LateToFIRE

Thinks s/he gets paid by the post

- Joined

- Jun 4, 2023

- Messages

- 1,171

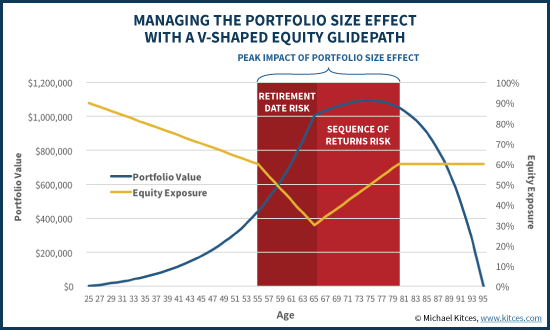

Everyone should have a strategy. There are many ways to manage it. I didn’t like the idea of just stashing cash because at the time, it paid nothing. I ultimately went with an individual bond tent per Kitces. See link below. I lucked out because bonds rose in yields rapidly and now they pay us about 145% of our income needs.

https://www.kitces.com/blog/managing-portfolio-size-effect-with-bond-tent-in-retirement-red-zone/

I'm starting to read up on the bond tent thing. Interesting observation the article highlights is how as your portfolio grows, the impact of contributions diminishes relative to impact of returns. I've certainly found that to be the case - shockingly so. I'm still saving, but the effort seems almost meaningless to the size of the portfolio as I near retirement.On the other hand, its surprising how small changes in modeling (return rates, expenses, etc.) have big impacts after 20-30 years.