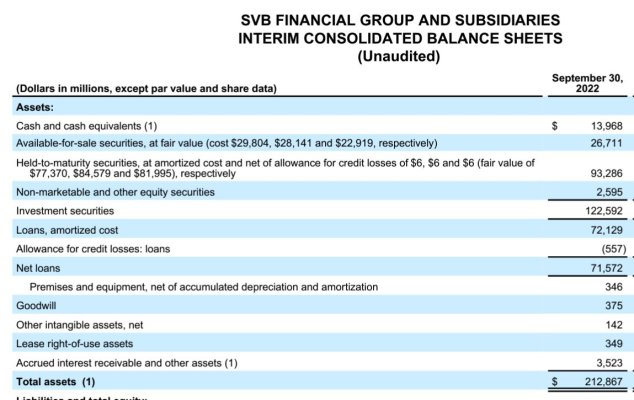

To be fair, this is nothing like the subprime fiasco. SIVB's trouble stems from the loss of value of its long bonds. Yeah, how can you go wrong holding US Treasuries? It's solid, like the rock of Gibraltar. Right!

The problem with institutional investors is that they cannot deny reality like individual investors and say "You don't lose until you sell". Nope, they have to sell to meet obligations.

And for individual investors, the unrealized loss does not go away. It sits there on your portfolio, even if you try not to look at it.