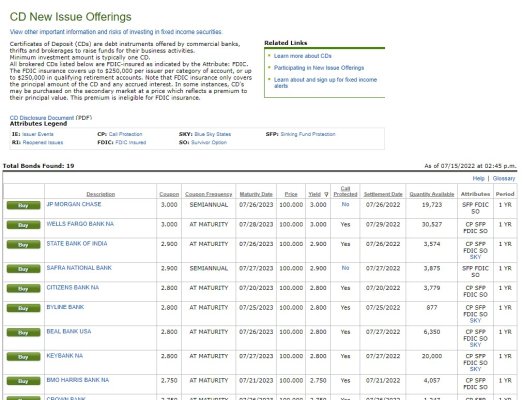

I have not found any risks or drawbacks at all. I just make sure they are non callable,

and insured by the FDIC. Seems 99.9% of new issue are non callable.

And all new issue CD's I have seen at Schwab are insured by the FDIC. (its easy to check)

Most are bank CD's, just sold through a brokerage. But at better rates than offered directly through the bank?

Its super easy, just pick the one you want and click. Its done.

But interest isn't compounded. It goes directly into an IRA cash account.

Or cash account for non IRA accounts. I have all 3 types. IRA, ROTH, and cash/sav brokered CD's.

Most pay twice a year, some monthly and some annually.

And that works for me as I plan to start taking the interest soon.

Selling early is not the same as it gets listed on the market. And bid on.

And you get an offer you can either accept or reject.

The only one I ended early, I actually made a small amount on.

As new issue CD rates were lower than the one I wanted to sell.

But it goes both ways..

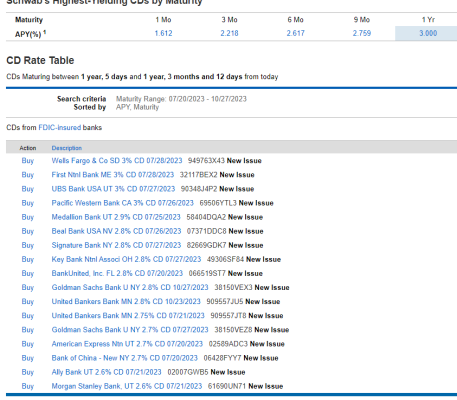

I listed Schwab's screen shot above up a few posts. They seem to follow interest rates faster, both to the upside and the downside. .

I am going to start taking IRA distributions Jan 2024 at 62..

I just set up an IRA / 5 yr cd ladder at Schwab last month. 3.25% average. Got a 3.5% 5yr, 3.4% 3 yr and 4yr. last month.

Today its 3.4% on the 5 yr. But expect it to go higher after the next rate hike.

Plan to take all the interest, and what ever else I want every year from the one that comes due.

Then put the balance into a new 5 yr. Went that route for simplicity. Also made a 30k and a 60k CD.

For Roth conversions. The 30k I converted last week. The 60k is for 2023.

Still have some 3.4 and 3.5% Roth CDs and Cash cds at Navy and PenFed.

Will see where they are at when due in 2023 & 2024. And go from there.

But have had both Credit union, Bank and Brokered CD's for quite a while.

Never had a problem with any. I just go with the best rates I can find. So far its been great.

As I am no longer swinging for the fence. Past 5 yrs returned 3.5%.

Am thinking it will be about the same for the next 5 yrs. Good enough for me.