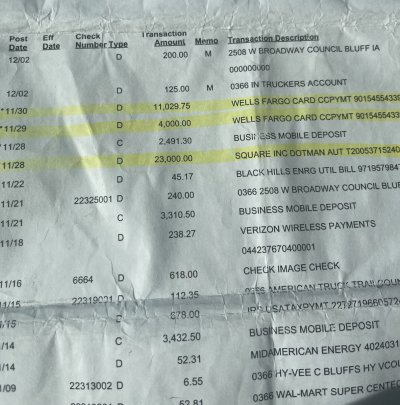

Has anyone experienced a fraudulent withdrawal from their bank checking

account that they weren’t able to resolve with the bank? My friend had 3

large withdrawals from his business checking account in late November. While 2 transactions ($4,000 and $11,000) from Wells Fargo were reversed by them, he cannot get anyone from his bank or from Square to help recover a $23,000 transaction on 11/30. The merchant is listed as Dotman AUT, which the bank suggested was a used car dealer in Columbus, Ohio. I wondered if anyone knows what your rights are in a situation like this and the best course of action for help? I’m very concerned with the increase in fraudulent activity that this could happen and there’s no recourse.

account that they weren’t able to resolve with the bank? My friend had 3

large withdrawals from his business checking account in late November. While 2 transactions ($4,000 and $11,000) from Wells Fargo were reversed by them, he cannot get anyone from his bank or from Square to help recover a $23,000 transaction on 11/30. The merchant is listed as Dotman AUT, which the bank suggested was a used car dealer in Columbus, Ohio. I wondered if anyone knows what your rights are in a situation like this and the best course of action for help? I’m very concerned with the increase in fraudulent activity that this could happen and there’s no recourse.