So, This is what I've found.

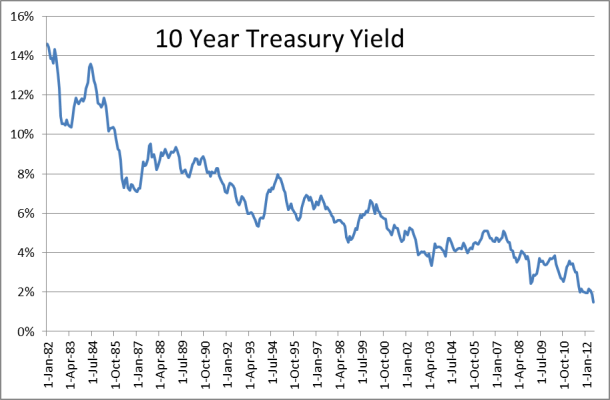

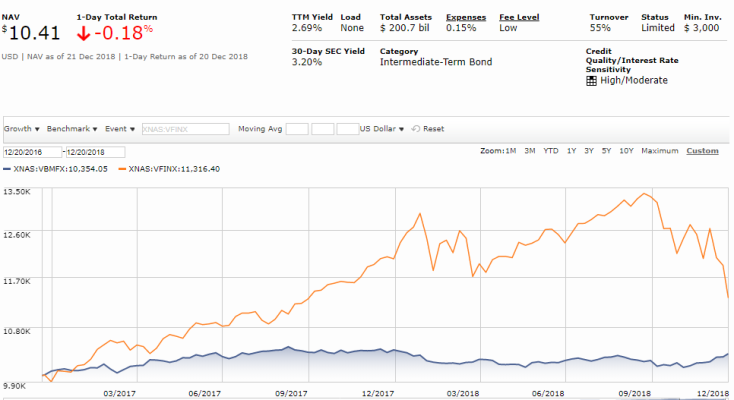

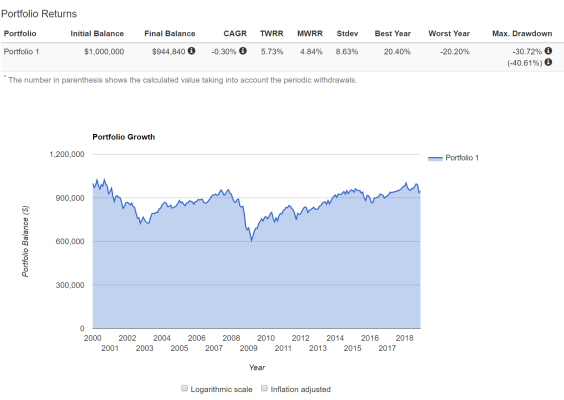

A graph that shows that in 1997, 10 year treasuries were yielding around 6%, and over the decade or so it took for equity prices to rebound to pre-crash prices, the overall bond market went through a decline in yields, so I assume that while it was paying 6%, the face value would have increased.

According to a graph showing the S&P Dividend Yield, for that decade it was averaging under 2%.

Here are the links to those graphs:

S&P 500 Dividend Yield

http://4.bp.blogspot.com/-wzAFfFWHL...Gyn0h7yvf0/s1600/10-yr+Treasury+yields+25.jpg

I tried to post the actual graphs, but I'm too dense to figure out how to do it. Sorry.

I think it shows that any dollars thus invested would do better for that decade than left in equities for the crash. Probably even better if you cashed in that bond after a bit of a tumble and then reinvested it in the market for some of the upswing, which is one of the big advantages of not being too strong in your equities AA, I would think.

http://www.early-retirement.org/forums/attachment.php?attachmentid=30247&stc=1&d=1545428058

I wouldn't know how to quantify that.

edit: I tried to edit this post to include the graphs but I only made it worse. sorry.