Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

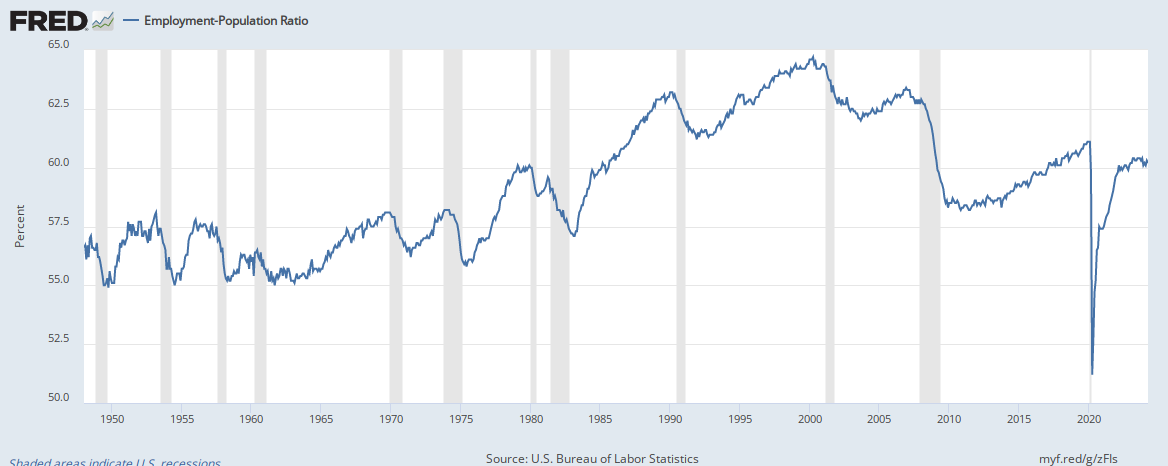

Why would that be? Would you have expected a roaring 20s boom in January 2020? If not, then why in January 2021? At best, and I really don't believe this, if there were 3/4 of a year of pent up demand that wouldn't seem to cause a long boom.

I stated many of the reasons in this thread. I was not saying it would last a decade if that is what you got from it. That's why I said "early 20s"

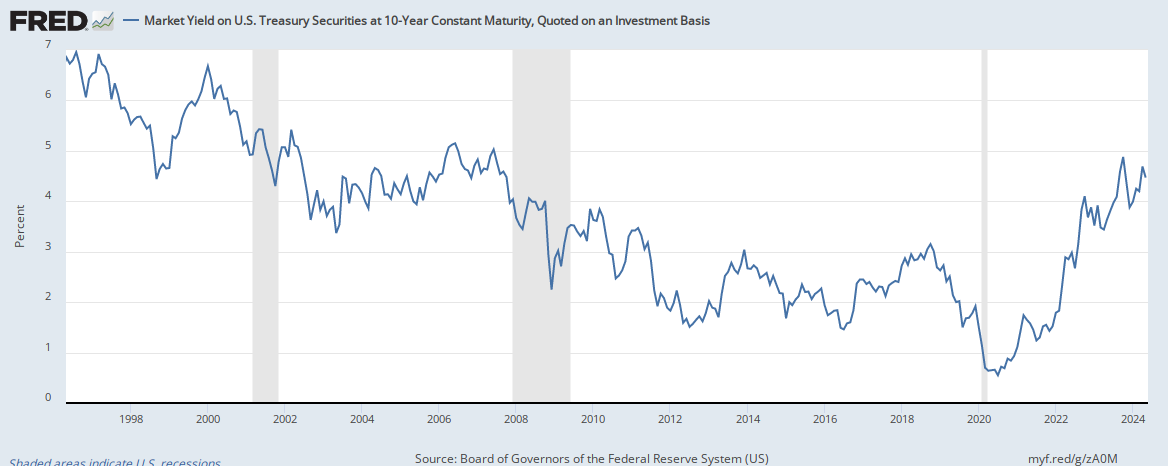

Jan 2020 and Jan 2021 could hardly be more different. In Jan 2020 we did not have 0 percent interest pledged to continue for years. We also did not have trillions in fiscal stimulus. We were not reshoring supply chains in Jan 2020. In that month we also did not care where our drugs were manufactured. These are only some examples. .The changes to our economy since last January have been dramatic.

But feel free to craft your own analogies. There is nothing at stake here.

Last edited: