NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Did you get rich on a single stock or sector?

The reason I ask was that so many people in the FIRE Milestone thread claim wonderful returns, far more than a person can save from his salary. There are also many high-tech workers who get stock options from their employers. Those can get you to FIRE status fairly quickly.

As I often told the story, I worked for old-fashioned megacorps where options were only given to people far too many levels above me. Even at a junior VP level, I doubt that they give enough stocks that can give one a life changing gain.

So, I got to FIRE by my own investing, and I have always been too chicken to put it all in a single stock. I never have more than 2% in any single stock, and usually it's only 1%. My large position right now at 4% is an ETF. So, you can see that I am fairly diversified.

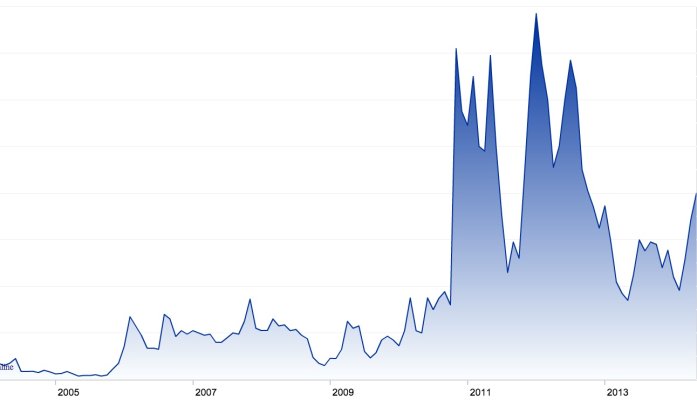

However, the above does not mean that I do not maintain concentration in a sector or industry. From 2003 to 2007, my portfolio grew by a factor of 3 after heavy expenses, due to concentration in material and mining sectors. These fed off the Chinese economy boom. Thank goodness I bailed out of them in late 2008, else would give back all the gain and then some. Since the Great Recession, I have been more diversified, but with some weighting in developing countries and some metal stocks. These had terrible years in 2012 and 2013, and did not help my portfolio which overall is roughly on a par with the S&P.

So, tell us your story. What was or has been your concentration? How's that working for you?

Note that this is not intended to be a stock picking analysis, and more reminiscent of past exploits, whether successful or not. By the way, I have also told the story of my heavy concentration in semiconductor stocks, which hurt me quite a bit in the 2001-2003 recession.

The reason I ask was that so many people in the FIRE Milestone thread claim wonderful returns, far more than a person can save from his salary. There are also many high-tech workers who get stock options from their employers. Those can get you to FIRE status fairly quickly.

As I often told the story, I worked for old-fashioned megacorps where options were only given to people far too many levels above me. Even at a junior VP level, I doubt that they give enough stocks that can give one a life changing gain.

So, I got to FIRE by my own investing, and I have always been too chicken to put it all in a single stock. I never have more than 2% in any single stock, and usually it's only 1%. My large position right now at 4% is an ETF. So, you can see that I am fairly diversified.

However, the above does not mean that I do not maintain concentration in a sector or industry. From 2003 to 2007, my portfolio grew by a factor of 3 after heavy expenses, due to concentration in material and mining sectors. These fed off the Chinese economy boom. Thank goodness I bailed out of them in late 2008, else would give back all the gain and then some. Since the Great Recession, I have been more diversified, but with some weighting in developing countries and some metal stocks. These had terrible years in 2012 and 2013, and did not help my portfolio which overall is roughly on a par with the S&P.

So, tell us your story. What was or has been your concentration? How's that working for you?

Note that this is not intended to be a stock picking analysis, and more reminiscent of past exploits, whether successful or not. By the way, I have also told the story of my heavy concentration in semiconductor stocks, which hurt me quite a bit in the 2001-2003 recession.