Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

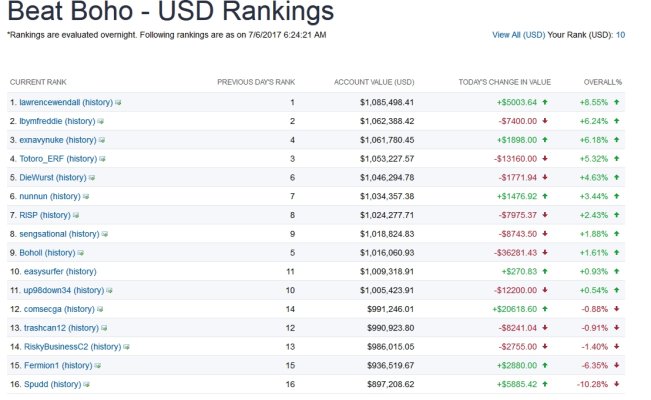

I'll have proven whatever there is to prove near the end and I'll feel free to play more for fun so I'm looking forward to it. I may end up ahead until the last week of the contest.

For the next contest I'm thinking of having people choose a stock for me and I'll go the entire contest trading only that stock.

Cool! I will choose you something good like Radio Shack or Sears.

.

.