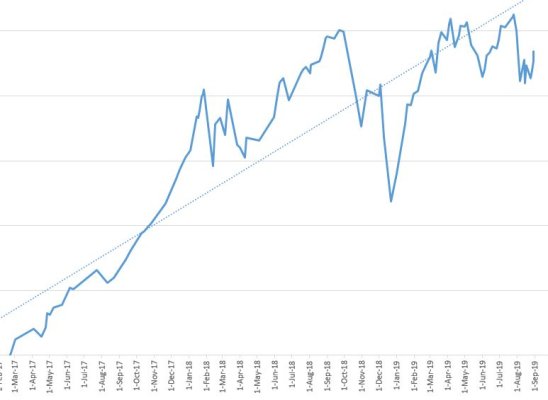

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

July 2019June 2019

June was a fantastic month for investing and saving. FYI, off-screen we have two salaries (mine reduced 40% this year), and our monthly spend comes out of that. So it really is a rosy picture.

- +14.21% Total Portfolio Value increase YTD (End of June)

- +10.36% YTD Performance (End of June), total pie weighted

- 50-45-05 (Stk-Bnd-Csh) Target AA

RLBGX American Funds Balanced R6 is +11.09% YTD according to M*. I hold that 50/50 fund in one of my 401k accounts, and it looks like a good barometer (or proxy) for overall performance of our AA.

- +15.27% Total Portfolio Value increase YTD (End of June)

- +10.00% estimated YTD Performance (End of July), total pie weighted

- 50-45-05 (Stk-Bnd-Csh) Target AA

I've noticed this thread has become less fun, and fewer posts...