I want to post this topic here because you all love CDs.

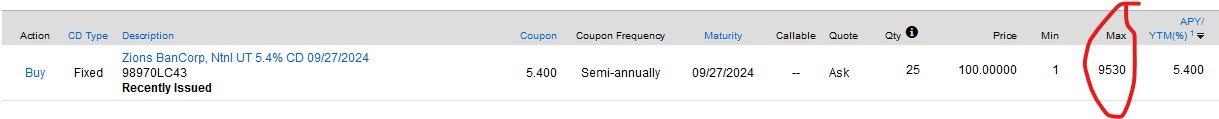

My situation: I want part of my IRA portfolio to be FDIC insured, therefore I'm now pretty much limited to CD's if I want any kind of return, so I am trying to make my own homemade FDIC mutual fund (joke)using individual CD's, but I groan when I think of keeping track of 100 CDs. In order to simplify this, would it be reasonable to just find 3 or 4 CDs at terms I like and by a lot of each, (ladder 3mo -2 years since that range seems be best rates)? Then I could just re-shop and revaluate every 3-6 months? I'd rather have 5-10 CD's instead of 100-200 based on what daily deal I find - because having 10 already is becoming a bit of a hassle trying to keep track of the ladder balance, rate etc.