OP, one thing that your daughter first needs to have an idea about is her overall life plan and income trajectory. Tax planning is quite different depending on whether she (a) wants to work and have a high income for the next 40 years and retire with two vacation homes and a boat, or (b) wants to work the next 5 years then barista FIRE and live on $30K.

This is because probably the biggest and best overall tax planning idea is to shift income from high tax years to low tax years, either by deferring income (retirement contributions) or accelerating income (Roth conversions). One first needs to have an idea of what is "high" and what is "low" to be able to make decisions.

Maxing out retirement accounts and HSAs are the main thing for W2s. There are also a number of education tax benefits that she can educate herself about - 529s, ESAs, AOTC, LLC, etc. 529s can come with a decent state tax benefit depending on where she lives, and the money isn't stuck there if the kid doesn't go to college; there are a number of ways to get the money out with little to no tax impacts.

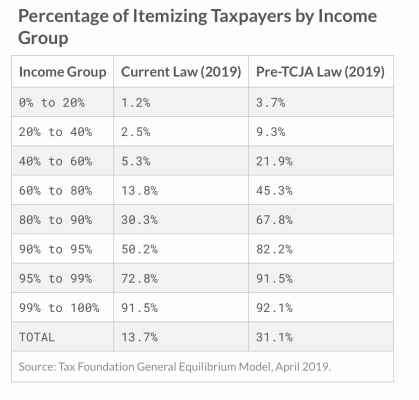

*If* she is charitably inclined, she can be tax-efficient with her donations. Donating appreciated long term securities is one way - she'll avoid CG taxes. DAFs are helpful for bunching, which enables itemizing, which can provide a tax benefit. QCDs down the road are very helpful.

Oh, another big thing. There are people on this board who end up having taxation issues because they own actively managed funds in taxable accounts. These actively managed funds can throw off large and sometimes unexpected distributions, which can mess with tax planning. I've read about people who are sort of stuck because they've accumulated these funds over years and therefore have large unrealized CGs. The tax bill to switch is painful, but so are the distributions. So you might suggest she invest in low-distribution investments in taxable, like BRK.B or index funds.

Agreed! Plus, I think it is very important for the younger generation to start appreciating charitable giving once they get into a position where they have the means to do so.

We have tried very hard to raise our kids with some sense for community and charity. In general, they turned out well, but I have to say, they are still not in a very charitable mindset even at near age 30. In fact, so much so that DW and I are in the process of changing our estate plans so that when we pass, half of our estate will go to charities we select. The other half will be split between our two kids. Chances are that they will still get a very nice inheritance and this way, we can make sure charity doesn't get short-changed. YMMV

As an aside, you might look into charitable remainder trusts if you're at risk of exceeding the estate tax exemption (which is dropping to about $6M in a few years).