Marc

Recycles dryer sheets

Zion bank has 18 month non-callable CDs at 5.4% with lots of supply at Fidelity. Fidelity bond people informed me that a flood of CDs are coming at higher yields at the short end from regional banks as they scramble for liquidity. The sweet spot is going to be 9-18 months.

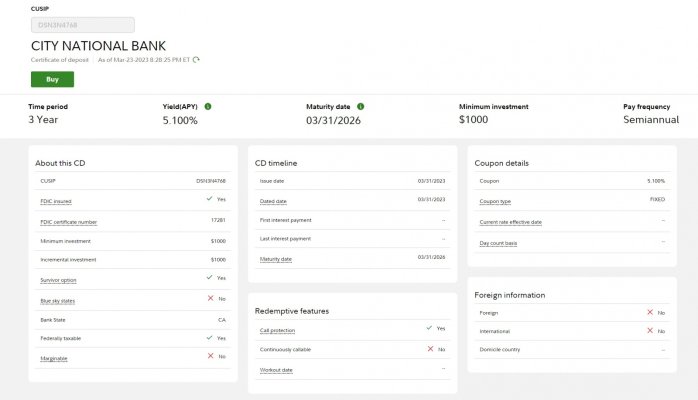

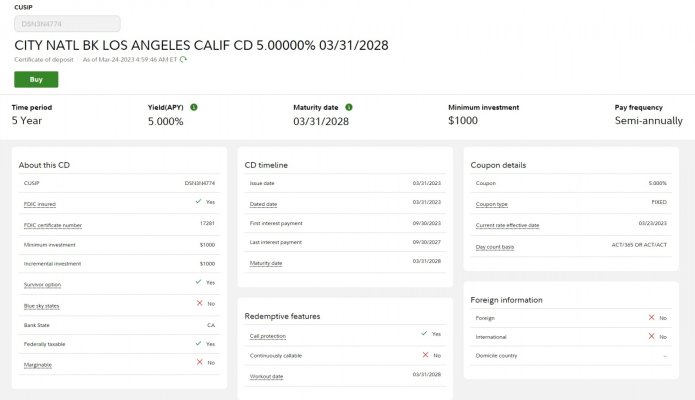

Just ordered $50K; my first CD at Fidelity (actually first CD ever).