Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I finished up our 2019 spending, an expensive year with moving south 750 miles, buying/selling a house, some reno/upgrades and 90%+ new furniture.

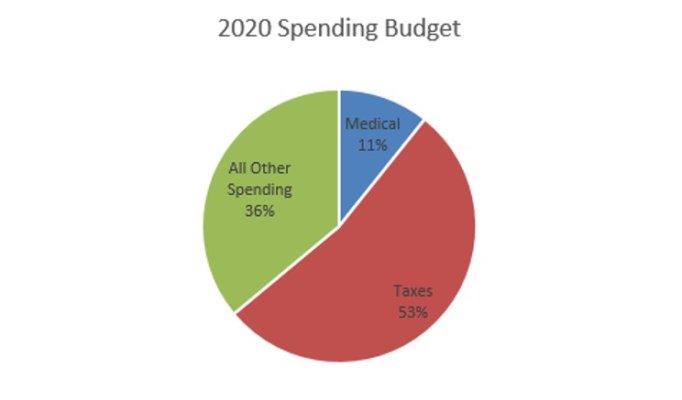

So I moved on to our 2020 plan, and it's so unlike anything that's come before I thought I'd share. It's because of Roth conversions, and much higher medical expenses now that we're both retired.

We paid some shockingly high taxes during our peak earning years when I couldn't do anything about it, but nothing like this - voluntarily this time!

I am sure others here are in the same spending boat, but it's new to me. And my spending after age 70 will be much improved, at least that's the plan.

So I moved on to our 2020 plan, and it's so unlike anything that's come before I thought I'd share. It's because of Roth conversions, and much higher medical expenses now that we're both retired.

We paid some shockingly high taxes during our peak earning years when I couldn't do anything about it, but nothing like this - voluntarily this time!

I am sure others here are in the same spending boat, but it's new to me. And my spending after age 70 will be much improved, at least that's the plan.

Attachments

Last edited: