You’d need to understand whether or not you’re including other sources of income like Social Security and any pension. Since you have 15 years, you have plenty of time to do the modeling required to answer your question. Remember, while the fund may increase at say 5% on average, inflation will also come into play over the next 15 years.

I am wary of taking Social Security into account because of all the scare-mongering that the trust is expected to go bankrupt in the 2030s. I am hoping that we will have a paid off home by the time we retire, and no further obligations towards our older kid, leaving only to provide for our younger (permanently disabled & unable to live independently) son. Between a paid off home, LIMITED travel (because our son cannot tolerate much moving and prefers a strict routine to keep him calm and anxiety-free), and not much income aside from property taxes, maintenance, insurance and frugal living, I am really hoping we can swing it. Running out of money in retirement or not leaving enough for our son to live off of after our time is my biggest worry / fear, which is one reason I'm quite panicked about retirement.

If you look at the Top 10 Holdings they are both loaded with FANGG stocks and not sure thats a good thing. I would put some into VYM and SCHD.

How much of the 500K would you advice we invest in VYM / SCHD? How much of the 20K contributions each year? I understand that you are not giving me investment advice, I am just curious to know what amount you'd recommend and how much we could expect it to generate in dividends (to be reinvested) in 2023?

Too many questions and variables here for a concise answer Safire. So just a few comments.

Of course investing $500k lump + $20k/yr for 15 years would "help a couple retire."

Whether it would be enough to live off the dividends (about 1.5%) is another question. You don't know how much all that VTI will be worth in 15 years. And living off only the dividends from VTI would be quite a low WR. To have the divs = the $60k/yr spending you want, you'd need $4 million. Pretty aggressive plan.

My FIRE portfolio is dominated by total stock market and similar low cost funds accumulated over decades. I didn't have a lump sum to begin with as you do, but I had more time. Took me about 30 years.

Good luck!

We were young and dumb, well into our early 40s. We have max 15 years left but I would like to learn more about your "strategy". How much do we start to invest for that time frame?

OP's plan is a start, but the $20k per year of additional money going into investments seems low for a couple.

401(k) plus Roth IRA contribution limits are now up to $30k per year or more if over 50.

Put aside $60k per year and increasing each year and you'll be in better shape...

Not going to happen. We can afford 20K max. 60K is a definite impossibility and it's disappointing to even read that number.

Impossible to tell the future, but one thing for sure is I would not be comfortable with this strategy because its lacking diversification. US equities could be in a slump for the next 5-10 years for all we know especially if the Fed abandons its easy money policy for a while. I would add some bonds, international, emerging market, and gold/silver and adjust accordingly based on economic conditions and policies.

We have some Treasury bonds that we purchase with tax returns every year. We also have a small portion in VTWEX, and 25% of his 401K in international. We don't have any emerging markets or gold / silver, and don't feel comfortable getting into them.

I would not lump sum such an amount unless it was already invested in mostly large cap US equities.

What makes you think today is the moment the market reached bottom, vs. tomorrow or next week or next month. Me, I can't fully see the future, so I would likely leg in keeping the rest in a T-Bill ladder to be allocated over the next 12 months.

I would also not just go VOO which is very tech heavy with 20.28% in Apple, Amazon, Google, Tesla, Amazon, Meta. Unless forced (e.g. limited choices in a 401k), why buy these in an ETF when you can just buy the individual holdings...which then gives you more control on taking losses or gains. Instead, for *some* of the money (note, not all -you can still do some VOO), consider equal weight ETF's like RSP (SP-500 equal weight) which would be much harder to replicate with individual equity purchases.

However, it's your money to invest how you decide. Good luck with your decision.

Why not lump sum? I thought we could not time the market. Did I get it wrong? Thank you for the heads-up on RSP, hadn't heard of that, will look into it.

FIRECalc suggests it is not a fool's dream. $60k spending, $500k portfolio, 45 year time horizon, 100% equities, retire in 2037 and add $20k a year from 2022 to 2037, all other default assumptions and that doesn't include any SS which most people are eligible to collect.

That -300K as a possible result is nerve wracking.

Another concern is that there might be additional equity losses before the bottom of the trough is here and if that happens the declne in value may adversely impact the results, so I would be careful.

Would you suggest DCA-ing the 500K over the next two years then? How do I handle this? I understand that you are not giving investment advice, but I am curious to know how you would suggest a solution for this (if any exist)? Thanks!

My "new" money is going into Vtsax (same as VTI) & Wellesley fund. I've been conservative for a long time and willing to take a little more risk. Wellesley is a bit more balanced and pays a touch more on dividends and less on the FAANG exposure. Plus a little bonds...

I believe he has some Wellesley in his 401K. We're currently wanting to both have our cake AND eat it, too. We are both very nervous about giving up on growth in order to generate more dividends eventually, as our son is still very young and growth now may help him as he ages and needs money over a lifetime. I will look into how much Wellesley we hold now - and see if we should maybe add to it. Thank you for the heads-up! Much appreciated.

I would not put new money into the stock market right now. The SP500 is down -19.7% since the high. In a recession the markets have been down (on average) something like -35%.

Not sure if market timing works but maybe we could invest 100K at a time into whatever fund we eventually decide to invest in, over a 2 year period.

You’d do better with SCHD and VYM. I have to disagree with the folks here about waiting, because market timing rarely works and time in the market works better.

SCHD and VYM both concentrate on companies that grow their dividends each year over a long period of time, even during some troubled economic times. Do some research and check them out.

Yes, will do. Thank you for the heads-up!

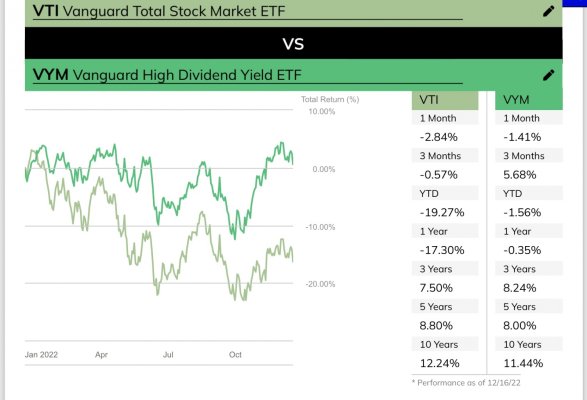

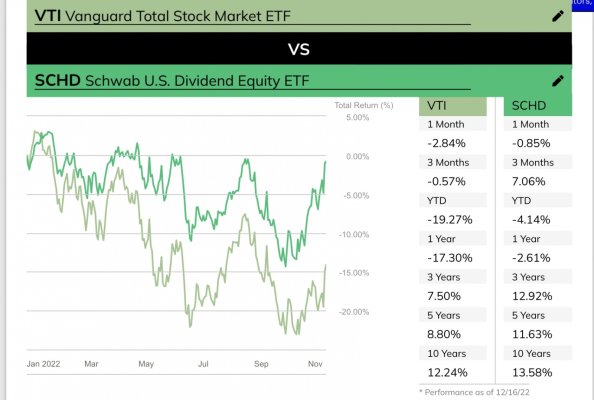

VYM trails VTI since it’s inception in Jan 2007, 8.32% vs 8.97%.

SCHD beats VTI since it’s inception in Jan 2012, 13.98% vs 13.19%. VYM does the worst at 12.14%. VOO is at 13.55%.

They’re all in the same ballpark.

SCHD has only been around since 2012? Then it's mostly only see a bull market, when VYM & VTI both existed through the Great Recession. I think that is something to consider when researching which to invest in. Thank you for the heads-up!

About 75% of my portfolio is VOO and VTI…. It’s a solid choice IMHO with a ~10% annualized avg return. I actually use them as tax loss harvesting partners because their returns are very similar.

How do they work as tax loss harvsting partners? Where can I learn more about this? Thank you for the reassurance. I really greatly appreciate it.