I hope so, but I really don't see it having an impact on my largest bills, such as insurance, property tax, utilities, services, and groceries.Just to put things in perspective, from today’s (01/13/24) WSJ:

The FED may get some help reaching 2% inflation, if Chinese manufacturers start doing some serious price cutting on items exported outside their borders. Possible?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Latest Inflation Numbers and Discussion

- Thread starter Gumby

- Start date

explanade

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 10, 2008

- Messages

- 7,456

Consumer sentiment in the University of Michigan survey is way up for the first half of January, after going up in December as well.

Biggest 2-month rise since 1991 and the highest number since 2021.

Gas price is on average 30 cents less than a year ago and the stock market is up.

Consumers can start spending more again, which could spur inflation again.

There's also talk that the Red Sea attacks on commercial shipping could lead to shortages and higher prices. Supposedly more air shipping activity has started.

Biggest 2-month rise since 1991 and the highest number since 2021.

Gas price is on average 30 cents less than a year ago and the stock market is up.

Consumers can start spending more again, which could spur inflation again.

There's also talk that the Red Sea attacks on commercial shipping could lead to shortages and higher prices. Supposedly more air shipping activity has started.

There are some inflationary pressures.

Big jump in gas prices, eggs are going up again, insurance costs are up around 20%. I'm headed to the store now - I still hold my breath every trip because the prices keep jumping.

Big jump in gas prices, eggs are going up again, insurance costs are up around 20%. I'm headed to the store now - I still hold my breath every trip because the prices keep jumping.

latexman

Thinks s/he gets paid by the post

Last weekend we drove from NC to our FL condo.

Saturday, gas was $2.40/gal. in Florence, SC (Buccee's). Sunday, gas was $3.10/gal. in Jacksonville, FL (Shell).

I'm scared to calculate that inflation rate!

Saturday, gas was $2.40/gal. in Florence, SC (Buccee's). Sunday, gas was $3.10/gal. in Jacksonville, FL (Shell).

I'm scared to calculate that inflation rate!

Last weekend we drove from NC to our FL condo.

Saturday, gas was $2.40/gal. in Florence, SC (Buccee's). Sunday, gas was $3.10/gal. in Jacksonville, FL (Shell).

I'm scared to calculate that inflation rate!

No, that is a tax arbitrage opportunity. You just need a trailer hitched fuel tanker

Here it got to $2.76 and then bumped up $.20 after all the recent nonsense. It is pretty volatile, which I guess is why it gets excluded from the policy numbers.

PS That Buccees is insane. I need a beef jerkey wall? Who knew

GravitySucks

Thinks s/he gets paid by the post

The ten year TIPS auction this week went with a 2.3% inflation kicker. I’m betting it will be higher. Cheap insurance if I’m wrong.

- Joined

- Apr 14, 2006

- Messages

- 23,169

Good PCE news out today. 0.2% for the month, 2.9% for the year. Lowest since March 2021.

https://www.cnbc.com/2024/01/26/pce-inflation-december-2023-.html

https://www.cnbc.com/2024/01/26/pce-inflation-december-2023-.html

schenbew

Recycles dryer sheets

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

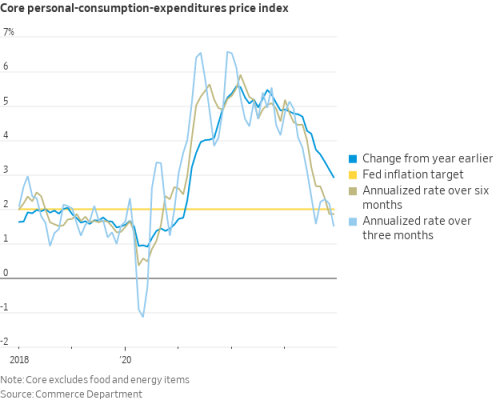

Just in from the WSJ:

December closed out a year in which inflation declined markedly. Prices were up 2.6% on the year—well down from the 5.4% increase at the end of 2022. Core prices, which exclude volatile food and energy costs, rose 2.9% on the year, a slowdown from the prior month.*

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Good PCE news out today. 0.2% for the month, 2.9% for the year. Lowest since March 2021.

https://www.cnbc.com/2024/01/26/pce-inflation-december-2023-.html

Wow!

Best lock in the better CD rates while you can!

That's actually core PCE. It's still about 50% above the Fed's target for year over year, which isn't good after it ran so high for years. They really need to tamp this down under 2% year over year.

Last edited:

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes PCE another good inflation report. Plus GDP. Good all around, for now.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Wow!

Best lock in the better CD rates while you can!

Should have while you could you mean.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Should have while you could you mean.

There have still been some nice bank CDs late Dec and early Jan.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There have still been some nice bank CDs late Dec and early Jan.

I hear you. I have not seen anything worth nibbling on. But your message that worse rates are ahead seems true.

I bought some 1 yr Marcus CD's in early Jan, the rate was 5.35% with 5.5% APY. They give you 30 days to complete funding, so I am thinking of rolling some of my t-bills out to cash and putting the max I can in those 3 cd's using joint owners, I could invest safely for 11 months at a fair rate. T-bills are so liquid, I like to use them for dry powder.

Marcus currently has a 5.4% APY on 14 months, still good for those who choose it. Ask me for a referral code and get an extra 1% for 90 days.

Marcus currently has a 5.4% APY on 14 months, still good for those who choose it. Ask me for a referral code and get an extra 1% for 90 days.

You can continue to look for ways to show core PCE is above target but it’s not and has not been for the past 6 months.That's actually core PCE. It's still about 50% above the Fed's target for year over year, which isn't good after it ran so high for years.

They already have. Even if you choose not to believe their numbers the bond market clearly does, and rates have fallen accordingly.They really need to tamp this down under 2% year over year.

1 month: 2.1%

3 months: 1.5%

6 months: 1.9%

12 months: 2.9%

The inflation of ‘21 and ‘22 are now history and it’s time to move on.

Notice that both my comments quoted said "year over year". That figure is 2.9%. So, that is the figure that I am reporting is still above the target 2%. That is after 2022. Yes, it is trending down from the very high levels of the past during those more recent shorter intervals of time, which I don't dispute, so that's good.

Continued price increases will be on top of the past price increases, so we never really leave the past behind when it comes to inflation. It's a different world we live in today.

Continued price increases will be on top of the past price increases, so we never really leave the past behind when it comes to inflation. It's a different world we live in today.

Last edited:

Notice that both my comments quoted said "year over year". That figure is 2.9%. So, that is the figure that I am reporting is still above the target 2%. That is after 2022. Yes, it is trending down from the very high levels of the past during those more recent shorter intervals of time, which I don't dispute, so that's good.

Continued price increases will be on top of the past price increases, so we never really leave the past behind when it comes to inflation. It's a different world we live in today.

Yes, but you ignore the trend. The Fed is not saying 2.9%, we better raise rates. They are saying 1.9%, hold steady or 1.5%, we better cut rates to stop deflation.

We are all aware that your personal income and expenses have not tracked inflation and gas used to cost $.25/gallon and it is a different world.

- Joined

- Apr 14, 2006

- Messages

- 23,169

...... Continued price increases will be on top of the past price increases, so we never really leave the past behind when it comes to inflation. It's a different world we live in today.

No, it's the same world it has always been. Prices do not go back down unless you have deflation. It has always worked that way. And if anyone didn't know that from the first 300 times you said this, I doubt that they ever will figure it out now.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You can continue to look for ways to show core PCE is above target but it’s not and has not been for the past 6 months.

They already have. Even if you choose not to believe their numbers the bond market clearly does, and rates have fallen accordingly.

1 month: 2.1%

3 months: 1.5%

6 months: 1.9%

12 months: 2.9%

The inflation of ‘21 and ‘22 are now history and it’s time to move on.

To put a finer point in it, I could argue the inflation path is a bit concerning. It is slowing rapidly. Who says it stops at zero ?

And if it doesn't, well then you really have a problem!

- Joined

- Nov 17, 2015

- Messages

- 14,027

Time to start the "Oh No Deflation!!!" thread?To put a finer point in it, I could argue the inflation path is a bit concerning. It is slowing rapidly. Who says it stops at zero ?

And if it doesn't, well then you really have a problem!

(oh please no, I'm kidding)

I never ignored the trend, but I was specifically making a point to post the year over year figures. That's why I said "year over year". I never said the Fed was considering raising rates, either. I'm not going to get too caught up in short term changes. You'll noticed that inflation actually started to trend back up over the last month compared to 3 month and 6 month periods. But I won't get upset about the short term "noise".Yes, but you ignore the trend. The Fed is not saying 2.9%, we better raise rates.

$.25/gal ? I certainly never said that. Maybe closer to $2/gal pre-pandemic, which is what I sometime compare to before inflation got out of hand. I'm living off mostly savings now rather than income as I no longer have a job for income as of the middle of last year, so that's apples and oranges now.We are all aware that your personal income and expenses have not tracked inflation and gas used to cost $.25/gallon and it is a different world.

Last edited:

Agreed. The world hasn't changed with regard to the definitions of inflation, disinflation, and deflation. I know a lot of people don't really understand it. Of course, I see the world differently now for other reasons.No, it's the same world it has always been. Prices do not go back down unless you have deflation. It has always worked that way. And if anyone didn't know that from the first 300 times you said this, I doubt that they ever will figure it out now.

Last edited:

And if it doesn't, well then you really have a problem!

Well, I won't. A little deflation would be a good thing, IMHO. Think of it as a correction, after a wild ride of excessive inflation.

Similar threads

- Replies

- 25

- Views

- 830

- Replies

- 219

- Views

- 24K

- Replies

- 158

- Views

- 7K

- Sticky

- Replies

- 289

- Views

- 34K

Latest posts

-

Who FIREd the Earliest with the Lowest FIRE Score and Why You Did?

- Latest: upupandaway

-

-

-

-

-

-

-