38Chevy454

Thinks s/he gets paid by the post

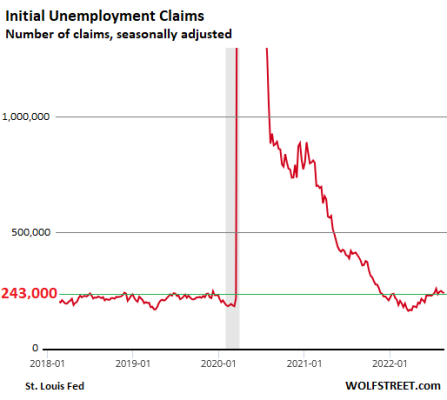

Fed chair Powell in his remarks today said about interest rates “We will keep at it until we are confident the job is done,” . Maybe the Fed is finally getting it that inflation is running much higher than they want and taking action? It's going to be a bumpy ride of they are serious about raising rates and the job market all of a sudden turns bad. They are numerous companies that are announcing layoffs, if those become more commonplace then I think the economy will become worse than it is currently. Making the recession (whether officially called that or not) longer and deeper. So far gov't has been throwing money at the problem, which never seems to end well.

The other side of the discussion is that inflation causes lower demand, and prices will seek a more normal value. Same with employment numbers, less employed means less overall money being spent by consumers leading to lower demand. Inflation becomes a self limiting problem to some extent. I think this is what the Fed is hoping will happen. Inflationary pressures will subside on their own so they do not have to raise interest rates as much. Trying to avoid an over reaction to the inflation where they cause worse problems and then have to pendulum back the other way to stimulate the economy.

So what do you think? Have confidence in the Fed? What about gov't spending throwing additional money out contributing to inflation when Fed is trying to control it?

The other side of the discussion is that inflation causes lower demand, and prices will seek a more normal value. Same with employment numbers, less employed means less overall money being spent by consumers leading to lower demand. Inflation becomes a self limiting problem to some extent. I think this is what the Fed is hoping will happen. Inflationary pressures will subside on their own so they do not have to raise interest rates as much. Trying to avoid an over reaction to the inflation where they cause worse problems and then have to pendulum back the other way to stimulate the economy.

So what do you think? Have confidence in the Fed? What about gov't spending throwing additional money out contributing to inflation when Fed is trying to control it?

Add on top of that Schwab had trading problems VIA their on-line trading this morning... Should have just stayed in bed!

Add on top of that Schwab had trading problems VIA their on-line trading this morning... Should have just stayed in bed!