Good for you. CongratulationsI finally get my revenge after years of Obamacare abusing me.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation: Official Rate vs. Observed Rate

- Thread starter CaptTom

- Start date

Markola

Thinks s/he gets paid by the post

^^^^^ Abuse? No one forced you to buy it.

We've been on the same budget for roughly 17 years now. It has worked just fine. All based on our total spending before retirement and inflated each year by the SS CPI number. Minus 2009 (announced in 2008) which was going to be 5.8% and clearly was not representative of the future. So a little less than inflation over that time, though with enough slop we may not be noticing inflation creeping up on us.

I do think we have required at least some of that inflation indexing. It's usually easy to find a place for the extra budget allocation at the start of each year. We would have had to be cutting back each year if we made no inflation adjustment. But the SS version of CPI has worked for us so far.

Easy enough to say we all have individual inflation rates, of course that's true. There are also many different (and official) inflation rates. One of those may be a closer fit. We own our house, with a mortgage, and drive electric cars, which makes us different from the normally quoted CPI. Of course not working probably skews us even farther away.

I'm going to have to see our total budget falling below our needs for a more than a year before I'm convinced we're falling behind. And even then it's a made up number not even meant to directly track our situation. An important concept, but not that important as a tracking number.

I do think we have required at least some of that inflation indexing. It's usually easy to find a place for the extra budget allocation at the start of each year. We would have had to be cutting back each year if we made no inflation adjustment. But the SS version of CPI has worked for us so far.

Easy enough to say we all have individual inflation rates, of course that's true. There are also many different (and official) inflation rates. One of those may be a closer fit. We own our house, with a mortgage, and drive electric cars, which makes us different from the normally quoted CPI. Of course not working probably skews us even farther away.

I'm going to have to see our total budget falling below our needs for a more than a year before I'm convinced we're falling behind. And even then it's a made up number not even meant to directly track our situation. An important concept, but not that important as a tracking number.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

^^^^^ Abuse? No one forced you to buy it.

Uhm ya… I was doing quite nicely on my $72 a month underwritten $5k deductible with HSA from BC/BS that went up less than $10 in 5 years until Obamacare came in and wiped this plan out. And you do remember the penalty if you didnt buy back in the day dont you?

And even when penalty was finally overturned, the exchange is the only place you could buy health insurance in my state.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I used to look at the reported CPI monthly during my career for procurement and wage negotations.

Anyone can look at the reports anytime, and the basket of goods is HUGE. Here's a recent copy, with the basket of goods high level breakdown beginning on page 8. The actual individual items are considerable. And they adjust the basket periodically to reflect society, but not so often that it disrupts the usability of the data. The basket of goods is a reasonably accurate reflection of our weighted collective demand. A set basket of goods is the only statistically value way to measure CPI, what one person might use is of no use.

https://www.bls.gov/news.release/pdf/cpi.pdf

Anyone can look at the reports anytime, and the basket of goods is HUGE. Here's a recent copy, with the basket of goods high level breakdown beginning on page 8. The actual individual items are considerable. And they adjust the basket periodically to reflect society, but not so often that it disrupts the usability of the data. The basket of goods is a reasonably accurate reflection of our weighted collective demand. A set basket of goods is the only statistically value way to measure CPI, what one person might use is of no use.

https://www.bls.gov/news.release/pdf/cpi.pdf

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

I'm not really sure how much food prices went up here. I stockpile food when things are on close out and give a lot to the local food bank, so our total grocery expenses fluctuate month to month depending on what bargains I find.

Other than that I just keep chipping away at our ongoing expenses to try to lower our personal inflation rate. Refinancing this year really helped lower our annual expenses. Then a bunch of other little things added up. DH found a new hair stylist for half the price of what he had been paying, we switched cable companies and dropped local channels for $40 a month savings, we switched to Zenni from Costco for glasses, we're old enough to get free and discounted ride share and train tickets now via local senior programs, and a bunch of other small changes that all really added up. Those savings, along with the pension and SS increases next year, should increase our cash flow by around $10K a year, so I'm pretty happy about that.

Other than that I just keep chipping away at our ongoing expenses to try to lower our personal inflation rate. Refinancing this year really helped lower our annual expenses. Then a bunch of other little things added up. DH found a new hair stylist for half the price of what he had been paying, we switched cable companies and dropped local channels for $40 a month savings, we switched to Zenni from Costco for glasses, we're old enough to get free and discounted ride share and train tickets now via local senior programs, and a bunch of other small changes that all really added up. Those savings, along with the pension and SS increases next year, should increase our cash flow by around $10K a year, so I'm pretty happy about that.

Thank you! Wondering when someone would post how the official numbers are calculated from the source rather than people saying things that are untrue and just anecdotal. I one says the government inflation stats are your personal inflation. You want to know your own, track your spending, consider substitution effects and hedonistic adjustments (good luck!). Or use MIT’s billion price index as another source. The official cpi is incredibly complicated and has 100s of phD economists that work on it. Anyone thinks it is manipulated purposefully by whatever government is crazy although some aspects can make it produce lower numbers over a long time frame (for example chain weighted cpi). But that is in plain sight in their methodology. l1729.com is offering a large reward for someone to come up with a better inflation calculation. Read it here to find more of the nuance. https://1729.com/inflation#taskFWIW, the CPI is much more complicated than one would conclude from most of the posts in this thread. Go to https://www.bls.gov/cpi/ and click on the "CPI Methods" tab. Also try this Google search: "adjustments to the CPI site:https://www.bls.gov/cpi/"

Identifying inflation is a tough problem that must be solved before inflation can be measured.

gooddog

Recycles dryer sheets

It is worth reading up on 'hedonic inflation adjustment' and it's relationship to the CPI. This method takes into account both quality and varied time frames that government uses to create the CPI. Essentially it gives the government 'wiggle room' to cheat on the numbers, while maintaining some form of honesty. Linkage for those interested: https://www.economicshelp.org/blog/603/inflation/hedonics-and-inflation/

USGrant1962

Thinks s/he gets paid by the post

Well, the official rate just hit 6.2% year-over-year

https://www.marketwatch.com/story/c...e-index-for-october-11636550300?mod=home-page

https://www.marketwatch.com/story/c...e-index-for-october-11636550300?mod=home-page

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Our WIN strategy (Whip Inflation Now - anyone else old enough to have the button?) has been to do without. For most items, there are simply no substitutes left (What is left to substitute after you've gone from prime to choice to "unrated" beef to chicken, etc.)

In the past year, we have deleted from our expenses:

1) 2nd car - estimated direct savings (tags/insurance/extra parking, yearly - not mileage based - maintenance): $1900/year

2) storage units - Our relatively unique living situation (2 locations, each with limited storage) prompted us to rent storage units. We've now pitched (donated, where possible) what we could not store "in house" and saved: $1400/year

3) deleted the (stupid) phone: $400/year.

Unfortunately, our personal rate of inflation has eaten MORE than this (so far) this year. YMMV

In the past year, we have deleted from our expenses:

1) 2nd car - estimated direct savings (tags/insurance/extra parking, yearly - not mileage based - maintenance): $1900/year

2) storage units - Our relatively unique living situation (2 locations, each with limited storage) prompted us to rent storage units. We've now pitched (donated, where possible) what we could not store "in house" and saved: $1400/year

3) deleted the (stupid) phone: $400/year.

Unfortunately, our personal rate of inflation has eaten MORE than this (so far) this year. YMMV

aja8888

Moderator Emeritus

Wolf Street Article on latest inflation - worth a read

Lots of graphs and commentary:

https://wolfstreet.com/2021/11/10/d...most-monstrously-overstimulated-economy-ever/

Lots of graphs and commentary:

https://wolfstreet.com/2021/11/10/d...most-monstrously-overstimulated-economy-ever/

Fed still printing money and repressing “real” interest rates to negative 6%, new vehicle prices spike by most since 1975, housing CPI jumps, food & energy soar.

As Atlanta Fed President Raphael Bostic pointed out, “transitory has become a dirty word.” This massive inflation occurred while the Fed still had its foot fully on the accelerator – $120 billion a month in money printing and near-0% short-term interest rates, meaning “real” short-term rates are at negative 6.0%.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

^ ^ ^ ^

I wonder if the FED has forgotten that one of their prime directives is to "control" inflation? YMMV

I wonder if the FED has forgotten that one of their prime directives is to "control" inflation? YMMV

Just a couple of comments on the fear that “the government is deliberately understating inflation”.

The view that CPI is understated, deliberately or not, is a view unsustained by those with the means to prove it.

THANK YOU! this thread was rapidly moving into Facebook “conspiracy theory” territory.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Quote without comment:

https://www.wsj.com/articles/us-inf...dex-october-2021-11636491959?mod=hp_lead_pos1

https://www.wsj.com/articles/us-inf...dex-october-2021-11636491959?mod=hp_lead_pos1

The Labor Department said the consumer-price index—which measures what consumers pay for goods and services—increased in October by 6.2% from a year ago. That was the fastest 12-month pace since 1990 and the fifth straight month of inflation above 5%.

The core price index, which excludes the often-volatile categories of food and energy, climbed 4.6% in October from a year earlier, higher than September’s 4% rise and the largest increase since 1991.

Last edited:

Inflation is predictable due to COVID19 and the federal government had to issue stimulus checks without raising taxes. In reaction to the stimulus checks last year, I reallocated my portfolio to (1) buy more income producing real estate, (2) Value Funds rather than growth funds, (3) Short Term Treasuries as my safe haven and (4) finally VCMDX which is based on Commodties derivatives.

My Income Producing properties are justified by my personal experience. I have seen this movie before. So far my real estate properties have done very well.

My Value funds are justified by:

https://www.investopedia.com/articles/investing/052913/inflations-impact-stock-returns.asp

VCMDX is pure speculation on my part. However, it is up 50% (1 yr performance) so I am ready to sell VCMDX in a heartbeat if inflation declines significantly in order to lock in my gains. Naturally, I am monitoring the prices of commodities.

Inflation can be caused by the public believing inflation will happen. If everyone believe inflation is upon us, then inflation will indeed happen. The news media is also fanning the flames. This is similar to a bear market when there is more fear than greed. The Fed did a great job avoiding a severe recession and protecting the markets but they now have to raise interest rates "gently" to mitigate inflation. I say "gently" because shock therapy can cause instability. This is good for me because I prefer low volatility on my higher risk investments.

My Income Producing properties are justified by my personal experience. I have seen this movie before. So far my real estate properties have done very well.

My Value funds are justified by:

https://www.investopedia.com/articles/investing/052913/inflations-impact-stock-returns.asp

VCMDX is pure speculation on my part. However, it is up 50% (1 yr performance) so I am ready to sell VCMDX in a heartbeat if inflation declines significantly in order to lock in my gains. Naturally, I am monitoring the prices of commodities.

Inflation can be caused by the public believing inflation will happen. If everyone believe inflation is upon us, then inflation will indeed happen. The news media is also fanning the flames. This is similar to a bear market when there is more fear than greed. The Fed did a great job avoiding a severe recession and protecting the markets but they now have to raise interest rates "gently" to mitigate inflation. I say "gently" because shock therapy can cause instability. This is good for me because I prefer low volatility on my higher risk investments.

Last edited:

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Electricity in the Maine area will be raising rates 60%. Rate case has been filed.

Average heating bill is expected to rise 45% this winter

https://nypost.com/2021/10/14/americans-should-expect-rise-in-heating-costs-this-winter/

https://apnews.com/article/coronavirus-pandemic-business-utilities-portland-legislature-9ea76763b8b70aaabcf7965eaf21dcdf

Average heating bill is expected to rise 45% this winter

https://nypost.com/2021/10/14/americans-should-expect-rise-in-heating-costs-this-winter/

https://apnews.com/article/coronavirus-pandemic-business-utilities-portland-legislature-9ea76763b8b70aaabcf7965eaf21dcdf

Electricity in the Maine area will be raising rates 60%. Rate case has been filed.

Average heating bill is expected to rise 45% this winter

https://nypost.com/2021/10/14/americans-should-expect-rise-in-heating-costs-this-winter/

https://apnews.com/article/coronavi...-legislature-9ea76763b8b70aaabcf7965eaf21dcdf

It seems like the news on inflation keep getting worse. I hadn't heard electricity was going to go up much, but I did hear natural gas bills are estimated to go up 50% in my area. I'm estimating that I'm seeing about 15% higher expenses for my budget over the last year without making any changes in what I'm purchasing.

Today: Dow drops 240 points, Nasdaq falls 1.7% after hot inflation data drives bond yield spike

Prices climbed 6.2 percent in October compared with last year, largest rise in 3 decades, as inflation strains economy

W2R

Moderator Emeritus

I think inflation is an endlessly fascinating topic to discuss.

Today I got gasoline for the Venza. Well, Frank got it, that is, I was just along for the ride since I have not yet started driving again after my illness.

Anyway, I thought it was hilarious that premium gas was $3.99/gallon!!! I probably wouldn't have thought it was so funny, if my annual gas expenditures were higher. I don't use much gas. But really, that price borders on the ridiculous!

I probably wouldn't have thought it was so funny, if my annual gas expenditures were higher. I don't use much gas. But really, that price borders on the ridiculous!

I remember when gas was 11 cents/gallon in St. Louis, back in the 1950's during a "gas war". My how time flies.

Today I got gasoline for the Venza. Well, Frank got it, that is, I was just along for the ride since I have not yet started driving again after my illness.

Anyway, I thought it was hilarious that premium gas was $3.99/gallon!!!

I probably wouldn't have thought it was so funny, if my annual gas expenditures were higher. I don't use much gas. But really, that price borders on the ridiculous!

I probably wouldn't have thought it was so funny, if my annual gas expenditures were higher. I don't use much gas. But really, that price borders on the ridiculous! I remember when gas was 11 cents/gallon in St. Louis, back in the 1950's during a "gas war". My how time flies.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Inflation is and will always be primarily a problem for low income individuals as they are least able to adjust their budgets other than otherwise just dropping items. With millions in the bank and a low withdrawal rate inflation becomes a curiosity, something to overcome with an investment strategy, not really a life issue at all, as can be seen by the vast majority of posts on this topic. Only if stock prices are effected would most on this forum be concerned about inflation.

Keep in mind that virtually every hedge fund and investment head that graduated from college in last 12 years has known nothing but up markets. As a matter of fact really no single investment advisor has known anything but a new all time high in stocks every 5 years their entire life! Returns of 10.9% since 1981 over inflation of 3 percent gives a positive 6.9% on average over inflation, making inflation laughable. Even this past year inflation of 6.9% is nothing with a 40.94 return on the S&P500.

Debt has maintained that pace of growth with the stock market but GDP has only grown 1.7% meaning the assets backing the debt, fueling the stocks Federal debt to gdp is now 131% in 2021 vs 31% in 1980. Borrowing low cost to invest in stocks with a 6 percent return on every dollar borrowed is a deal made in heaven.

I don't expect anything but that the FED is willing to go to 500% of debt to GDP if necessary to maintain the financial structure unless they have something in mind to replace it, which I cannot envision for the life of me.

Keep in mind that virtually every hedge fund and investment head that graduated from college in last 12 years has known nothing but up markets. As a matter of fact really no single investment advisor has known anything but a new all time high in stocks every 5 years their entire life! Returns of 10.9% since 1981 over inflation of 3 percent gives a positive 6.9% on average over inflation, making inflation laughable. Even this past year inflation of 6.9% is nothing with a 40.94 return on the S&P500.

Debt has maintained that pace of growth with the stock market but GDP has only grown 1.7% meaning the assets backing the debt, fueling the stocks Federal debt to gdp is now 131% in 2021 vs 31% in 1980. Borrowing low cost to invest in stocks with a 6 percent return on every dollar borrowed is a deal made in heaven.

I don't expect anything but that the FED is willing to go to 500% of debt to GDP if necessary to maintain the financial structure unless they have something in mind to replace it, which I cannot envision for the life of me.

Calico

Thinks s/he gets paid by the post

- Joined

- Apr 16, 2012

- Messages

- 2,949

The only inflation I'm concerned about this year is my (anticipated) heating cost. I really dread receiving my winter delivery of propane - I expect the cost will be a shock.

I have always said that I would not skimp on heating, or lower the thermostat to save a few pennies, and I have held to that for as long as I have owned my own home.

I guess this year will establish once and for all which is more dominant: my comfort gene or my frugality gene!

If I start bundling up in every sweater I own, I guess I will have my answer!

It is not as if I am among the folks in this country who have to choose between "heat or eat" every year. I can pay whatever the cost of the propane is, and am grateful to be in the position to do so.

I have always said that I would not skimp on heating, or lower the thermostat to save a few pennies, and I have held to that for as long as I have owned my own home.

I guess this year will establish once and for all which is more dominant: my comfort gene or my frugality gene!

If I start bundling up in every sweater I own, I guess I will have my answer!

It is not as if I am among the folks in this country who have to choose between "heat or eat" every year. I can pay whatever the cost of the propane is, and am grateful to be in the position to do so.

Last edited:

Some of the inflation might be delayed. For example, rental costs are shooting up but until more rental agreements are re-signed next year rental costs in 2021 I suspect are only slightly up when compared to 2020 when the "spot rate" of rents clearly shows that costs are rising rapidly. It will just show up in CPI next year.

Electricity in the Maine area will be raising rates 60%. Rate case has been filed.

Well, yes, but...

Maine separates out the electricity supply cost and the delivery cost. From the Portland Press Herald:

Not that I'm looking forward to the increase, but our total bills will (supposedly) increase more like 24% next year, or 19% since 2019. That's in line with everything else we've been talking about here, and still higher than any of the official numbers we've been seeing.Supply currently makes up roughly 40 percent of a total residential bill from CMP. Supply rates have been falling the past two years – the standard offer supply prices for homes and small business fell by 12 percent last year compared with 2019 rates.

gcgang

Thinks s/he gets paid by the post

- Joined

- Sep 16, 2012

- Messages

- 1,571

If inflation is going up, why are my money markets still paying next to nothing?

But all the money created probably causes more than stocks, real estate and crypto to go up in price.

My cash feels like trash.

But all the money created probably causes more than stocks, real estate and crypto to go up in price.

My cash feels like trash.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

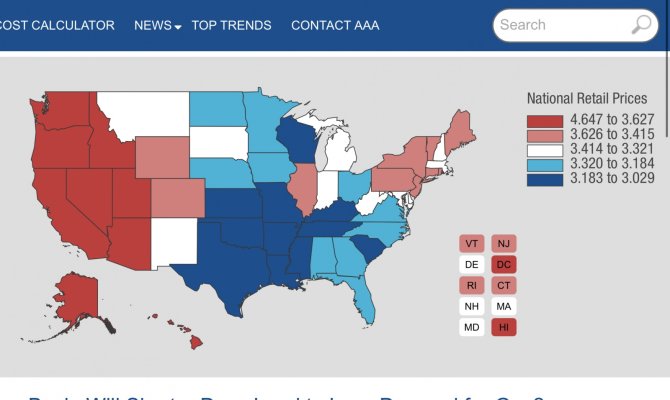

And you’re in a state with the cheapest gas…I think inflation is an endlessly fascinating topic to discuss.

Today I got gasoline for the Venza. Well, Frank got it, that is, I was just along for the ride since I have not yet started driving again after my illness.

Anyway, I thought it was hilarious that premium gas was $3.99/gallon!!!I probably wouldn't have thought it was so funny, if my annual gas expenditures were higher. I don't use much gas. But really, that price borders on the ridiculous!

I remember when gas was 11 cents/gallon in St. Louis, back in the 1950's during a "gas war". My how time flies.

Attachments

Inflation is and will always be primarily a problem for low income individuals as they are least able to adjust their budgets other than otherwise just dropping items. With millions in the bank and a low withdrawal rate inflation becomes a curiosity, something to overcome with an investment strategy, not really a life issue at all, as can be seen by the vast majority of posts on this topic. Only if stock prices are effected would most on this forum be concerned about inflation.

I disagree.

I'm definitely not low income, but I already have my budget cut very lean with nowhere left to cut, and I have a very healthy stash, but inflation has devalued my savings by multiple years of retirement in the last year alone. You can't always expect your investments to outgain inflation, especially with stocks so overvalued and a big correction still on the horizon. Plus, people typically invest more conservatively as they get older so they don't take such a massive hit to their portfolios when the markets drop and can take well over a decade to recover as inflation continues to increase prices.

If someone is low income and still working, they will likely be getting raises to help compensate for inflation. If you have a massive savings, it's just taken a big hit in devaluation, and even if you are still working and get a raise, that's not going to make up for the massive devaluation of your current savings.

Last edited:

Similar threads

- Replies

- 26

- Views

- 2K

- Replies

- 6

- Views

- 2K

- Replies

- 95

- Views

- 13K