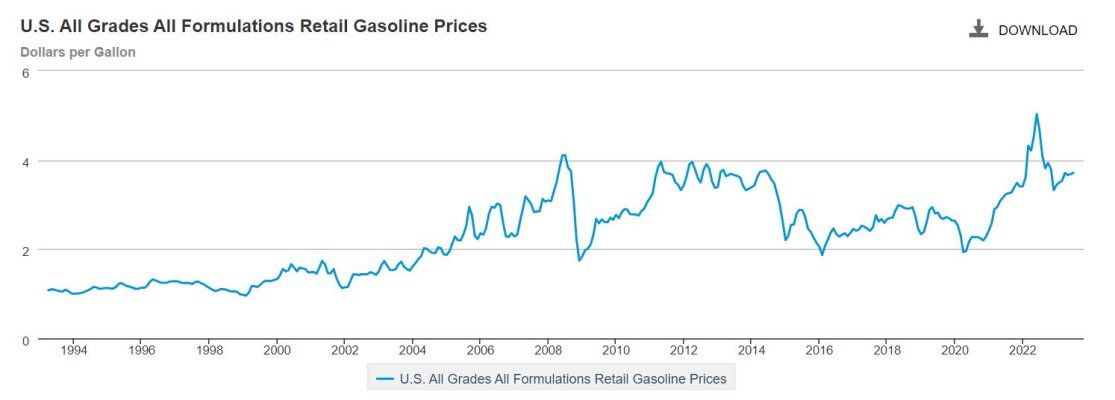

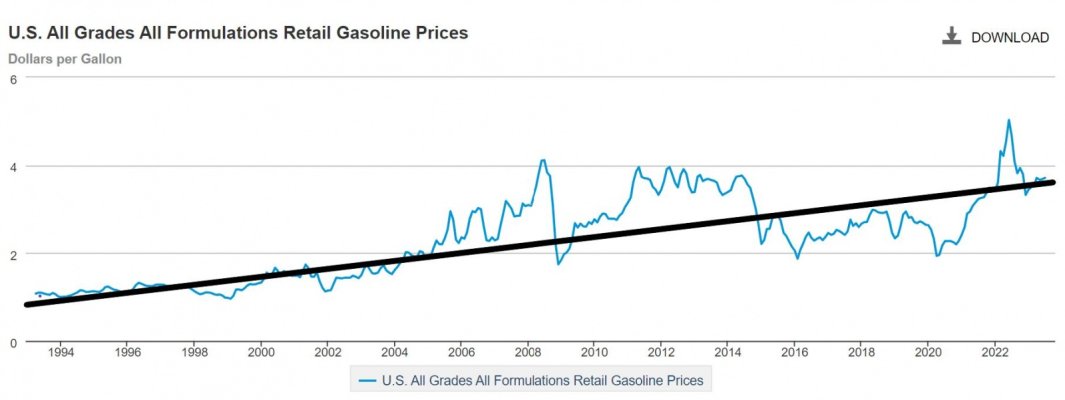

Here is an interesting site that "suggests" gas prices (with all their usual ups and downs) have remained reasonably stable at the equivalent of about $4.25 (my average - not theirs.)

I have no idea if this is correct, but I wouldn't doubt that the prices have been "stable" if you forget the wild fluctuations that we see over months or even years at a time.

https://www.usinflationcalculator.com/gasoline-prices-adjusted-for-inflation/

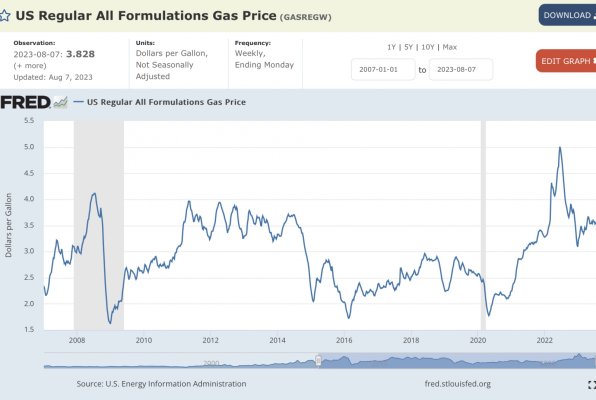

Based on your link, it says gas is up 63.8% since 2020, which isn't far off from what I calculated based on early Feb 2020 before COVID was affecting anything. We got hit pretty hard with inflation on most everything after that, including gas, all piling on.

The referenced article is cherry-picking data and then implying that the inflation war is over.

The Fed uses a 12-MONTH moving average of inflation data, NOT 2-MONTH.

I hope most here understand why the Fed uses a longer range of data than the 3 months referenced by the author of the linked article.

Some of the data are known to require long dead times from the time a rate is increased until the resultant data point reflects the impact of the move.

Agree. A month or so of inflation data isn't very meaningful. I'm interested in year over year, just as the Fed is following for their 2% Core PCE target. The last I read, it's still running at 200%+ of the target. Much work left to do to bring down inflation.

Last edited: