flintnational

Thinks s/he gets paid by the post

ETA: Post deleted

Last edited:

This statement and similar ones are common in writings by people who are advocating stock-picking. IMO they have a sort of sneering quality.

As a passive investor over the long term, literally a half-century* of data predict that I will beat around 95% of stock-picking mutual fund "expert investors."

If someone told me I had a roughly 40% chance to beat the market or sit back and take average returns, I'm going to take that 40% chance.

The market is not the same now as it was even 25 years ago. There are entirely new market sectors and companies that didn't even exist back then. It might behoove you to compare index investing vs. active investing for the past 15-20 years or so. It's not a 95% success rate for passive investing, far from it.

For example, in 2017 Morningstar's Active/Passive Barometer shows that 46% of active funds beat passive funds; in 2018 the number was 38%. While not a majority, that's a far cry from the paltry 5% advantage you are claiming over 50 years.

Maybe, but this is a one-year number and investing is a long-term endeavor. The problem is that the results are random and the the winners cannot be predicted (ref S&P Manager Persistence reports) ahead of time. So over 5 years, that 40% chance (.4^5) gives you about a 1% chance of beating the market.If someone told me I had a roughly 40% chance to beat the market or sit back and take average returns, I'm going to take that 40% chance.

It's not a 95% success rate for passive investing, far from it.

It's an accurate statement. Index funds yield market average returns. If that's what your goal is, by all means invest in the three fund portfolio.

I'm not a stock picker, though I do have an account at TD Ameritrade with $6,000 I use to play the market. Most of my portfolio is in mutual funds.

...If you put 10,000 monkeys in a stadium (approximately the number of mutual funds) and you have them each flip a coin 8 times, there will be about 40 of them who have flipped all heads.

Yup. Boring. Agreed. I tell the students in my investing class this: "Investing is boring. If you're not bored, you're not doing it right."... I have "risk taking" in my DNA and I gotta have some fun in my life. Index fund works well...but they are boring to me. I get a thrill when i take a risk and then I get rewarded for it. ...

Yup again. It's just like convincing the flat-earthers or the people who think the moon landing was a fake. The scientific evidence is against them but they don't care.Trying to convince an active investor to become a passive investor (or vice versa) is like trying to change someone's religion. It can't be done.

....

I have "risk taking" in my DNA and I gotta have some fun in my life. Index fund works well...but they are boring to me. I get a thrill when i take a risk and then I get rewarded for it. This thrill I can never get....when i am a passive investor and I am fully invested in index funds.

...

This is who I am. Nobody is going to change me since I made money buying on the market dips in the last 40 years. 40 years of Investing experience takes precedent over other people's statistical data or someone's publications or someone's say-so.

Trying to convince an active investor to become a passive investor (or vice versa) is like trying to change someone's religion. It can't be done.

I tend to agree with Qs Laptop in that Index funds yield market average returns. I also play the market but only about 10% of my portfolio.

I have "risk taking" in my DNA and I gotta have some fun in my life. Index fund works well...but they are boring to me. I get a thrill when i take a risk and then I get rewarded for it. This thrill I can never get....when i am a passive investor and I am fully invested in index funds.

I am retired and getting close to age 70 but i have a 50/50 portfolio which is aggressive for my age. When the market is down, I re-allocate to an even more aggressive 60% stock/40% bond to take advantage of the recovery. As my backup plan, I have 7-1/2 years of retirement income in CD, short term treasury bonds and short term corporate bonds to hold me over if there is a crash or bear market.

This is who I am. Nobody is going to change me since I made money buying on the market dips in the last 40 years. 40 years of Investing experience takes precedent over other people's statistical data or someone's publications or someone's say-so.

Trying to convince an active investor to become a passive investor (or vice versa) is like trying to change someone's religion. It can't be done.

Maybe, but this is a one-year number and investing is a long-term endeavor. The problem is that the results are random and the the winners cannot be predicted (ref S&P Manager Persistence reports) ahead of time. So over 5 years, that 40% chance (.4^5) gives you about a 1% chance of beating the market.

It is always the case that there are winning funds. If you put 10,000 monkeys in a stadium (approximately the number of mutual funds) and you have them each flip a coin 8 times, there will be about 40 of them who have flipped all heads. Skill? Hardly. And, far worse, at the beginning of the game there is no way to predict which monkeys will be the lucky ones. Same story with mutual funds, as the Manager Persistence reports consistently show.

The thing about humans is that we have 100,000 or more years of evolution that has made us individually believe that we are exceptional and lucky. That is why the casinos and lotteries will never go out of business.

Virtually everyone going to a casino or buying a lottery ticket knows that the odds are against them, but they play anyway because of this human trait. If you didn't believe that you were exceptional, you wouldn't touch a game with only 40% odds of winning in the short term and virtually zero chance of winning in the long term.

If you have statistical data to back up your contrary claim, I would be interested to see it.

Ah, come on: you're basing your argument on one study that took place in Yugoslavia (circa 1951) and has never (at least to my knowledge) been replicated. As a side note, about 1200 the monkeys did not complete the experiment as they were asked to leave due to their disruptive behaviors. Furthermore, the researchers' judgment was called into question regarding trying to place 10,000 monkeys in a stadium with a capacity of 4300.

...

Sure, and I've done so. Most of my large growth investments is in several mutual funds, like FKDNX, FOCPX, FBGRX, ANEFX. I could show you some past data but you would respond with "backtesting is not predictive of the future" or something similar. Meanwhile, I happily go on beating the market.

But if you want average returns, that's your prerogative.

.

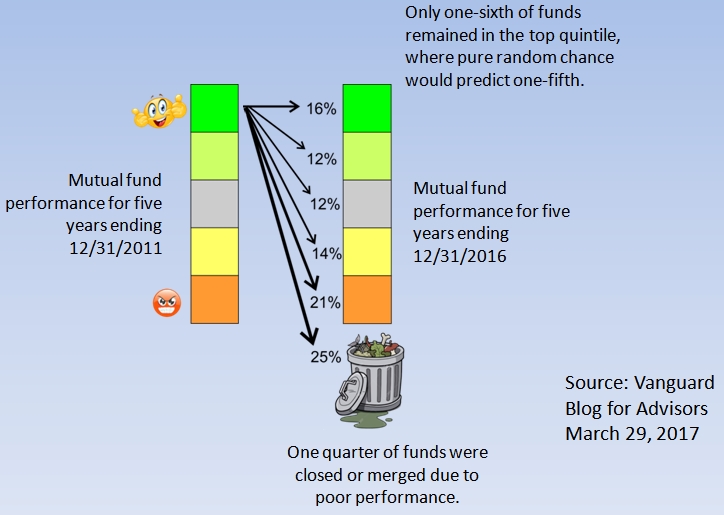

.Actually, the S&P Manager Persistence reports have basically run that experiment for you. They took the top 20% of thousands of funds' performance over a 5 year period and looked at their results over the next five year period. Here is the result:... Here is a better analogy. There are some baseball players that can hit a lot of home runs. There are some that cannot. When an MLB team goes to draft day and is looking to pick the best players, do they consider spending their time, effort, and money to pick an average player? Because over time it will simply average out that we will win the World Series...

Another way to look at it is that there are some high school basketball players that can dunk, though most of them cannot. Who are you going to pick for your team--the guy that can dunk, or the average guy that cannot? ...

You are invited to show us how you happily go on beating the market over the next couple of years.

http://www.early-retirement.org/forums/f44/stocking-picking-contest-v3-0-a-97638.html

No need to show us past data or anything, just simply see how well you stack up against a total stock market index fund and others in the contest.

IIRC that is a two-year contest. If stock-picking mutual fund results are indicative you'll have about a 10% chance of beating your benchmark.I'm in.

Yup. Boring. Agreed. I tell the students in my investing class this: "Investing is boring. If you're not bored, you're not doing it right."

Re thrill, all true. Read Zweig's book. We are wired that way. Same reason I raced sports cars for 15 years and same reason people jump out of perfectly good airplanes. Addictive brain chemistry.

Yup again. It's just like convincing the flat-earthers or the people who think the moon landing was a fake. The scientific evidence is against them but they don't care.

There is nothing at all "wrong" with being a trader, but fifty years of studies and statistical data say that it is highly unlikely to beat a passive strategy. I'm totally OK with anyone deciding to be a trader but I do want to encourage people to select a strategy based on good information rather than on internet anecdotes. The plural of "anecdote" is not "data."... However, if they take the active investing path, then the hard core passive investors better be OK with that ....and not try to prove that it is wrong to do so.

You are invited to show us how you happily go on beating the market over the next couple of years.

http://www.early-retirement.org/forums/f44/stocking-picking-contest-v3-0-a-97638.html

No need to show us past data or anything, just simply see how well you stack up against a total stock market index fund and others in the contest.

..... For example, in 2017 Morningstar's Active/Passive Barometer shows that 46% of active funds beat passive funds; in 2018 the number was 38%. While not a majority, that's a far cry from the paltry 5% advantage you are claiming over 50 years.

If someone told me I had a roughly 40% chance to beat the market or sit back and take average returns, I'm going to take that 40% chance.

(emphasis added).... In general, actively managed funds have failed to survive and beat their benchmarks, especially over longer time horizons; only 24% of all active funds topped their average passive rival over the 10-year period ended December 2018; long-term success rates were generally higher among foreign-stock funds and bond funds and lowest among U.S. large-cap funds.

https://www.morningstar.com/blog/2019/02/12/active-passive-funds.html

My own scientific evidence is my portfolio and that fact that i purchased a $1/2 M California house in cash for my college attending daughter so she will never have to pay rent or a mortgage payment in her life. ....

I'm in.

Aside from this forum, my favorite financial forum is the Bogleheads Forum. Like this one, it includes many really smart people who simply want to help and tolerate basic newbie questions that may seem stupid to those in the know. Nothing ticks me off more than when I ask a question on a forum and somebody replies with "Why not just Google it?". They don't seem to understand I DID Google it and I don't understand what I read. Anyway, that being said, one of the basic tenants of Bogle Investing is the index fund approach to investing. Similar to what Ben Stein recommended in his book. Your total portfolioi is three index funds, total domestic stock, totoal international stock, and total bond market. I think this was originally called the Couch Potato portfolio. Jack Bogle in a 2017 interview said he does not include International in his portfolio, but he can see the logic of doing so. This simple approach makes a lot of sense to me. Does anyone have any feelings yay or nay on this investing approach? I should add, I am a p poor investor, am not interested in finance or investing, am just looking for a reasonably safe way to park my IRA money in retirement that requires little or no maintenance.

IIRC that is a two-year contest. If stock-picking mutual fund results are indicative you'll have about a 10% chance of beating your benchmark.

Over 2 years mutual funds have about a 13% chance of failing badly enough to either be closed or merged; not sure how that plays in the contest situation.

Keep us posted.