unclemick

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Rats!

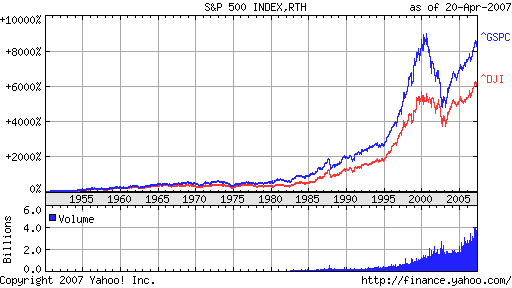

Skip the piglets - now that I'm getting in the mood to go bargin shopping the stupid market seems to going up.

Heck - may end up getting that kayak and exploring the Missouri Ozarks yet - Mr Market will fall in the Fall - for sure - right?

heh heh heh - sell in May and go away - is that the old cliche : .

.

Skip the piglets - now that I'm getting in the mood to go bargin shopping the stupid market seems to going up.

Heck - may end up getting that kayak and exploring the Missouri Ozarks yet - Mr Market will fall in the Fall - for sure - right?

heh heh heh - sell in May and go away - is that the old cliche :