My problem is that it's not black and white.

I like a lot of aspects of my job but there are parts that drive me insane. I work on multiple initiatives and projects at the same time. If it's a good team and it's a well thought out initiative, then I'm usually in a happy place. However, sometimes I get dropped into pretty impossible situations and have to deal with people/resourcing conflicts, funding issues, ridiculous timelines, etc. That's when I'm constantly thinking about solutions during the offhours and I get pretty stressed out.

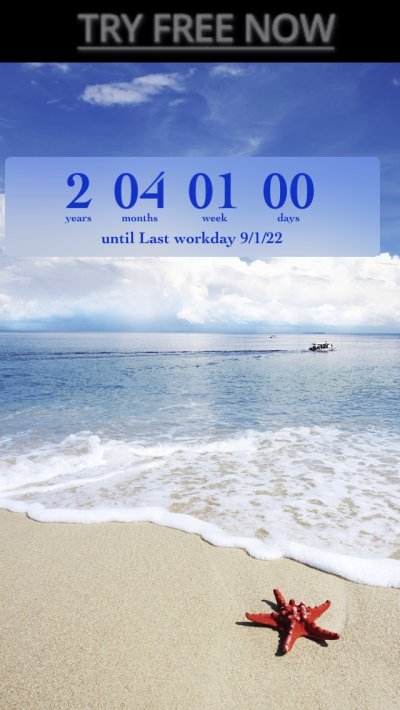

I was humming along for about a year and a half on this great project and then had two other projects added to my plate that have been sucking the life out of me for the last 5 months.

Ya, that's sort of sucky. It lulls you to sleep when things are good and then wham-o hits you hard when it's bad. Mine is more consistently marginal with doses of horrible mixed in. Except on quarterly bonus day things usually seem great that day. I feel I could work forever those 4 days a year. Ha, ha!