Just finished the book...my thoughts:

1. I agree with his concepts that you should give with a warm hand (alive) rather than a cold hand (dead).

2. I agree that experiences can be more rewarding than things.

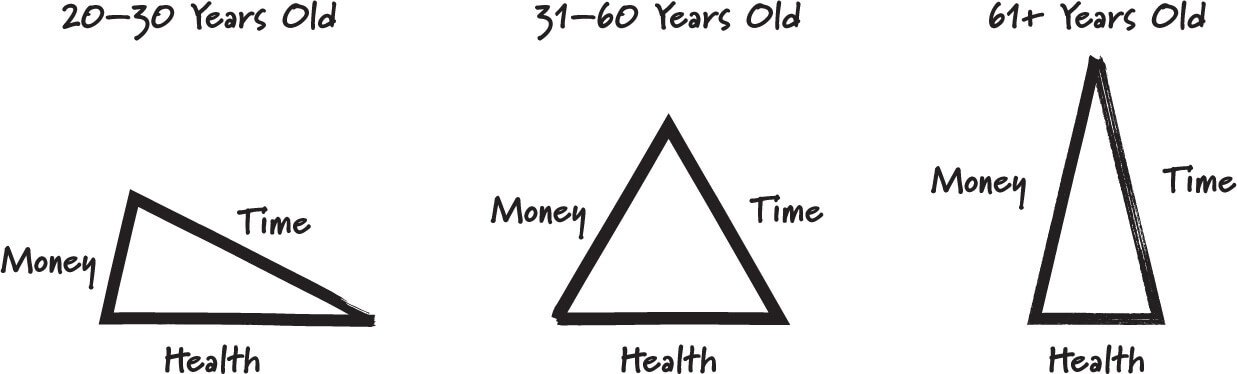

3. I disagree that your prime years are 45-60 and you go downhill rapidly after that. I believe you can spend time and/or money to help maintain your good health, and people should do that. My wife and I did a mini triathlon last year in the Everglades, but I also see quite a few of my peers who cannot walk up a flight of stairs. I am 71 right now, and we kayak, bike, or hike on a daily basis. We also do Bikram Yoga 4 days each week. (google it)

I think the author focuses too much on Net Worth and not enough on Cash Flow. If you have SS and Pension income, for example, you may not need much of a nest egg later in life...but he really does not mention sources of income much.

His focus on DOING THINGS is spot on for this community. Once we stop doing things, I believe we can deteriorate quickly. Each of us should spend time putting together a time oriented bucket list as he suggests. Give your retirement and your life some purpose.

And have absolutely no desire to be served by young waitress in bikinis on a private beach. Having free time to do what I want when I want for the past 12 years…priceless

And have absolutely no desire to be served by young waitress in bikinis on a private beach. Having free time to do what I want when I want for the past 12 years…priceless