In CT last year Bronze plan foe me now 64 and DW 63 was $15.18.

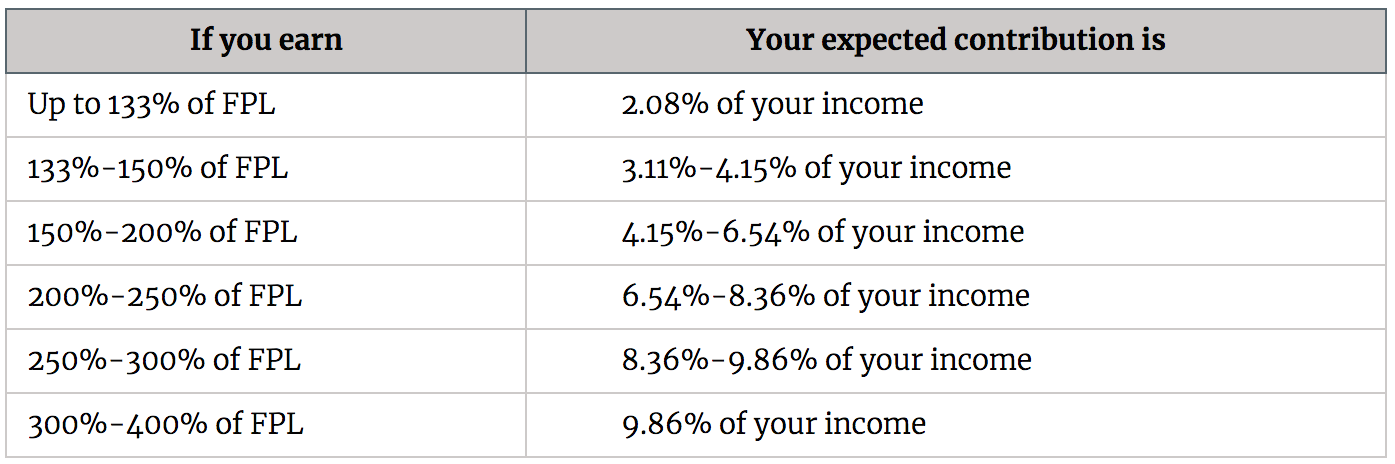

JUst renewed, same plan this year $14.16 but if my income is a dollar over the threshold the premium is $1895 per month. Crazy the way the law was written. This is why we are delaying taking SS till 66.

JUst renewed, same plan this year $14.16 but if my income is a dollar over the threshold the premium is $1895 per month. Crazy the way the law was written. This is why we are delaying taking SS till 66.