ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think I found it.

A Combination of Dopamine Genes Predicts Success by Professional Wall Street Traders

I did 23andme. I should check.

I wonder if 23andme will show a gene for Rock, Paper, Scissors ability?

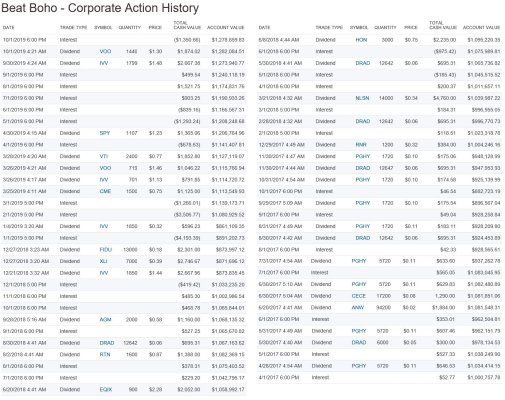

EHTH worked out well. I'm trying to sell MSGN now at a profit but I can only sell 1/4 of it because of volume restrictions. I'm selling it at market. I bought more yesterday and now I have 30000 shares.

So let's see how you do at our monthly update, one week from now. "good trades" don't mean much, you need to do good on average. So far, you are not. You had some bad trades, too.

-ERD50