First, happy Father’s Day to all you dads!

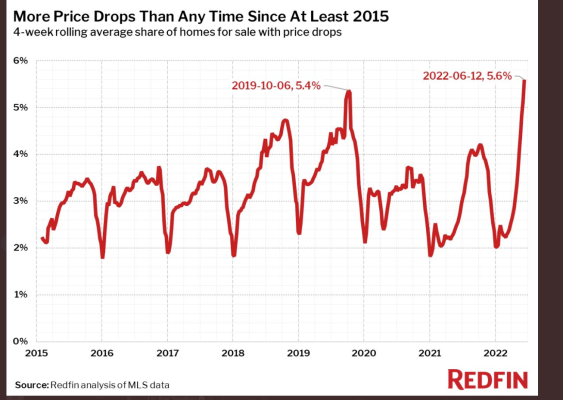

So here’s a real time housing market experience. My son and DIL are opportunist house hunting in a few golf course neighborhoods (boy loves his golf!). 2 weeks ago they found one that caught their eye. It went on the market in mid May, price dropped a couple of times (about 5%) by June. Stop there - first observation, 3 months ago offers would be pouring in 10% over sticker! He makes an offer another 3% below and they counter…. Now $15k apart on a $650k house. Son holds, part ways. Today, 9 days later, Seller comes back with $5k over son’s last offer, looks good… until son prices new debt. It will cost another $10k in points to match previous loan quote… hence, the deal did not change. Father’s Day advice…. Only if he loves the house: Option 1: buy house hoping interest rates drop over the next 5 yrs and refinance, option 2: Hold tight, ride thru downturn and wait for more motivated sellers, hopefully rates moving down.

IMHO, this is what we should expect from housing market effectively creating allot of no sales unless one party is very motivated.