Gearhead Jim

Full time employment: Posting here.

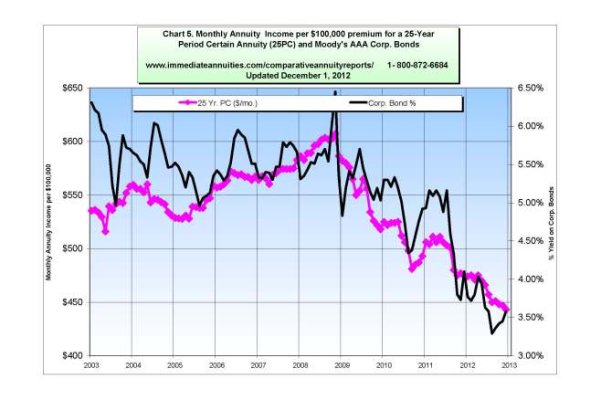

When I retired at 60, that seemed too young for DW (58, then) and I to want a SPIA. We have SS and a modest pension already, plus our IRA's.

But I planned to think about a SPIA a few years later. After all, our greater age should produce a higher income for a given investment.

Well, here I am age 67, and the monthly payout for a given SPIA investment is lower than it was 7 years ago when we were 7 years younger. Those low bond rates have been a very effective War on Savers.

I'm interested in everyone's thoughts on how this price/payout situation might play out in the future. Obviously, interest rates are an important component. But perhaps not the only thing...

But I planned to think about a SPIA a few years later. After all, our greater age should produce a higher income for a given investment.

Well, here I am age 67, and the monthly payout for a given SPIA investment is lower than it was 7 years ago when we were 7 years younger. Those low bond rates have been a very effective War on Savers.

I'm interested in everyone's thoughts on how this price/payout situation might play out in the future. Obviously, interest rates are an important component. But perhaps not the only thing...