Per Kitces

"Accordingly, it’s also worth noting that because the 5-year rule for Roth conversions merely leaves the withdrawal of conversion principal potentially subject to the early withdrawal penalty, any other exceptions to the early withdrawal penalty can still shelter the Roth conversion amount from the penalty. Thus, withdrawals within 5 years of conversion by someone who is already over age 59 1/2 are not subject to the early withdrawal penalty, regardless of the 5-year conversion rule, simply because being over age 59 1/2 itself is an exception to the penalty!"

Per Business insider

"The 5-year rule on Roth conversions requires you to wait five years before withdrawing any converted balances — contributions or earnings — regardless of your age. If you take money out before the five years is up, you'll have to pay a 10% penalty when you file your tax return."

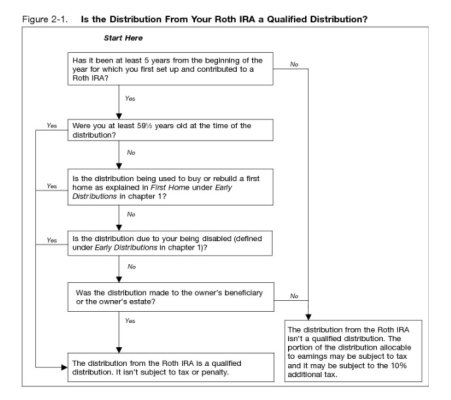

I know that we already had a thread discussing this, but I still do not understand. For example, if I convert 100k of my traditional 401k to a 5+year old Roth IRA at age 58, then per Kitces, I can access the converted amount without penalty as long as I am over 59.5 even though 5 yrs may not have passed yet? He does not mention anything about earnings.

However, Businessinsider says that age 59.5 is meaningless and only the passing of 5 years satisfies the rule to access converted amounts and earnings.

This board is full of folks well-versed in conversions. Can someone enlighten me please?

"Accordingly, it’s also worth noting that because the 5-year rule for Roth conversions merely leaves the withdrawal of conversion principal potentially subject to the early withdrawal penalty, any other exceptions to the early withdrawal penalty can still shelter the Roth conversion amount from the penalty. Thus, withdrawals within 5 years of conversion by someone who is already over age 59 1/2 are not subject to the early withdrawal penalty, regardless of the 5-year conversion rule, simply because being over age 59 1/2 itself is an exception to the penalty!"

Per Business insider

"The 5-year rule on Roth conversions requires you to wait five years before withdrawing any converted balances — contributions or earnings — regardless of your age. If you take money out before the five years is up, you'll have to pay a 10% penalty when you file your tax return."

I know that we already had a thread discussing this, but I still do not understand. For example, if I convert 100k of my traditional 401k to a 5+year old Roth IRA at age 58, then per Kitces, I can access the converted amount without penalty as long as I am over 59.5 even though 5 yrs may not have passed yet? He does not mention anything about earnings.

However, Businessinsider says that age 59.5 is meaningless and only the passing of 5 years satisfies the rule to access converted amounts and earnings.

This board is full of folks well-versed in conversions. Can someone enlighten me please?