SecondAttempt

Thinks s/he gets paid by the post

This could probably fit in other recent threads but I'm starting a new one to avoid hijacking anyone's thread that has drifted to a similar topic.

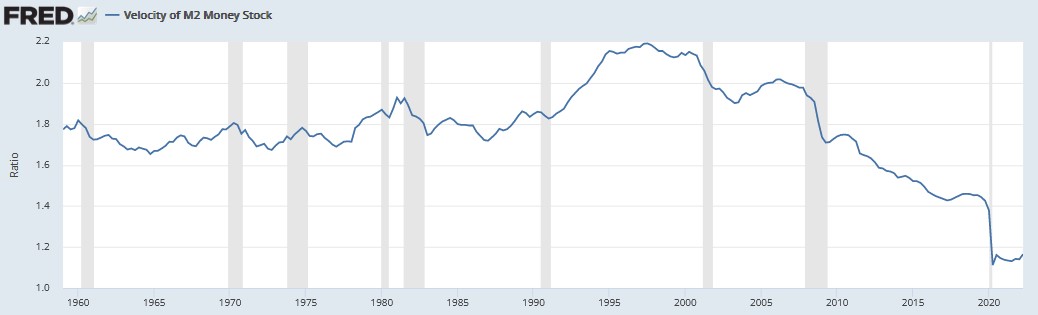

When the Fed started Quantitative Easing in 2008, there were a lot of people screaming to anyone who would listen that it would cause rampant inflation. And the CPI/PCE kept drifting down.

So now we are seeing very high inflation following less dramatic acts of the Fed. Is there something to be learned here?

Maybe inflation has a very long time constant, 14 years or so.

Maybe money supply and interest rates have less influence on inflation than we want to believe.

And what about the gold bugs? In the face of high inflation the price of gold seems to be on a downtrend, of course that is in USD which is superstrong against almost all other currencies right now.

It is so surprising to me how wrong everyone has been about inflation, both the political extremists and the professional economists!

When the Fed started Quantitative Easing in 2008, there were a lot of people screaming to anyone who would listen that it would cause rampant inflation. And the CPI/PCE kept drifting down.

So now we are seeing very high inflation following less dramatic acts of the Fed. Is there something to be learned here?

Maybe inflation has a very long time constant, 14 years or so.

Maybe money supply and interest rates have less influence on inflation than we want to believe.

And what about the gold bugs? In the face of high inflation the price of gold seems to be on a downtrend, of course that is in USD which is superstrong against almost all other currencies right now.

It is so surprising to me how wrong everyone has been about inflation, both the political extremists and the professional economists!