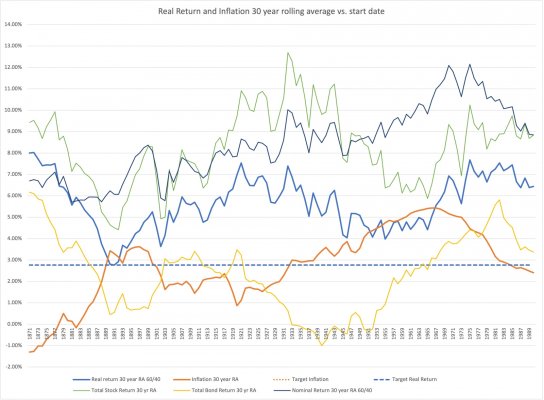

In real return even individual bonds lose money .

As an example ,Getting paid back 1k in 10 years is a loss is a loss is a loss when it buys less then it did..

Bond funds increase over time in rising inflation while the nav adjusts downward so you come close to individual bond returns if held for the funds duration .

A treasury bond fund that sells for 10 bucks and pays 5% the day you bought and has a duration of 5 years is no different for the most part than a 5 year bond.

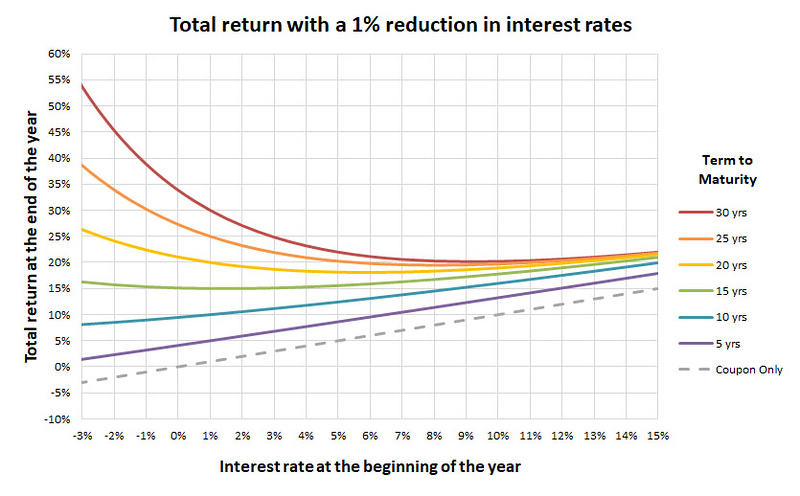

The bond fund will lose 5% in nav if rates rise a point but gain an extra 1% a year getting 6% instead of 5% ….at the end of the funds duration period you end up with the same 5% as the day you bought .

No different then a 5 year bond paying 5% .

In both case though you got only 5% in a 6% world so both are behind the curve,

staying at least the funds duration and using a high quality bond fund with little credit risk will give you a total return similar to an individual bond .

both will lose money if sold before its maturity or duration if rates went up . both will see similar returns if held , less expenses in the bond fund .

however bond fund managers can do things an individual likely wont , like riding the bond curve .

so that can off set expenses

https://www.kitces.com/blog/how-bon...ve-help-defend-against-rising-interest-rates/