Here are some details from the offer:

A total cash payment to be determined by reference to the fixed spread of

85 basis points plus the yield based upon the bid side price of the U.S.

Treasury Bonds 0.750% due 03/31/2026, as quoted on page FIT1 on the

Bloomberg reference bond trader series of pages at 10:00 a.m., New York

City time, on April 12, 2021 (the price determination date).

If you tender your notes PRIOR to the early tender date you will

receive the total consideration offered above which includes an early

tender premium equal to $30.00 per $1,000 principal amount. The early

tender premium is included in the fixed spread formula. *

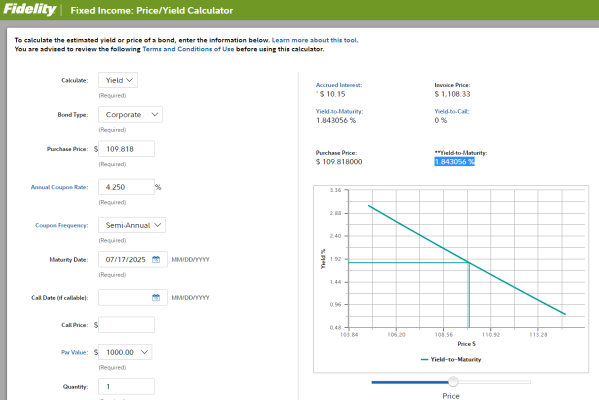

The hypothetical total consideration, assuming a hypothetical price

determination date of 03/26/2021, 10:00 a.m. New York City time, is

$1,098.18 per $1,000 principal amount.

I paid 100.84 for this bond in Sept '20. I think I should take this offer but there is some uncertainty about the actual amount that will be paid to redeem.