Finance Dave

Thinks s/he gets paid by the post

- Joined

- Mar 29, 2007

- Messages

- 1,864

DW and I both worked for MegaCorp most of our lives. I left MegaCorp about 5 years ago and have been self-employed with plans to fully FIRE in October of this year. Wife is a couple years older but for purposes of this question let's assume she's same age as me (56 1/2).

Within our MegaCorp retirement plan (there are two parts to it, but let's focus on the Retirement Savings Plan (RSP). This is a defined contribution plan where we put in a % of pay, and the company matches a portion (for part of my career, they were matching with company stock, thus the ESOP (employee stock ownership plan)).

However, here's the key part....we were allowed to contribute on both a pre-tax and after-tax basis. Early in my career tax bracket was low, so I split my contributions about 50/50 between the two categories. Once income went up, I switched to all pre-tax.

Now we're in a position where we have plenty of money, but most of it is in tax-deferred accounts and we're not yet 59 1/2.

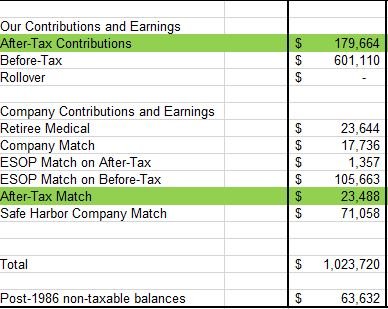

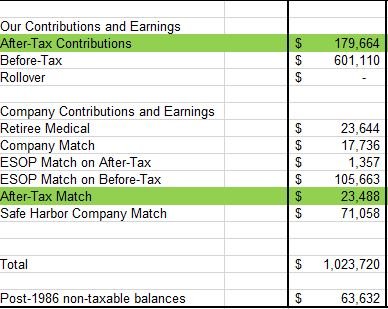

Yes, I know we can use rule 72t....but I'd rather avoid that. So I got to digging around in the website on which our RSP data is held. I found out that within my account, I have $176,000 in after-tax money. At this point I'm not sure if it's a combination of money I contributed on an after-tax basis as well as growth on that money or whether it's ONLY my contributions. I need to check further.

If it's both, I realize I'll have to pay taxes on the earnings and if I withdraw funds I may have to take a pro-rata share of the growth. But if it's only the contributions, then it seems I'd be able to take all of it out with no tax implications at all.

So I have a few questions (or feel free to add other comments):

1) Would you think this is a combination of both contributions and growth? (note the second green line that may be the growth on after-tax, which may be the taxable portion if I pull it all out)

2) If it's all contributions, would I be able to take it out prior to 59 1/2?

I will put on my "to do" list to call some people at MegaCorp and ask about this...but wanted to get input from those on this forum.

My plan would be to simply put a portion of this in checking account and use for daily living, then "invest" the rest in a CD or other "safe" investment where I can get it out easily in the next 2-3 years for more living expenses.

Once we reach 59 1/2 things get much easier...so I'm looking for a 3-year solution to get some cash flow while not increasing MAGI to maintain ACA subsidy.

Thanks in advance for your input. I have pasted below the "categories" of funds they show in the account...thought it may help clarify.

Within our MegaCorp retirement plan (there are two parts to it, but let's focus on the Retirement Savings Plan (RSP). This is a defined contribution plan where we put in a % of pay, and the company matches a portion (for part of my career, they were matching with company stock, thus the ESOP (employee stock ownership plan)).

However, here's the key part....we were allowed to contribute on both a pre-tax and after-tax basis. Early in my career tax bracket was low, so I split my contributions about 50/50 between the two categories. Once income went up, I switched to all pre-tax.

Now we're in a position where we have plenty of money, but most of it is in tax-deferred accounts and we're not yet 59 1/2.

Yes, I know we can use rule 72t....but I'd rather avoid that. So I got to digging around in the website on which our RSP data is held. I found out that within my account, I have $176,000 in after-tax money. At this point I'm not sure if it's a combination of money I contributed on an after-tax basis as well as growth on that money or whether it's ONLY my contributions. I need to check further.

If it's both, I realize I'll have to pay taxes on the earnings and if I withdraw funds I may have to take a pro-rata share of the growth. But if it's only the contributions, then it seems I'd be able to take all of it out with no tax implications at all.

So I have a few questions (or feel free to add other comments):

1) Would you think this is a combination of both contributions and growth? (note the second green line that may be the growth on after-tax, which may be the taxable portion if I pull it all out)

2) If it's all contributions, would I be able to take it out prior to 59 1/2?

I will put on my "to do" list to call some people at MegaCorp and ask about this...but wanted to get input from those on this forum.

My plan would be to simply put a portion of this in checking account and use for daily living, then "invest" the rest in a CD or other "safe" investment where I can get it out easily in the next 2-3 years for more living expenses.

Once we reach 59 1/2 things get much easier...so I'm looking for a 3-year solution to get some cash flow while not increasing MAGI to maintain ACA subsidy.

Thanks in advance for your input. I have pasted below the "categories" of funds they show in the account...thought it may help clarify.

Last edited: