You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hypothetical Portfolio

- Thread starter augam

- Start date

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not readable.

atmsmshr

Full time employment: Posting here.

Can't even tell what the question is all about or response solicited.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1 not sure what it all means

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It doesn't mean anything. Drawdowns don't matter. Total return is what matters.+1 not sure what it all means

+1 not sure what it all means

Not readable.

Can't even tell what the question is all about or response solicited.

It doesn't mean anything. Drawdowns don't matter. Total return is what matters.

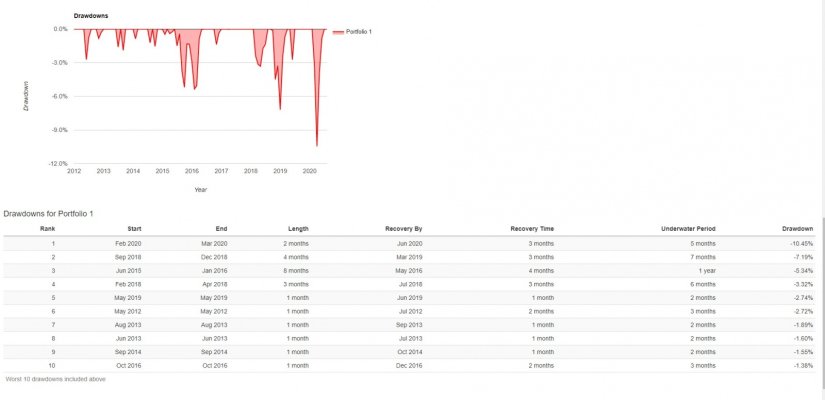

Scenario is 1.7mil 200k cash and 50/50 AA FBNDX/VTSMX 500k in each back tested with a 3% draw down annually.

In the chart shown I am wondering if this a typical scenario.

Thanks,

oh and sorry for confusion.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes. It is typical for the market to go down sometimes....I am wondering if this a typical scenario. ...

Edit: It is also typical for the market to go up sometimes.

Last edited:

Out-to-Lunch

Thinks s/he gets paid by the post

Scenario is 1.7mil 200k cash and 50/50 AA FBNDX/VTSMX 500k in each back tested with a 3% draw down annually.

In the chart shown I am wondering if this a typical scenario.

Thanks,

oh and sorry for confusion.

I still don't understand the portfolio yet: If you have 500k each in FBNDX & VTSMX and 200k in cash, and 1.7M total, where is the other 500k?

I still don't understand the portfolio yet: If you have 500k each in FBNDX & VTSMX and 200k in cash, and 1.7M total, where is the other 500k?

My bad. I placed some side bets in various equities.

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

Scenario is 1.7mil 200k cash and 50/50 AA FBNDX/VTSMX 500k in each back tested with a 3% draw down annually.

This is an odd mix of 2 funds because

(a) they are from two different firms

(b) VTSMX is no longer available for purchase I think since it has been replaced with VTSAX

(c) FBNDX is an actively-managed bond fund though many people confuse it with a total US bond index fund.

So one could have picked just about any 50/50 US stock / US bond mix I suppose and gotten similar results.

This is an odd mix of 2 funds because

(a) they are from two different firms

(b) VTSMX is no longer available for purchase I think since it has been replaced with VTSAX

(c) FBNDX is an actively-managed bond fund though many people confuse it with a total US bond index fund.

So one could have picked just about any 50/50 US stock / US bond mix I suppose and gotten similar results.

I needed to back test an equity holding that had some history. Hence hypothetical.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

OP, are you familiar with firecalc? (http://www.firecalc.com - notice there are tabs across the top for multiple sections of input)

If you’re interested in worst case scenarios have a look at a more detailed review:

http://https://portfoliocharts.com/2019/08/20/the-top-4-portfolios-to-recession-proof-your-investments/

http://https://portfoliocharts.com/2019/08/20/the-top-4-portfolios-to-recession-proof-your-investments/

Out-to-Lunch

Thinks s/he gets paid by the post

If you’re interested in worst case scenarios have a look at a more detailed review:

http://https://portfoliocharts.com/2019/08/20/the-top-4-portfolios-to-recession-proof-your-investments/

Somehow, a colon was missing from your URL. I think this is the link you meant:

https://portfoliocharts.com/2019/08/20/the-top-4-portfolios-to-recession-proof-your-investments/

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 51

- Views

- 5K

- Replies

- 26

- Views

- 1K

- Replies

- 21

- Views

- 1K