As someone who runs a small e-commerce business, the idea of collecting and remitting for all 45+ states that have sales tax, not to mention those that have multiple tax jurisdictions, is a nightmare. (Interacting with state revenue websites is like a bad visit back in time to late 90's internet speed, function, and navigation...)

Just gathering together the data for my own state to file each quarter takes about a half an hour. This is just me, a very small part time business/hobby, so yes there are probably better costlier solutions to do this for me, somewhat automatically.

But just registering, and then keeping track of, all the jurisdictions alone would be hours and hours of work.

It will hit the smaller online seller far harder than the big ones. And it will cause a lot of small sellers to severely limit those states they will do business with. I would look at selling only to states are most profitable to me, vs. the cost of tracking and filing those 1 or 2 sales a year to say, Idaho or something. (sorry idaho). If that one $50 sale to Idaho comes with an extra 20 mins of work, vs. those 12 California sales with the same amount of work... it makes sense.

This year, Amazon started collecting and remitting ST for all purchases in Washington state, including those from small 3rd party sellers. But for independent sellers outside of selling on amazon, they need to make their own solutions.

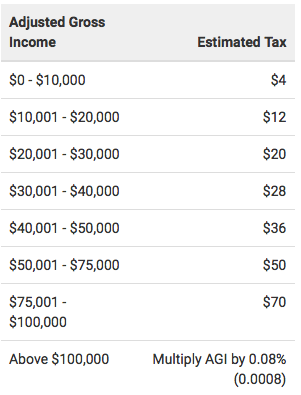

. I'll have to check with my sons. Oregon has one of the highest income taxes.

. I'll have to check with my sons. Oregon has one of the highest income taxes.