Boho

Thinks s/he gets paid by the post

- Joined

- Feb 7, 2017

- Messages

- 1,844

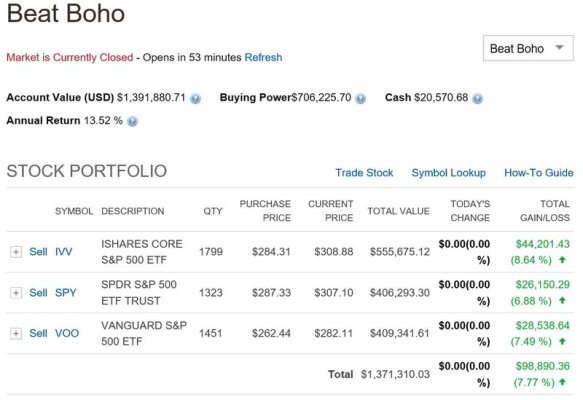

Below is from M* for 3/29/17 to 10/31/19.

S&P 500 (VFIAX): $1,354,221... 12.41% annualized return

Total Stock Market (VTSMX): $1,335,594... 11.81% annualized return

Boho II: $1,329,442... 11.61% annualized return

That's me being .2% behind VTSMX, right? I know that's not the benchmark some of us are using but it's a total stock market fund. It's the kind of fund I'm comparing myself with. I know I'm further behind some other funds.