I noticed a lot of you use spreadsheets and some use tt for tracking spending, income and tax liability. which one is the best and easiest to use? I have one rental and was wondering if there was something out there for download that would work for this, plus just keeping track of income and spending.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

what software for tracking spending and income throughout the year?

- Thread starter frank

- Start date

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think some start out with the thought that tracking a few expenses with a spreadsheet over the years is doable. After a few years it might be a challenge for some.

What really really helps is to make sure your rental or business stuff is not mixed with personal. If you have a separate checking and credit card for those expenses, it is simple to get year end statements and input as needed to your Schedule E.

Everything business related for me goes through a separate checking account and one CC. Each month I make sure I download transactions to a historical spreadsheet. That has made tax prep a lot simpler.

Maintaining an accounting program even if simple might bog down and stop working at some future time. If you have complex needs, then my best guess is Quickbooks, although some users kinda hate it.

What really really helps is to make sure your rental or business stuff is not mixed with personal. If you have a separate checking and credit card for those expenses, it is simple to get year end statements and input as needed to your Schedule E.

Everything business related for me goes through a separate checking account and one CC. Each month I make sure I download transactions to a historical spreadsheet. That has made tax prep a lot simpler.

Maintaining an accounting program even if simple might bog down and stop working at some future time. If you have complex needs, then my best guess is Quickbooks, although some users kinda hate it.

davebarnes

Thinks s/he gets paid by the post

I am using Moneyspire. It is OK.

I have used Quickbooks, but the cost and on/off support for the Mac drove me away.

I have used Quickbooks, but the cost and on/off support for the Mac drove me away.

SumDay

Thinks s/he gets paid by the post

- Joined

- Aug 9, 2012

- Messages

- 1,862

I've used Quicken for years, and am opposed to subscription models, but decided this one was worth it for me.

https://www.quicken.com/personal-finance/rental-property

https://www.quicken.com/personal-finance/rental-property

I think some start out with the thought that tracking a few expenses with a spreadsheet over the years is doable. After a few years it might be a challenge for some.

What really really helps is to make sure your rental or business stuff is not mixed with personal. If you have a separate checking and credit card for those expenses, it is simple to get year end statements and input as needed to your Schedule E.

Everything business related for me goes through a separate checking account and one CC. Each month I make sure I download transactions to a historical spreadsheet. That has made tax prep a lot simpler.

Maintaining an accounting program even if simple might bog down and stop working at some future time. If you have complex needs, then my best guess is Quickbooks, although some users kinda hate it.

I used quickbooks years ago when we owned a convenience store and hated it. I think the separate cc and check book might be the easiest as you suggest. the thing I noticed is that a lot of the members seem to track expenses year around and that seems like a lot of unnecessary paperwork. I wonder if it is worthwhile. I usually pay 100 percent of previous tax liability to avoid penalties, so I just usually figure things out at the time when taxes are coming due.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I track all my spending with my phone app: Spending Tracker (its free and good)

I have roughly 30 categories, (and you can add whatever you want).

I always have my phone with me and it takes 15 sec to enter a purchase at the end of the day, so easy it doesn't bug me.

Each month or two, I transfer the monthly summary to a spreadsheet so I have a history and can chart it and compare to previous years.

I make a new tab each year, copy the previous year and delete the entries to have a fresh identical new year to start with. This way I have multiple years each in a tab.

Separately, for my rentals, I use a spreadsheet, separate tabs for: rent paid, rental expenses, rental CCA. I don't find it hard to track that way.

Harder to me is saving all the little receipts (I currently use separate yearly envelope, but am thinking I should take photos of the receipts in case the receipts fade away over the years).

I have roughly 30 categories, (and you can add whatever you want).

I always have my phone with me and it takes 15 sec to enter a purchase at the end of the day, so easy it doesn't bug me.

Each month or two, I transfer the monthly summary to a spreadsheet so I have a history and can chart it and compare to previous years.

I make a new tab each year, copy the previous year and delete the entries to have a fresh identical new year to start with. This way I have multiple years each in a tab.

Separately, for my rentals, I use a spreadsheet, separate tabs for: rent paid, rental expenses, rental CCA. I don't find it hard to track that way.

Harder to me is saving all the little receipts (I currently use separate yearly envelope, but am thinking I should take photos of the receipts in case the receipts fade away over the years).

jkern

Full time employment: Posting here.

I have been using Excel spreadsheets for the last 30 years. It's not really that difficult. It takes me about 15 minutes once per month and about 1 hour at the end of each year. I have 3 rental too.

Big_Hitter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have been using Excel spreadsheets for the last 30 years. It's not really that difficult. It takes me about 15 minutes once per month and about 1 hour at the end of each year. I have 3 rental too.

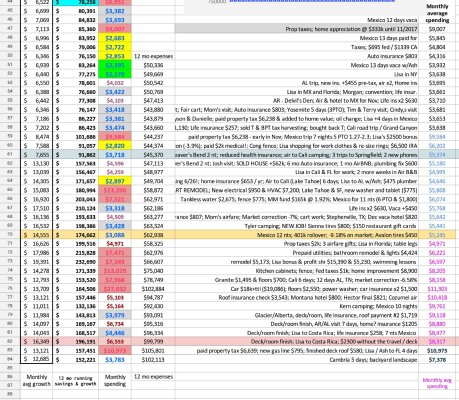

that's what I've been doing - tracking every dime of spending in excel - I enter it every day or two

W2R

Moderator Emeritus

I record every penny that I spend, as well as every penny of income. I love doing this and do not regard it as a burden.

I use Excel to do all this (well, Open Office, which is a free clone of Excel). I love Excel and feel very comfortable with it.

A few years ago I tried Quicken, since many forum members here that I respect use Quicken and like it a lot. But for me - - - well, I hated it. So, now I know.

I use Excel to do all this (well, Open Office, which is a free clone of Excel). I love Excel and feel very comfortable with it.

A few years ago I tried Quicken, since many forum members here that I respect use Quicken and like it a lot. But for me - - - well, I hated it. So, now I know.

I use Quicken. I hit the "update" button a few times a week while I'm doing other things on the computer, and Quicken automatically downloads and categorizes all our transactions in the background. Before I shutdown the computer, I just go back to Quicken, click on each account that has a flag indicating that new transactions were downloaded and click "Accept" to enter them in the registers. It also updates our investment values at the same time so I usually glance at the portfolio value while I'm there. Total time, less than 1 minute of active attention per update, so maybe 3 minutes per week. The only time I type anything in manually is if I hand-write a check or if we open a new account somewhere, both of which are pretty rare events.

Souschef

Thinks s/he gets paid by the post

I put almost all my purchases on my credit card. At year's end, I get a statement showing all my spending broken down by category.

I can then look at each category to see where the money went.

I can then look at each category to see where the money went.

Jimmie

Recycles dryer sheets

I've use GnuCash for many years after Quicken drove me off with their cash extortions for upgrades. It's free and has lots of features. Even has a stock/fund/bond price tracker to help keep investments current. Will admit there's a slight learning curve as it uses double-entry accounting, but utilizes a checkbook register as the user interface. Has prebuilt SW binaries for windows and mac operating systems that are easy to download and install. It's found at gnucash.org

BMP2CPM

Confused about dryer sheets

I use YNAB for everything, personal and my consultant business.

I can retrieve any category for any time period, very quickly.

But the budgeting features are the real reason I use it. Plus, I can expense the annual subscription to my business.

I can retrieve any category for any time period, very quickly.

But the budgeting features are the real reason I use it. Plus, I can expense the annual subscription to my business.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

Given that in my 23-year actuarial career I created and used spreadsheets all the time, creating some for my own use was pretty simple. Although I used Lotus 1-2-3 and Excel for most of my career, I always preferred Lotus 1-2-3 unless I absolutely needed to use Excel.

When I bought my first home PC in 1995, I created some spreadsheets starting with one which mimics my checkbook register. Over time, I created a skeleton income tax forms section which was linked to the checkbook register. Other things I had done on paper or had no summary records I put into spreadsheets such as my 401k statements.

As my ER plan was beginning to take shape, I created a new spreadsheet to analyze my spending and project it against projected investment income, for the short-term, medium-term, and long-term. The short-term is basically a projected checkbook register for the calendar year so I know how my lumpier expenses mesh with my more steady income.

When I bought my first home PC in 1995, I created some spreadsheets starting with one which mimics my checkbook register. Over time, I created a skeleton income tax forms section which was linked to the checkbook register. Other things I had done on paper or had no summary records I put into spreadsheets such as my 401k statements.

As my ER plan was beginning to take shape, I created a new spreadsheet to analyze my spending and project it against projected investment income, for the short-term, medium-term, and long-term. The short-term is basically a projected checkbook register for the calendar year so I know how my lumpier expenses mesh with my more steady income.

mountainsoft

Thinks s/he gets paid by the post

What really really helps is to make sure your rental or business stuff is not mixed with personal.

I agree! You should have a separate checking account and credit card for your business. Mixing business and personal gets messy really fast. I wrote a custom database program for my business that is personalized for my particular situation. It's really old and outdated, but it still does what I need it to.

As for personal expenses, I use Money Dance to track the balances in our checking and savings accounts. I only use it like an electronic checkbook, I don't utilize any of the online account features. It has some annoying quirks, but it beats the old paper based check registers.

At the end of the year I log on to our various banking sites and download the transactions from our credit cards and checking accounts to CSV files. Then I import the CSV files into a program called Alzex Personal Finance. It lets me easily categorize expenses to see where our money is going.

https://www.alzex.com/

Surewhitey

Thinks s/he gets paid by the post

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Another Excel user for all things financial and more, but I used Excel and earlier spreadsheets (VisiCalc, Lotus 1-2-3) throughout my career. The advantage is I can tailor each to do exactly what I want, present results exactly as I like, and modify as I see fit. And I know the exact calcs and assumptions underlying everything, unlike many canned financial packages. There’s nothing Excel can’t do for 99.9% of users...

Last edited:

jimbee

Thinks s/he gets paid by the post

- Joined

- Oct 11, 2010

- Messages

- 1,227

I use LibreOffice. Most of my spending is through a credit card account. The rest is through a checking account. One download from each account at the end of the year, and I have all of my spending in sufficient detail for my needs.

I record relevant things for taxes or medical expenses since I may need them for taxes, HSA documentation and so forth.

Most other things I don't. I have other things to spend cycles on that are either more important or more fun.

I learned in my 20's and early 30's that tracking that stuff was not needed for us.

If you need it to keep your budget straight or it makes you feel better.. have at it.

Most other things I don't. I have other things to spend cycles on that are either more important or more fun.

I learned in my 20's and early 30's that tracking that stuff was not needed for us.

If you need it to keep your budget straight or it makes you feel better.. have at it.

I have triple redundancy:

1) Quicken for Mac 2007 (amazingly still does free downloads from my bank)

2) Quicken for Mac 2020 (subscription model believing 2007 will die someday)

3) Mint (been using since inception in 2011)

For budgeting I like Quicken for Mac 2007 the best.

Needless to say, tracking our finances is kind of a hobby for me. Definitely not a burden.

1) Quicken for Mac 2007 (amazingly still does free downloads from my bank)

2) Quicken for Mac 2020 (subscription model believing 2007 will die someday)

3) Mint (been using since inception in 2011)

For budgeting I like Quicken for Mac 2007 the best.

Needless to say, tracking our finances is kind of a hobby for me. Definitely not a burden.

ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

I don't need expenses broken down by category. I just need to know how much I'm going through, and what my average spending looks like. All I need for that is my checkbook and a simple Word table.

- Joined

- Apr 14, 2006

- Messages

- 23,058

I use an Excel spreadsheet of my own creation to track spending. I run everything through a single credit card, so when I get the monthly bill, I categorize everything and enter it. I write very few checks now, but easy enough to enter those as I write them. And my cash expenses tend to be the same every month (haircut, dry cleaner, car wash, etc). All easy enough to remember until the end of the day and then enter them.

Ex scientia tridens and other useful things.

Ex scientia tridens and other useful things.

I have been using one of many account aggregation services online (powered by backend called Yodlee). I use bank of America "My Accounts" in particular. I let BoA/Yodlee do the heavy lifting of collecting all non-cash transactions (income as well as expenses). I use "custom nested categories" to track rental income and expenses. BoA/Yodlee is smart and auto-learns the categorization rules and you can create manual categorization rules as well. I download CSV file containing "transactions" every month and then add cash transactions by hand on top of that. Then all the transactions entries go into a "Master" tracking spreadsheet where I have custom pivot tables to create different "views" e.g. Personal expenses by category, rental income+expenses, cashflow, etc. This system has been working great for me for over 15 years. You can extend/replace this system in the future since you own the data locally on your computer in raw format. Here is my empty "master" spreadsheet with example pivot tables.

Last edited:

Similar threads

- Replies

- 20

- Views

- 1K

- Replies

- 17

- Views

- 726

- Replies

- 5

- Views

- 672

- Replies

- 12

- Views

- 882