I think "conservative" normally means "risk averse" but certainly there are investors like you for whom it probably means "volatility averse."

With respect, I submit that you are confusing volatility with risk. As long as you don't need to draw on an equity portfolio and you are still accumulating, volatility is actually your friend.

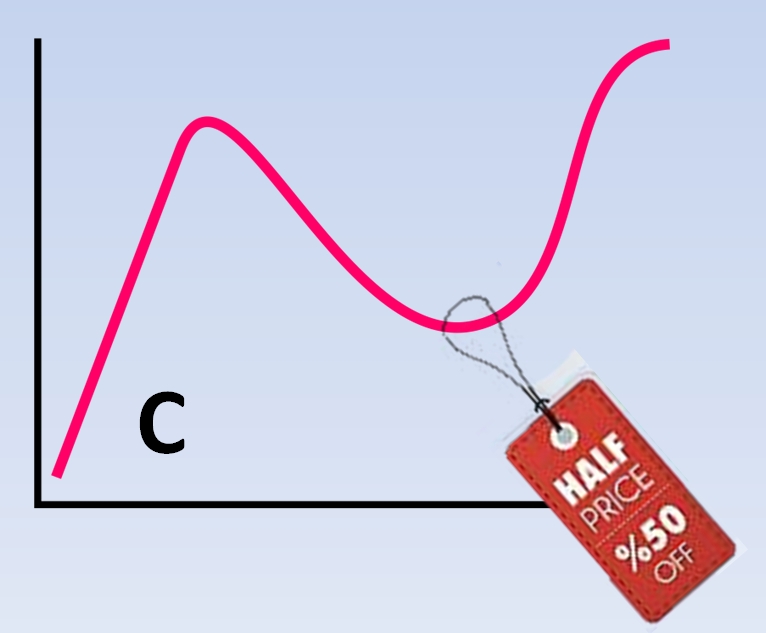

Technical: The distribution of prices is not a "normal" Gaussian distribution. The center of the distribution is not zero; it trends slowly upward at maybe 4-7% a year. The distribution also has "fat tails" as evidenced by the current excitement. If it were truly Gaussian with historical standard deviations, the recent price drops would be mathematically almost impossible. Here's the important bit: The fat tail the left is fatter than the one on the right. So a dollar cost averaging strategy will result in the accumulator consistently getting prices that are slightly lower than average.

In my Adult-Ed investing class I tell the accumulators to rejoice when the market drops. Here's the chart I use:

Risk comes at withdrawal time, SORR, as mentioned.

Good job. You have just capsulized Harry Markowitz's Capital Assets Pricing Model (CAPM) ! (https://www.investopedia.com/terms/c/capm.asp) Markowitz already has the Nobel though, so it's probably not worth putting in your application.

Good job. You have just capsulized Harry Markowitz's Capital Assets Pricing Model (CAPM) ! (https://www.investopedia.com/terms/c/capm.asp) Markowitz already has the Nobel though, so it's probably not worth putting in your application.