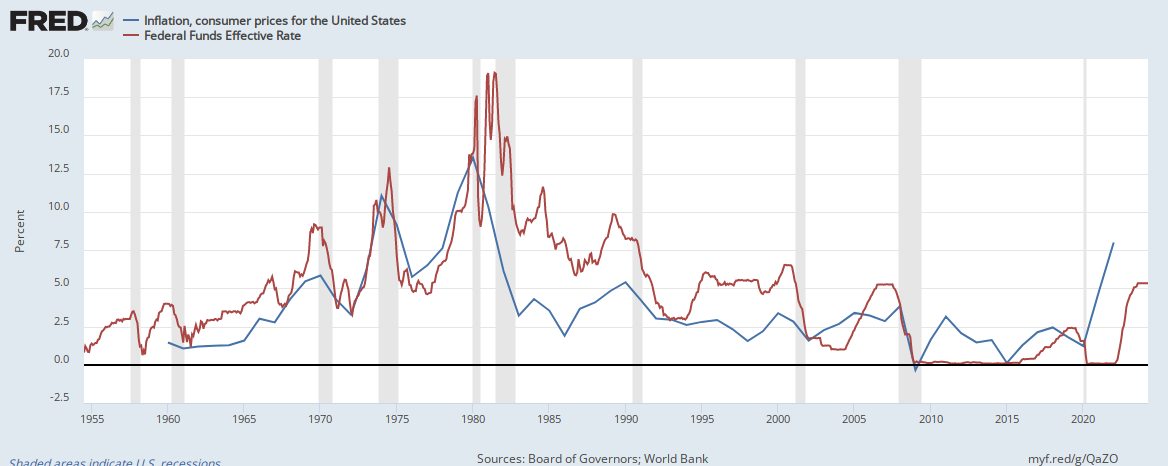

If I heard him correctly, Powell seems to think that all the QT they're scheduled to do is about equal to a 1/4 point rate increase on the Fed funds rate, so it really isn't much.

Sure, it's unprecedented, but I think we understand generally what QT is going to do. The only thing we don't know for sure is how strong the effects will be. I think they'll be able to tell after a few months and then can adjust.

I'm not surprised that people aren't following Dimon like he's an oracle. I know he's a smart guy and runs a pretty large financial institution. But what is his track record on predictions? As far as I can tell, he's just one voice among many smart people, some of which are talking about market recoveries and soft landings later this year. Who knows who is right? Not me.

Well this one wasnt so great…From August 2018…

I think rates should be 4 percent today,” Dimon says. “You better be prepared to deal with rates 5 percent or higher.”

The rate on the closely followed 10-year note remains below even the 3 percent level despite Dimon’s expectations.