I know this seems odd given the spectacular returns of the past year, but I saw this posted on another forum:

Equity markets are dying - Matthew Lynn's London Eye - MarketWatch (1/2/13)

I read the article comments and did a quick Google search. Apparently there have been prior proclaimers of the death of equities, but I have not had time to investigate them thoroughly:

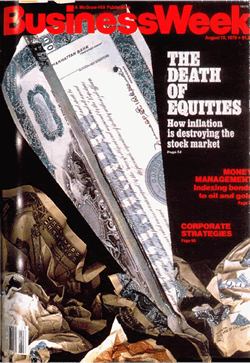

The Death of Equities - Businessweek (8/13/79)

Bill Gross Proclaims Death of Equities: We've Heard That Before - MarketBeat - WSJ (8/1/12)

Is there any water to the arguments raised in the commentary, or is it another piece of sensationalist journalism?

Equity markets are dying - Matthew Lynn's London Eye - MarketWatch (1/2/13)

I read the article comments and did a quick Google search. Apparently there have been prior proclaimers of the death of equities, but I have not had time to investigate them thoroughly:

The Death of Equities - Businessweek (8/13/79)

Bill Gross Proclaims Death of Equities: We've Heard That Before - MarketBeat - WSJ (8/1/12)

Is there any water to the arguments raised in the commentary, or is it another piece of sensationalist journalism?