enjoyinglife102

Recycles dryer sheets

- Joined

- Jan 6, 2013

- Messages

- 162

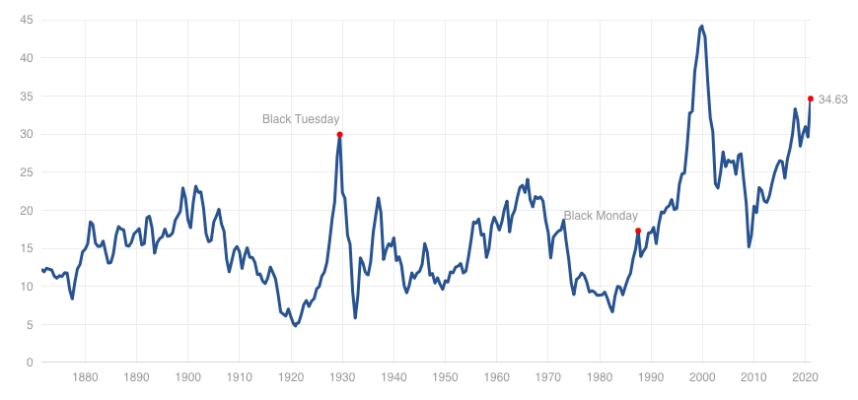

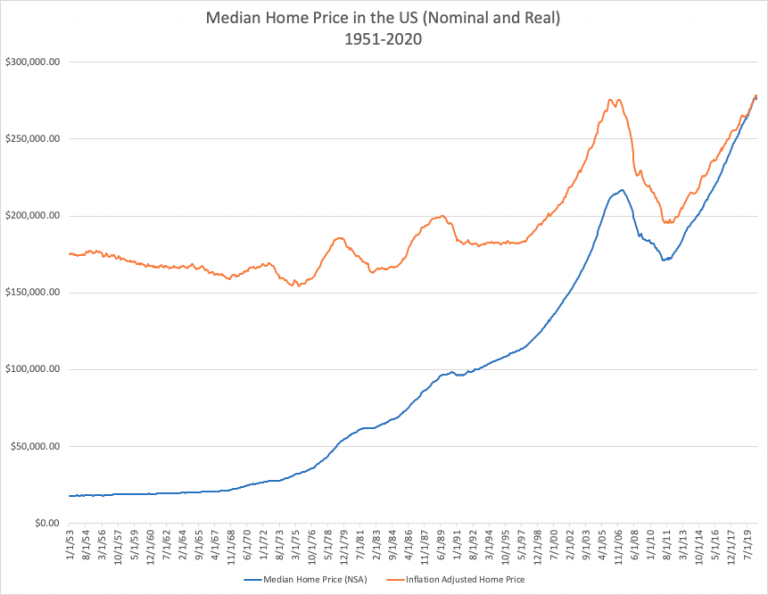

I don't disagree with the Japan thought, but what is your evidence of a "bubble"?

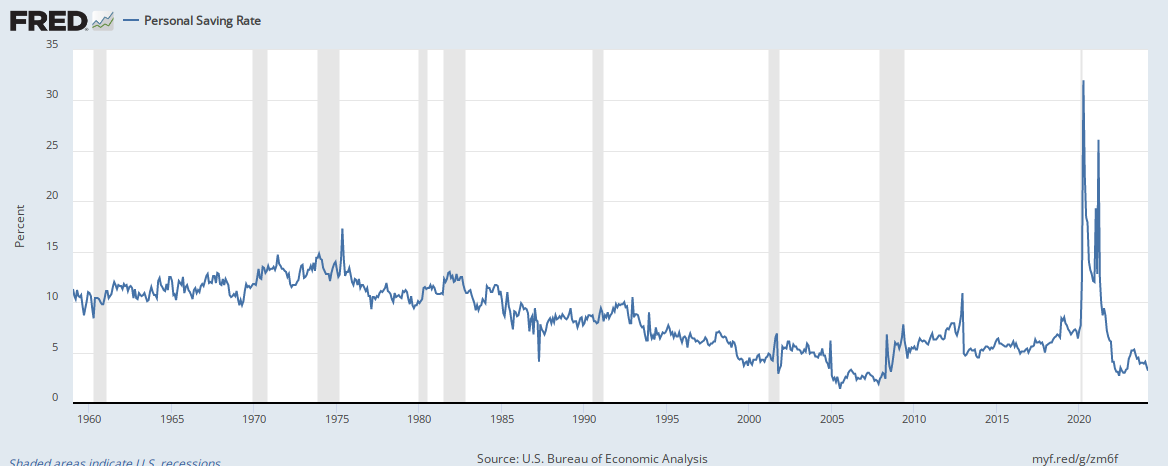

I also agree with your statement regarding return of capital. In fact regularly I seriously consider reducing my allocation to equity sharply. But not because I think we are in a bubble.

I don't know of any valuation metric that says we are not in a bubble or at the very least extremely expensive. No one can time anything so I just periodically rebalance my conservative portfolio knowing I can adapt to a worse case scenario and live a good life.