I know Roth's have been discussed ad nauseum, but this is a very specific question regarding the tax ramifications on withdrawals from Roth IRAs that I can't seem to get confirmation on.

The rule is:

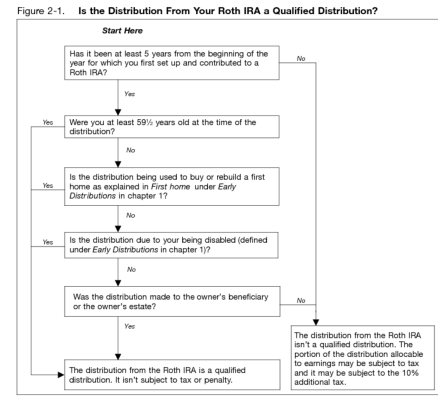

At age 59½, you can withdraw both contributions and earnings with no penalty, provided that yourRoth IRA account has been open for at least five tax years.

Does that mean in year 6 you can withdraw ALL of the money in the Roth IRA and not be taxed? Even money you converted into the Roth in the year right before you withdraw money ?

Or for a tax free withdrawal do the contributions made have to have been held in the account for 5 years?

The rule is:

At age 59½, you can withdraw both contributions and earnings with no penalty, provided that yourRoth IRA account has been open for at least five tax years.

Does that mean in year 6 you can withdraw ALL of the money in the Roth IRA and not be taxed? Even money you converted into the Roth in the year right before you withdraw money ?

Or for a tax free withdrawal do the contributions made have to have been held in the account for 5 years?