You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Reevaluating your AA?

- Thread starter GravitySucks

- Start date

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

On the first part, $3,333/month ($40k per year) adjusted for inflation, so increasing withdrawals to preserve $40k of spending power in Jan 2000.... I'm not sure if the inflation adjustments are monthly or annual, I presume annual, but I don't think that it makes much difference.

The hypothetical retiree wasn't putting themselves in any particular position to rely on a bull market unless they had some crystal ball... they just happened to retire in Jan 2000 and based on conventional wisdom selected a 60/40 AA and 4% WR. In retrospect, they retired at a particularly bad time... but they had no way of knowing that.

All the studies work is annual AFAIK, so their withdrawals and inflation adjustments would be annual. Which is why I ran it with annual and not monthly withdrawals.

But you really want to look at the inflation adjusted portfolio value over the years to see what is happening, and the portfolio is down 40% in real terms. Your nominal image above does not show this. So withdrawal rate is quite a bit higher than when they started.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Now all of that presumes that the retiree's spending had no wiggle room and that they strictly stuck to 4% plus inflation withdrawals.... I think the reality is that the decline in the portfolio in the early years would have caused the retiree to do some belt tightening to stem the decline of the portfolio... or start SS or a pension earlier than the original plan... or the like.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Now all of that presumes that the retiree's spending had no wiggle room and that they strictly stuck to 4% plus inflation withdrawals.... I think the reality is that the decline in the portfolio in the early years would have caused the retiree to do some belt tightening to stem the decline of the portfolio... or start SS or a pension earlier than the original plan... or the like.

Indeed, because mostly nobody actually follows the 4% inflation adjusted withdrawal strategy vs. using it as a retirement preparedness analysis.

Additionally as pointed out by others in other threads, everyone has their own personal inflation rate and some rates could be less (or more) than the official inflation rate.

Now all of that presumes that the retiree's spending had no wiggle room and that they strictly stuck to 4% plus inflation withdrawals.... I think the reality is that the decline in the portfolio in the early years would have caused the retiree to do some belt tightening to stem the decline of the portfolio... or start SS or a pension earlier than the original plan... or the like.

Which underscores the importance of not cutting it too tightly with the spending/WR, and not being too optimistic in our projections about rates of return, and sequence risk etc

W2R

Moderator Emeritus

My portfolio is screaming rebalance right now - between a combination of dropping equities and capital gains distributions paid out over the past few weeks.

I will be rebalancing soon anyway as I usually do so near Jan 1.

Mine is screaming the same thing! It sailed past my rebalancing criteria a day or two ago.

But like you I am going to wait until January 1st before rebalancing, for tax reasons since so much of my portfolio is in taxable accounts. I always rebalance during the first week in January anyway.

If it seems like I do a lot of the same things as you, Audreyh1, that's because I think about your posts and generally they are very logical and clarify my thinking on financial matters. So, often I end up following your lead because what you do makes sense to me. Thanks for being so helpful over the years.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

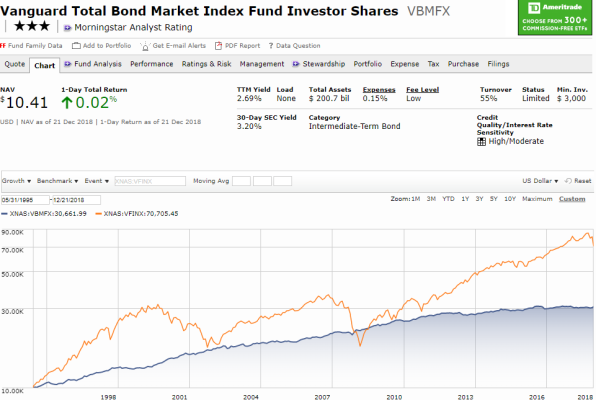

I'd say we are more closer aligned in our thinking than we are different. I understood your selected date, but that supposes that one jumped in feet first at that date, at the absolute peak of the S&P. Those that chose that date did experience a bit of a scare, but chances are most either got in before or after.bobandsherry, yes, I see your point. It looks to me from the top graph that it took over 16 years for the S&P to catch back up to the bond fund, with two steep plummets at approximately the two year, and eight year out points.

{lots of other great points truncated}

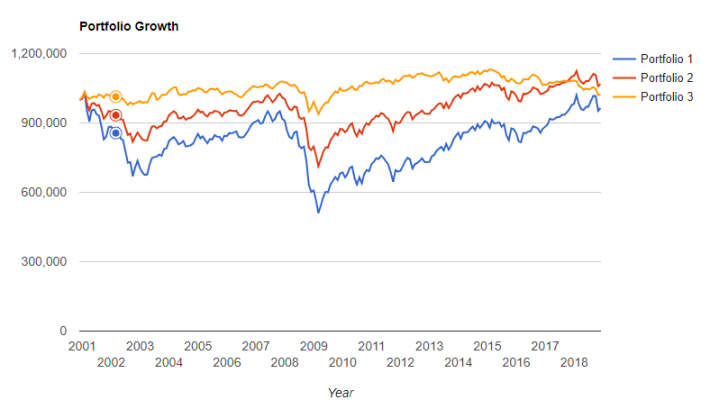

This chart shows if one was in just 5 years before that date and heavier in equities they still pretty much consistently better off than if they were in bonds. I had previously shown the period prior to that, each consistently showed a better performance with equities. With this starting point the portfolio would never had sank below the original starting point and with exception of one brief period of time, was consistently above what the bond fund performance would have returned (even in the time falling rate time period that was most beneficial to bonds).

In looking at the charts the period 1998-2008 was just a bad time to have jumped into equities. And perhaps this is a similar moment in time, but with lower rates recent historical rates there are fewer "better options" for money this go around (low rate environment with prior years even lower and foreign markets not performing well). So perhaps cash does become king, but don't think fund managers would settle with keeping cash as their investment for clients. So then where will people put their money?

I do get your point, but by and large one has been consistently better off with heavier AA on equities. I'm not 100% equities by any means. But don't think selling now and moving to a different AA (other than what the market has "forced" upon me with the lower equity prices) would be beneficial in the long run. Time will tell. Nice sharing thoughts with you.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

.... But you really want to look at the inflation adjusted portfolio value over the years to see what is happening, and the portfolio is down 40% in real terms. Your nominal image above does not show this. So withdrawal rate is quite a bit higher than when they started.

True, but if the 4% WR initially selected was based on a 30 year time horizon, then the remaining time horizon is only 12 years. If I then use FIRECalc for the remaining 12 years, with spending at $59,719 annually ($3,333 inflated from Jan 2000 to Nov 2018, then annualized), $944,840 portfolio and 60/40 AA then you get 100% success.

Now let's change it assuming that the hypthetical retiree retired early, at age 55... so he had a 40 year time horizon... he would have selected a lower WR.. let's say 3.5%. His $1 million portfolio in Jan 2000 would be $1,184,678 at November... and his current spending would be $52,265 annually... and his success rate for the remaining 22 years would be 98.4%.

In both cases, while unknowingly retiring into a "bad" time, they are both still looking good.

Why is that? IMO it is because the 4% rule is based on bad cases in history so it is conservative enough to provided safety to those who retired in Jan 2000.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,703

My portfolio is screaming rebalance right now - between a combination of dropping equities and capital gains distributions paid out over the past few weeks.

I will be rebalancing soon anyway as I usually do so near Jan 1.

I echo W2R's remarks about you and your posts.

Even though I happen to be within my AA rage, because I am taking a large cap gain distribution in cash, as I mentioned much earlier in this thread, I will take a long, hard look at my AA and figure out how I want to split up that large cash inflow after I have allocated some of it to predetermined places.

I don't have a preset time of year to rebalance, but January will be time I do so. I will wait a few weeks into the month because that stock fund sometimes spits out another (smaller) cap gains distribution around the 15th. By then, I will also have paid all my 4th quarter estimated income tax payments so my cash position will have settled down.

I bet this thread will continue to be active several weeks into 2019.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

My portfolio is screaming rebalance right now - between a combination of dropping equities and capital gains distributions paid out over the past few weeks.

I will be rebalancing soon anyway as I usually do so near Jan 1.

With the drops and distribution the market may have already made your AA adjustment for you

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

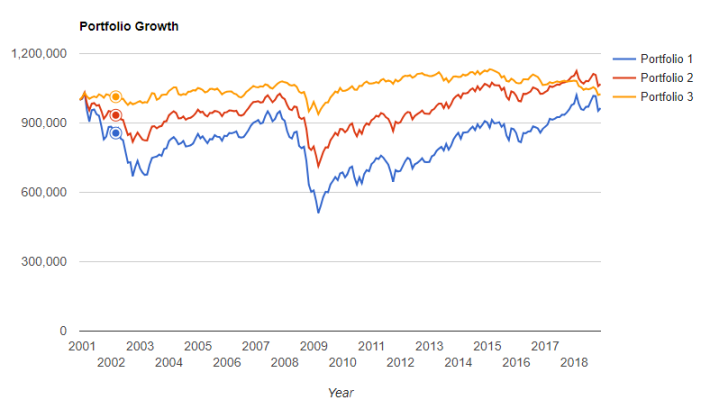

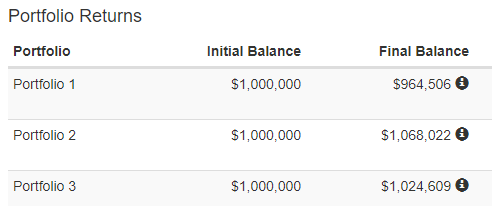

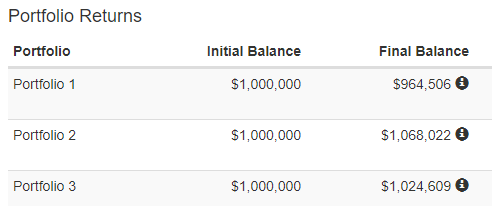

Thanks, that's exactly the tool I was looking for to compare the various scenarios. So I ran a 80/20 (Portfolio 1), 50/50 (Portfolio 2) and 20/80 (Portfolio 3) scenario. The portfolio more heavily weighted during this time was down vs. the bonds but was pretty close. The 50/50 portfolio actually ended up better their either.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Thanks, that's exactly the tool I was looking for to compare the various scenarios. So I ran a 80/20, 50/50 and 20/80 scenario. The portfolio more heavily weighted during this time was down vs. the bonds but was pretty close. The 50/50 portfolio actually ended up better their either.

https://www.portfoliovisualizer.com...&allocation2_3=80&symbol3=VGTSX&symbol4=VIPSX

Last edited:

I definitely have the most conservative allocation on this board. I am 30% equities and 70% fixed income. I sleep well at night with my allocation. I just turned 58 am retired and am two years away from receiving a modest state pension and free healthcare for life. I took a buyout last year and made the decision not too expose too much in equities. Anyway, for 2019, the rest my buyout covers my fixed expenses and healthcare. Fixed expenses are low since house is paid off. I have a part time gig (which I treat as volunteer work) that provides enough money to cover ALL discretionary expenses. Hence, I’m not trying to maximize my return on investments - I’m trying to accept being comfortable with what I spent 30 + years trying to save.

Oh, no dependents over here except for a codependent cat and a wife who covers her portion of our fixed costs.

Cheers and Happy Holidays,

I

Oh, no dependents over here except for a codependent cat and a wife who covers her portion of our fixed costs.

Cheers and Happy Holidays,

I

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Now all of that presumes that the retiree's spending had no wiggle room and that they strictly stuck to 4% plus inflation withdrawals.... I think the reality is that the decline in the portfolio in the early years would have caused the retiree to do some belt tightening to stem the decline of the portfolio... or start SS or a pension earlier than the original plan... or the like.

Spending and withdrawals/income are two different things. If the retiree doesn’t spend all in one year, they have extra to spend the next if desired.

The “constant spending” model was specifically developed for the case where the retiree spending had little or no variation.

Variable spending - well you have to come up with your preferrred ways of handling it, same with variabele income.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

With the drops and distribution the market may have already made your AA adjustment for you

No it hasn’t. I’m at 43.5% equites instead of 50%, way low.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

I definitely have the most conservative allocation on this board. I am 30% equities and 70% fixed income. I sleep well at night with my allocation.... Hence, I’m not trying to maximize my return on investments - I’m trying to accept being comfortable with what spent 30 + years trying to save.

Ours is more conservative and I think there are others on this board with 0 - 20% stock allocations as well. There just isn't as much to talk about or react to with a low market allocation. The main financial event in our house is we are winding down the number of years left we are going to try to limit our taxable income for ACA subsidies. So I get to start spending a bit more next year no matter what the market does.

Apropos of nothing, I did about 20-25% of my rebalance Friday during the collapse (I usually rebalance in late Jan/early Feb, although sometimes it's later in Feb). Over the last two years, I scraped off some stock gains and let cash accumulate to 20% and now I'm about 8% below my nominal stock allocation. I'm a little more comfortable with valuations now, after the 15% or so haircut. Luckily, I sold most of the funds considerably higher, so I'm buying back at a discount (for now).

It could be I'll have to add even more stock and did less of the rebalance than I know think--if the Harlem Slide in stocks continues.

It could be I'll have to add even more stock and did less of the rebalance than I know think--if the Harlem Slide in stocks continues.

clifp

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 27, 2006

- Messages

- 7,733

I'm guessing it is of the original balance using the standard Trinity study concept.

Yes, one had to have the huge bull market, but the flip side is how many retirees had to face 2 bear markets in 10 years and an upcoming 3rd one in a total of 20 years?

Thus both sides of the analysis equation come into play.

Raises hand, now that retiree would be me. 1999 retiree, bear market of 2000-2002 and 2008-2009 and now 2018 and I believe some of 2019 also.

I don't think there is any question that over most ten-year periods and all 20+ year period stocks outperform bonds. In some small number of cases a 50/50 portfolio outperforms a 75/25 but generally speaking for early retiree your best chance of being able to withdraw 4% are with a high equity AA.

However, if your WR is under 4%, I think perhaps the right question to ask is what the AA the helps you sleep at night during volatility markets. That's an individual preference, so I think it is important to find what works for you.

If we hit the bottom of this correction, then selling stocks to buy bonds is foolish financially. On the other hand, if this beginning of a bear market than selling stocks will not only make you sleep better at night but is financially wise. None of us know with any certainty if this end of the correction or the beginning of the bear.

One thing, which I believe we don't ask ourselves often enough. Is how will owning this particular asset class help me right now reach my retirement goals.

My bond allocation right after retirement was the highest its ever been 60/40. Which in many ways makes no sense a 39-year-old should have had less bonds than a 58-year-old. But in many ways it did. If you have withdrawal rate of say 3.5% and you figure 2 percent inflation, then your portfolio needs to average 5.5%. If you are over 60 and you are comfortable drawing down your principal 1% to 2% you can reduce the needed return even further.

Back in 2000, I bought TIPs bonds and i-bonds with coupon rates of between 3.5 and 3.93%. If I could have bought 50-year bonds I could have funded my retirement right there. In contrast a few years ago CDs were only paying 1%. I don't care about asset allocation, a 1% CD doesn't make a meaningful contribution to the 5.5% rate my portfolio needs to earn. So I'm going to buy stocks (or may case buy some real estate and other assets) even though they are risky. Hence, as my bond portfolio matured, I stop buying more bonds. The Fed had a declared a war on savers, and the adage "don't fight the fed"

Nowadays the situation has changed, while long-term interest rates are still low short-term rates have improved. A 2 year CD pays 3%, less than the average of what typical portfolio need to earn, but within range. The Fed has told us they are going be unwinding the 4 Trillion of long-term bonds they own. This should drive prices down and yields up on long-term bonds. Meaning that if you stick your money a 2 year CD, by the time it matures, there is a good chance you'll be able to buy high-quality bonds with 4-5% yields.

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ours is more conservative and I think there are others on this board with 0 - 20% stock allocations as well. There just isn't as much to talk about or react to with a low market allocation.

True. CD rate discussions is about all I contribute to these days. Being near 20/80 I'm not hurting as much right now but I don't 'wheeeee' much either when the market is going out the roof. But thats okay.....

Ours is more conservative and I think there are others on this board with 0 - 20% stock allocations as well. There just isn't as much to talk about or react to with a low market allocation. The main financial event in our house is we are winding down the number of years left we are going to try to limit our taxable income for ACA subsidies. So I get to start spending a bit more next year no matter what the market does.

Thanks to you and Dawg52 for your responses! I really don’t like stretching my AA and it’s comforting to hear that other folks think similar.

Based on the market gyrations over the past 2 to 3 months, I would have:

1. Worried More

2. Began to sell holdings, based on fear or feeling that I knew more than other investors (which is not the case.)

3. Wasted more time watching CNBC, which would have depressed me.

Glad I’m not there anymore.

I

W2R

Moderator Emeritus

(Bolded emphasis mine)Thanks to you and Dawg52 for your responses! I really don’t like stretching my AA and it’s comforting to hear that other folks think similar.

Based on the market gyrations over the past 2 to 3 months, I would have:

1. Worried More

2. Began to sell holdings, based on fear or feeling that I knew more than other investors (which is not the case.)

3. Wasted more time watching CNBC, which would have depressed me.

Glad I’m not there anymore.

I

One of the multitude of wonderful consequences from cutting the cable, is that I no longer get CNBC. No more Cramer!

lem1955

Recycles dryer sheets

- Joined

- Mar 1, 2007

- Messages

- 315

Raises hand, now that retiree would be me. 1999 retiree, bear market of 2000-2002 and 2008-2009 and now 2018 and I believe some of 2019 also.

Nowadays the situation has changed, while long-term interest rates are still low short-term rates have improved. A 2 year CD pays 3%, less than the average of what typical portfolio need to earn, but within range. The Fed has told us they are going be unwinding the 4 Trillion of long-term bonds they own. This should drive prices down and yields up on long-term bonds. Meaning that if you stick your money a 2 year CD, by the time it matures, there is a good chance you'll be able to buy high-quality bonds with 4-5% yields.

I just moved a significant portion of my bond asset allocation to CD's for baseline living expenses in 2021-2023 at 3.1-3.4%. I sold all of VTABX to do so. I still have a little more than half my bond portfolio in VBTLX. My plan is to reinvest CD dividends in VBTLX. I'll reconsider the CD to VBTLX ratio as I go forward.

Closet_Gamer

Thinks s/he gets paid by the post

Fantastic discussion. I like hanging around smart people.

Back to the OPs original question: I review my AA every 5 years in a methodical way and leave it alone in between.

The implosion of 2008 did "scare me straight" at the time.

One day I was asked to sit in a quiet megacorp meeting to ponder how to ensure the company's survival if great depression #2 actually arrived. It was an un-nerving discussion with questions of massive unemployment for years, etc.

I was, in a very practical way, faced with the prospect of losing my job for an extended period of time and perhaps losing the house. Thankfully the depression did not arrive.

After that meeting, my wife and I reviewed our financial situation and the fact that we had two young kids to care for. We pounded down a large house mortgage obtained when we relo'd to a high COL area and stretched our emergency cash position. I also moved a lot of college funds into a guaranteed return fund (which may have been a mistake...we will know the answer to that question in the next 24 months).

I have maintained that posture since but reviewed my AA on the 5 year schedule noted above.

Back to the OPs original question: I review my AA every 5 years in a methodical way and leave it alone in between.

The implosion of 2008 did "scare me straight" at the time.

One day I was asked to sit in a quiet megacorp meeting to ponder how to ensure the company's survival if great depression #2 actually arrived. It was an un-nerving discussion with questions of massive unemployment for years, etc.

I was, in a very practical way, faced with the prospect of losing my job for an extended period of time and perhaps losing the house. Thankfully the depression did not arrive.

After that meeting, my wife and I reviewed our financial situation and the fact that we had two young kids to care for. We pounded down a large house mortgage obtained when we relo'd to a high COL area and stretched our emergency cash position. I also moved a lot of college funds into a guaranteed return fund (which may have been a mistake...we will know the answer to that question in the next 24 months).

I have maintained that posture since but reviewed my AA on the 5 year schedule noted above.

I use the Monte Carlo calculator in portfolio vizualizer.

https://www.portfoliovisualizer.com/monte-carlo-simulation#analysisResults

You can visualize portfolio AA inflation sor WR and specific tickers in a portfolio. The calculator figures out where your portfolio is on the risk reward plane and the calculator reads out failure rate as well as the probable distribution of success. Monte Carlo is forward looking not based on the past. It generates 10,000 "futures" and then lists them across a Gaussian distribution using Bayesian statistics, so you don't know the future you know the most likely "futures" and likely failures and how far into retirement failure starts to occur for a given set of parameters. The biggest risk is early in retirement where SORR is greatest and something like 50/50 is suggested. 5 years in you might go a little more aggressive since you are 5 years closer to death and if you make a mistake the likelihood of running out of breath is greater than running out of money from the mistake. If things go well you might increase risk a little bit more another 5 years in, as you are closer still to death. If things go poorly you can re-optimize based on what remains. Using this calculator you can risk adjust AA every so often, say every 5 years given changing circumstances and understand what that means in a forward looking way, than just guessing or making 30 year projections. You essentially re-retire every 5 years. You can also analyze whether owning something like a international fund or REITs buys you more failure or less failure across a long time. Risk adjusting your portfolio against failure is quite useful once you eliminate the W2.

Deflation is a different situation than accumulation. Accumulation's rule is to maximize gain. Deflation's rule is to not run out money before you run out of breath given some starting portfolio and WR values. I don't use FIREcalc because it only looks at history. I sold some stock at the market high in Jan and I'm living off that cash for 5 years while I Roth convert. so my AA is about 55/45 now. As I spend the cash my AA will automatically glide back up to maybe between 60/40 or 65/35, depending on recession. At this point I take SS and RMD a tiny bond based TIRA to keep me in the 12% bracket for a couple decades. At that point I can become even more aggressive in my stock allocation as the 2 annuities fund my hamburgers and my need to tap the portfolio fades.

https://www.portfoliovisualizer.com/monte-carlo-simulation#analysisResults

You can visualize portfolio AA inflation sor WR and specific tickers in a portfolio. The calculator figures out where your portfolio is on the risk reward plane and the calculator reads out failure rate as well as the probable distribution of success. Monte Carlo is forward looking not based on the past. It generates 10,000 "futures" and then lists them across a Gaussian distribution using Bayesian statistics, so you don't know the future you know the most likely "futures" and likely failures and how far into retirement failure starts to occur for a given set of parameters. The biggest risk is early in retirement where SORR is greatest and something like 50/50 is suggested. 5 years in you might go a little more aggressive since you are 5 years closer to death and if you make a mistake the likelihood of running out of breath is greater than running out of money from the mistake. If things go well you might increase risk a little bit more another 5 years in, as you are closer still to death. If things go poorly you can re-optimize based on what remains. Using this calculator you can risk adjust AA every so often, say every 5 years given changing circumstances and understand what that means in a forward looking way, than just guessing or making 30 year projections. You essentially re-retire every 5 years. You can also analyze whether owning something like a international fund or REITs buys you more failure or less failure across a long time. Risk adjusting your portfolio against failure is quite useful once you eliminate the W2.

Deflation is a different situation than accumulation. Accumulation's rule is to maximize gain. Deflation's rule is to not run out money before you run out of breath given some starting portfolio and WR values. I don't use FIREcalc because it only looks at history. I sold some stock at the market high in Jan and I'm living off that cash for 5 years while I Roth convert. so my AA is about 55/45 now. As I spend the cash my AA will automatically glide back up to maybe between 60/40 or 65/35, depending on recession. At this point I take SS and RMD a tiny bond based TIRA to keep me in the 12% bracket for a couple decades. At that point I can become even more aggressive in my stock allocation as the 2 annuities fund my hamburgers and my need to tap the portfolio fades.

- Joined

- Jul 1, 2017

- Messages

- 5,833

Has this recent correction have you reconsidering your asset allocation?

I went into 2015 at 80/20 and found the first minor dip made it difficult to get a good night's sleep. I readjusted to 70/30 but the next drop was still to deep. Ive been 60/40 since and have barely paid attention to this ride down so far. Now I'm wondering if 60/40 is too conservative, but I doubt 65/35 would make any major difference so I guess it's time to sit here and do nothing.

Yes, I'm a bit high in equities, I'm thinking about lowering it by 5%.

But not now.

Similar threads

- Replies

- 51

- Views

- 5K

- Replies

- 69

- Views

- 6K