- Joined

- Apr 14, 2006

- Messages

- 23,244

I see the headlines today, too.

But have any of these people been to a supermarket lately? Some products are up 400% this year. Many 200%. Most at least 50-75%. A few only 25%.

I'll be glad if it's true that inflation is finally abating. But I still can't wrap my head around these insanely low numbers being reported. I could probably count on one hand the number of things I buy which "only" increased 7-8%.

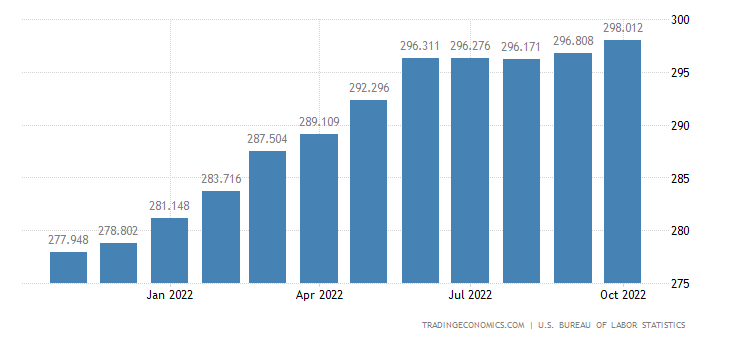

Nothing I can do about the rise in prices that has already happened. I'm much more concerned with what will happen to prices in the year ahead. The current inflation rate is the slope of the line of the CPI graph, which is small right now.

Attachments

Last edited: