I have heard for years that we should have some gold. Is this mostly hype and scare tactics? Should I be in a hurry to get into gold and out of the dollar?

Is there a fund that we can buy using our Schwab account to invest in gold, metals, hard assets?

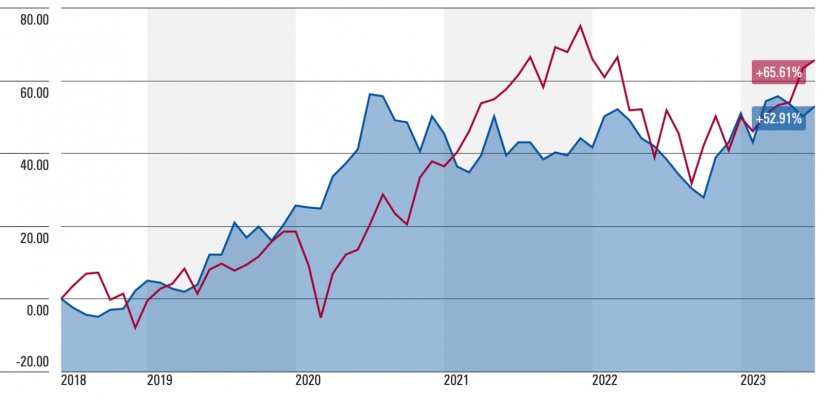

Birch Gold told me this morning that gold has been going up every year around 9%...does anyone know if this is true?

If this is true, I'd much rather buy gold and I would be happy with the 9% of returns. Thanks for any advice!

Is there a fund that we can buy using our Schwab account to invest in gold, metals, hard assets?

Birch Gold told me this morning that gold has been going up every year around 9%...does anyone know if this is true?

If this is true, I'd much rather buy gold and I would be happy with the 9% of returns. Thanks for any advice!