CardsFan

Thinks s/he gets paid by the post

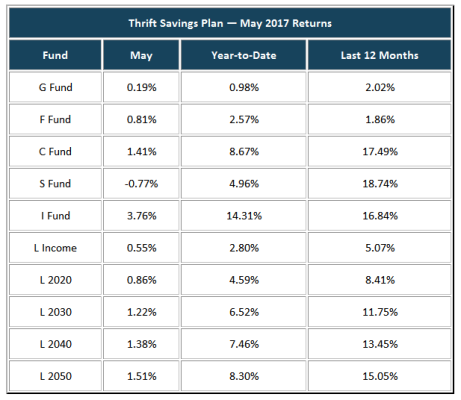

All-in, expense adjusted, YTD return is 7.28%

Since retiring January 2016, the portfolio has increased 16% even though we are spending from it!

I know this can't last, but I am enjoying the ride.

Since retiring January 2016, the portfolio has increased 16% even though we are spending from it!

I know this can't last, but I am enjoying the ride.