The inflation report this morning is a lagging indicator. The bond market is looking past that report with the oil and other commodity bubbles bursting, gas prices dropping, a huge inventory buildup, and the USD rising. It is a good time for savers and fixed income investors. All those businesses that have been gouging consumers have created their own demand destruction. The short term profit gains are going to lead to longer term misery.

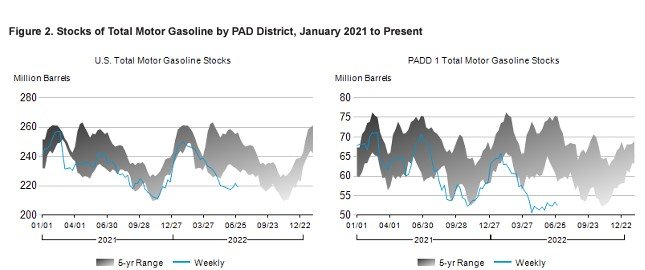

Be careful with claims of "huge inventory buildup". Gasoline is still on a knifes edge, especially in PADD1. We normally build leading into this time of year.

Attachments

Last edited: