twaddle

Thinks s/he gets paid by the post

- Joined

- Jun 16, 2006

- Messages

- 1,703

Honestly, it's been years since I paid much attention to valuation metrics, but it seems like a good time to take a peek at a few.

Got any favorites?

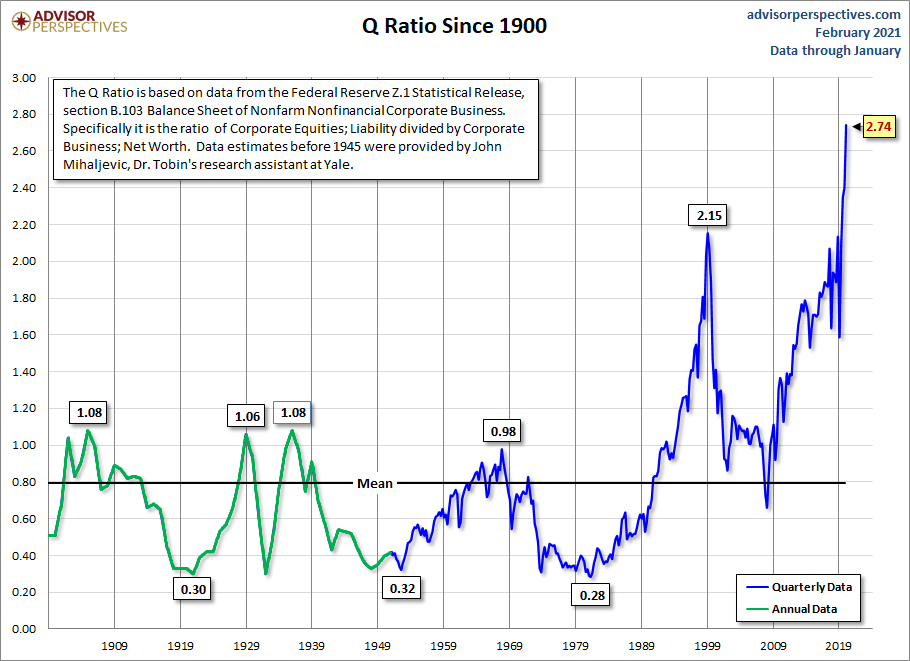

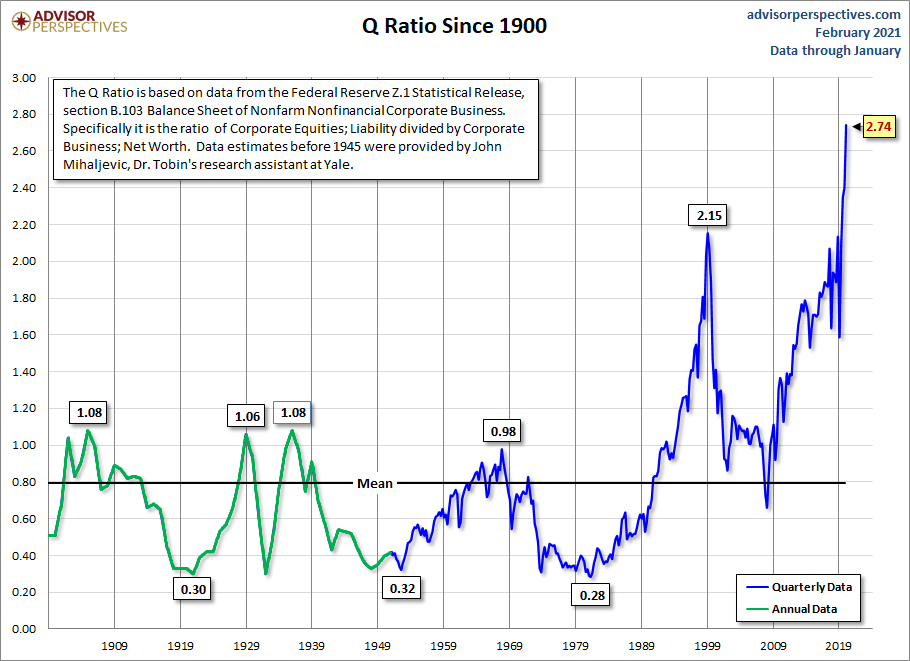

Everybody loves Tobin's Q, right? Just checked, and it's indicating the market is a bit overvalued. OK, way overvalued. The most overvalued ever.

What do I do with this info? Nothing actionable. I use it to set expectations of magnitude of a correction if/when we get one.

Got any favorites?

Everybody loves Tobin's Q, right? Just checked, and it's indicating the market is a bit overvalued. OK, way overvalued. The most overvalued ever.

What do I do with this info? Nothing actionable. I use it to set expectations of magnitude of a correction if/when we get one.