ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

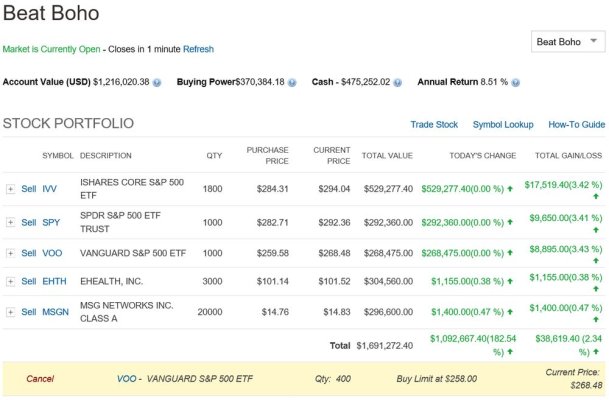

$293.01, so I lost about $12,000. I shorted about 5 things in the last several months. I may have come out about even but I didn't add it up. I don't know whether the cash I had during that time hurt or helped.

Also, I bought SPY and IVV.

8/13/2019 10:24 AM Stock: Buy at Limit IVV 2000 $294.16 $588,324.99 Acct value: $1,208,656.11

8/13/2019 10:24 AM Stock: Buy at Limit SPY 2000 $292.43 $584,864.99 Acct value: $1,208,661.10

8/13/2019 10:19 AM Cover Stock: Cover at Market SPY 2000 $293.01 $586,024.99 Acct value: $1,208,666.09

So you went short about a week ago, covered at a higher price, and now are buying near that high price?

That's some strategy ya' got there. Let's see how it works.

Would it be alright with you if we used your username as a verb to mean "identifying alternative metrics to win by when the original relevant one isn't going so well"?

I think sengsational already beat you to it. He said something like 'I don't mean to Boho this...',

Ahhh, here it is, close:

http://www.early-retirement.org/forums/f44/magic-formula-tracker-82446.html

Here's another attempt to Boho the results of this experiment...

-ERD50